Gold Price Forecast: XAU/USD sellers eye $1,815 support amid firmer USD

- Gold begins 2022 on a firmer footing after snapping two-year advances in 2021.

- Risk appetite improves despite surging covid infections, Fed rate-hike concerns.

- US PMIs, FOMC Minutes and NFP are the key for short-term direction.

- Will 2022 be better for gold than 2021?

Update: Gold (XAU/USD) remains depressed around intraday low close to $1,825, down 0.25% intraday during early Monday’s trading.

In doing so, the yellow metal portrays a pullback from a six-week high while also snapping the two-day uptrend.

The metal’s latest weakness could be linked to the US dollar’s bounce from the monthly low amid the escalating fears of the South African covid variant, as well as rising chatters surrounding the US Federal Reserve’s (Fed) faster rate hikes in 2023. Also helping the gold traders to consolidate recent gains is the off in multiple markets and an absence of major data/events. On the same line are the fears emanating from China’s troubled real-estate player Evergrande and geopolitical tension between Russia and Ukraine.

That said, US PMIs for December may offer intermediate direction to gold prices during the week but major attention will be given to FOMC Minutes and Friday US employment figures for December.

End of update.

After a disappointment in 2021, gold (XAU/USD) kick-starts 2022 on a firmer foot around $1,830 during Monday’s Asian session. In doing so, the yellow metal cheers market’s risk-on mood amid a light calendar and off in multiple markets ahead of the key weekly events.

That said, the S&P 500 Futures rise 0.55% while the US Dollar Index (DXY) struggles around a one-month low amid cautiously optimistic markets.

Among the key risk catalysts are the market fears over the South African covid variant versus upbeat studies terming the virus strain as less severe than the previous versions of the COVID-19.

While portraying the covid data, Reuters said, “Worldwide infections hit a record high over the past seven-day period, with an average of just over a million cases detected a day between Dec. 24 and 30.” The news also mentioned, “Over 4,000 flights were canceled around the world on Sunday, more than half of them were the US flights, adding to the toll of holiday week travel disruptions due to adverse weather and the surge in COVID-19 cases.”

On the same line were comments from Anthony Fauci, Director of the National Institute of Allergy and Infectious Diseases, per CNN stating, “When you have so many, many cases, even if the rate of hospitalization is lower with Omicron than it is with Delta, there's still the danger that you're going to have a surging of hospitalizations that might stress the health care system.”

In addition to the market’s consolidation, an absence of major data/events and off in multiple bourses also underpin the latest corrective pullback in gold prices.

Even so, recently increasing hopes of the Fed’s faster rate-hikes in 2022 and virus woes are likely to challenge gold buyers. For that matter, the Federal Open Market Committee (FOMC) Meeting Minutes and Friday’s US Nonfarm Payrolls (NFP) will be crucial to watch. For intraday, final readings of the US Markit Manufacturing PMI for December may offer immediate directions.

Technical analysis

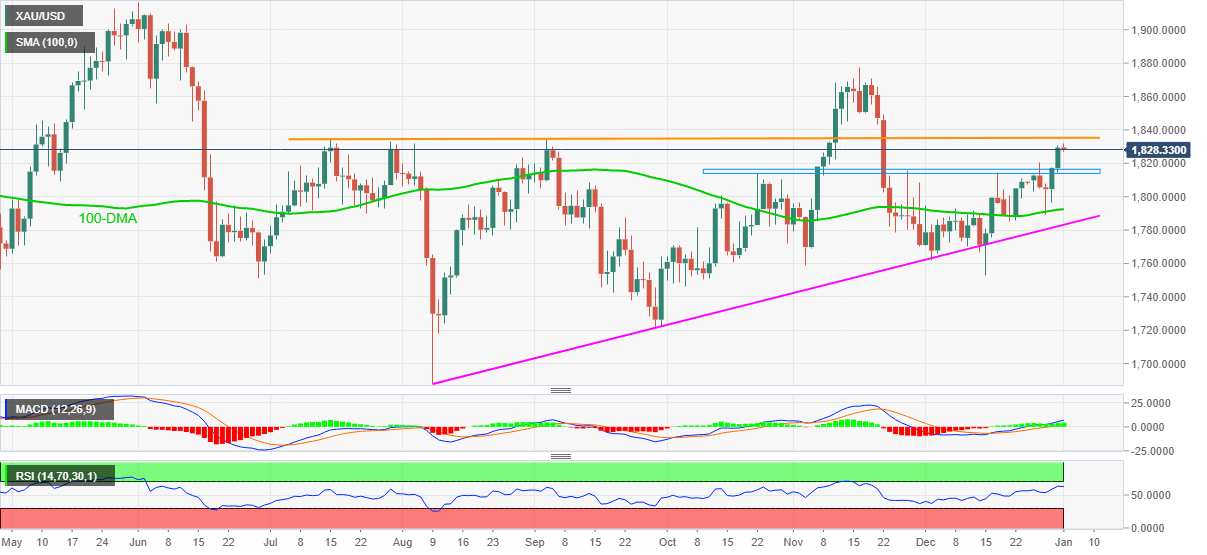

A clear upside break of a 10-week-old horizontal resistance, near $1,814-16, enabled gold buyers to refresh monthly top on Friday. The run-up gained support from firmer RSI and bullish MACD signals, keeping gold buyers hopeful of late.

However, tops marked in July and September, around $1,834, become a tough nut to crack.

Adding to the upside filters are multiple levels marked near $1,850 and November’s peak of $1,877.

Meanwhile, pullback moves remain less interesting until staying beyond the previous horizontal resistance, now support around $1,816-14.

Following that, the $1,800 threshold will precede 100-DMA level surrounding $1,794 and an ascending support line from August, near $1,782, becomes the key to watch.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.