Gold Price Forecast: XAU/USD nears key $1,940 resistance amid US data focus – Confluence Detector

- Gold Price remains firmer around two-week high as bulls cheer softer US Dollar, cautious optimism.

- US Dollar traces downbeat yields amid uncertainty about Fed’s next moves and anxiety ahead of Consumer Confidence data.

- Hopes of more stimulus from China add strength to XAU/USD run-up after snapping the four-week losing streak.

- Gold Price approaches key upside hurdle as top-tier US statistics loom.

Gold Price (XAU/USD) defends the previous weekly recovery, the first in five, as it rises for the second consecutive day amid the broad US Dollar weakness. Also adding strength to the XAU/USD rebound is the cautious optimism in the market, as well as the downbeat Treasury bond yields.

It’s worth noting that the US Dollar Index (DXY) cheers the Fed policymakers’ data dependency and recent mixed US data, as well as a sustained pullback in the US Treasury bond yields from the multi-year high marked last week.

Elsewhere, hopes of more stimulus from China via fiscal, as well as monetary policy, keep the Gold buyers hopeful.

However, the cautious mood ahead of the US inflation and employment clues, as well as China activity data, prod the XAU/USD bulls around the key $1,940 resistance confluence.

To sum up, the Gold Price has the majority of catalysts needed for the further upside but $1,940 and broad US Dollar weakness, as well as the downbeat yields, will decide the further advances of the XAU/USD.

Also read: Gold Price Forecast: Tide turns in favor of XAU/USD buyers, US jobs data awaited

Gold Price: Key levels to watch

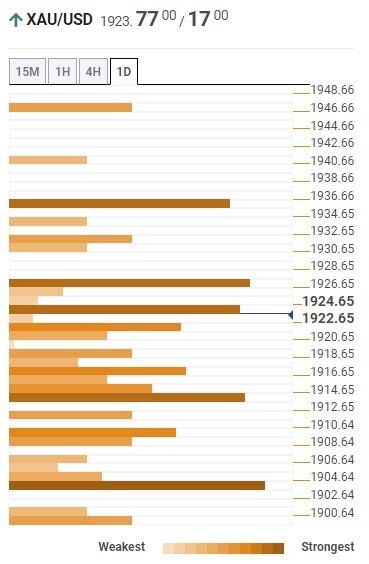

As per our Technical Confluence indicator, the Gold Price floats within a $40 region multiple resistance area ahead of this week’s top-tier US inflation and employment clues.

That said, a convergence of the Pivot Point one-day R1 and the previous daily high guards the immediate recovery of the Gold Price near $1,928.

Following that, the 200-SMA on the four-hour (4H) chart and Fibonacci 61.8% on one-month, around $1,937, restricts further upside of the Gold Price.

In a case where the XAU/USD buyers keep the reins past $1,937, the Pivot Point one-week R2 around $1,945 will act as the last defense of the Gold sellers.

On the flip side, a convergence of the 5-DMA, previous daily low, Fibonacci 23.6% on one-week and Pivot Point one-day S1 together restrict the immediate Gold Price downside near $1,910.

Should the XAU/USD bears manage to conquer the $1,910 key support, the 10-DMA, previous monthly low and Fibonacci 161.8% on weekly chart, close to $1,900 at the latest, will act as the last check for the sellers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.