Will 2022 be better for gold than 2021?

2021 was bad for gold. Unfortunately, 2022 doesn’t look any better, especially at the beginning. The end, however, gives the yellow metal some hope…

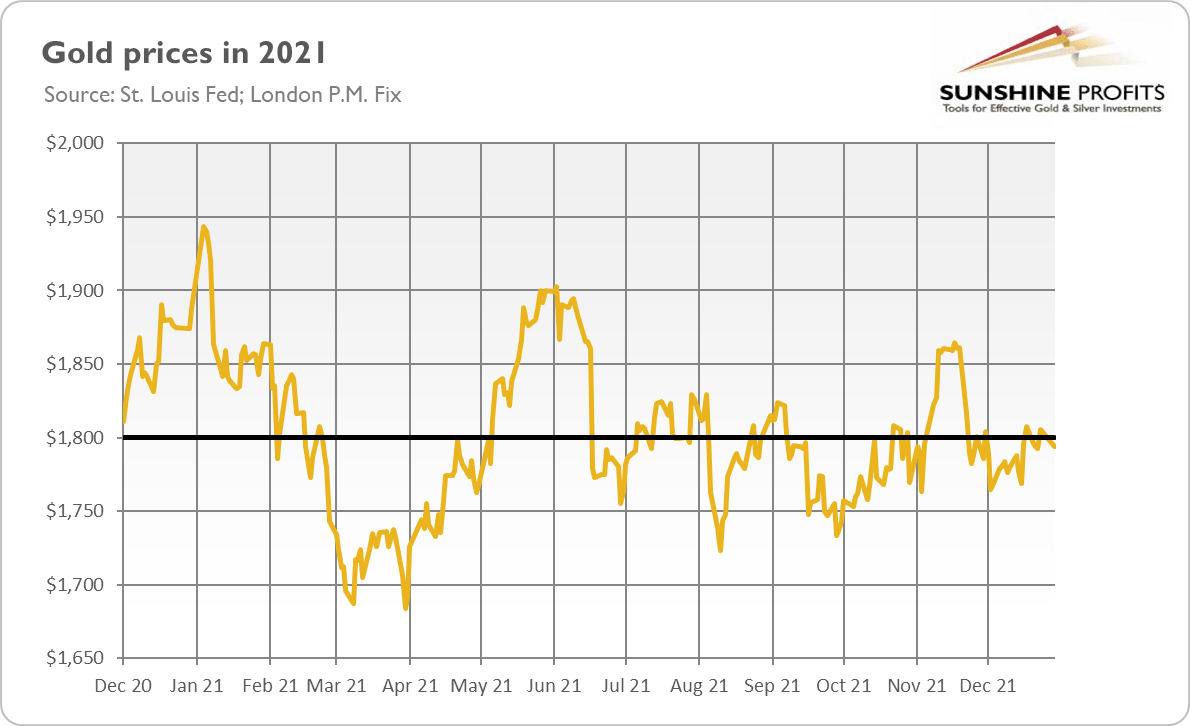

Bye, bye 2021! It definitely wasn’t a year of gold. As the chart below shows, the yellow metal lost 5% of its value over the last twelve months, declining from $1,887.60 on December 30, 2020, to $1,794.25 on December 29, 2021. Thus, the gold bulls won’t miss 2021, I guess.

What about me? Well, I correctly predicted in January that “gold’s performance in 2021 could be worse than last year”. However, I expected more bullish behavior. I thought that rising inflation would be more supportive of gold prices. I’m fully aware that gold is not a perfect inflation hedge, but historical analysis suggests that high and accelerating inflation should be positive for gold prices. After all, inflation lowers the real interest rates, the key fundamental factor in the gold market.

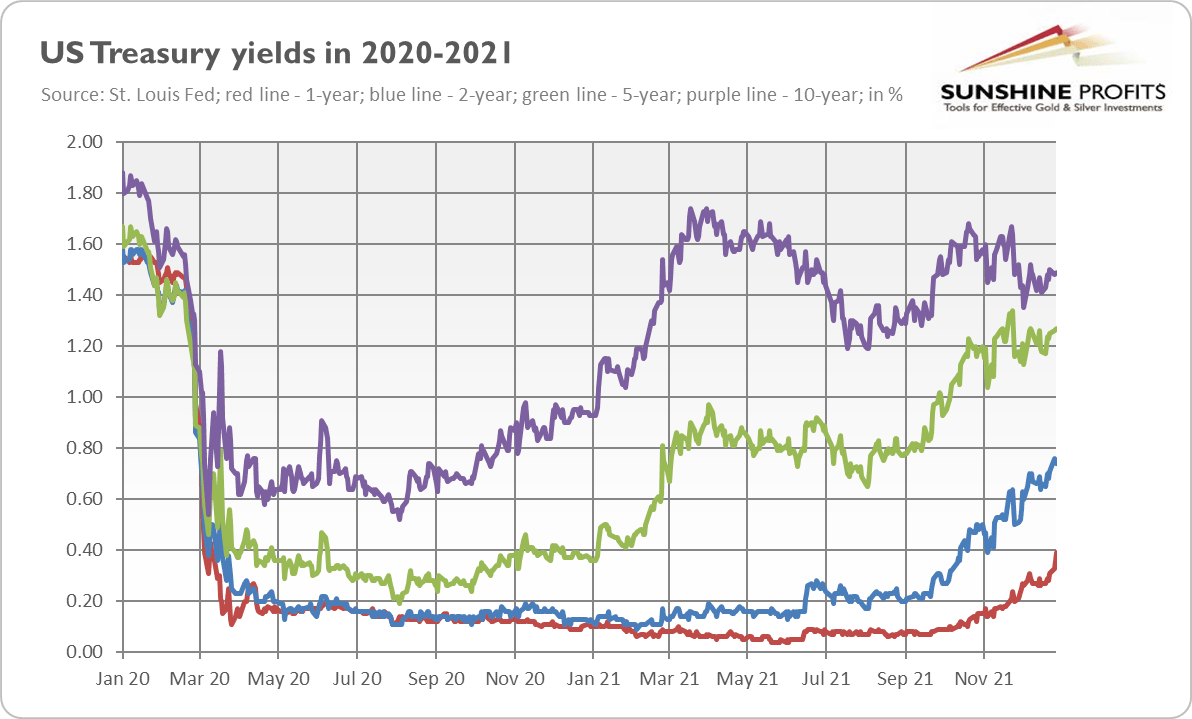

However, rising inflation has prompted the Fed to tighten its monetary policy and speed up the tapering of its quantitative easing. Expectations of hikes in the federal funds rate in 2022 also strengthened. In consequence, as the chart below shows, bond yields rose, especially those short- and medium-term, creating downward pressure on gold prices. Thus, we’ve learned two important lessons in 2021: don’t just count on inflation, and don’t fight with the (hawkish) Fed.

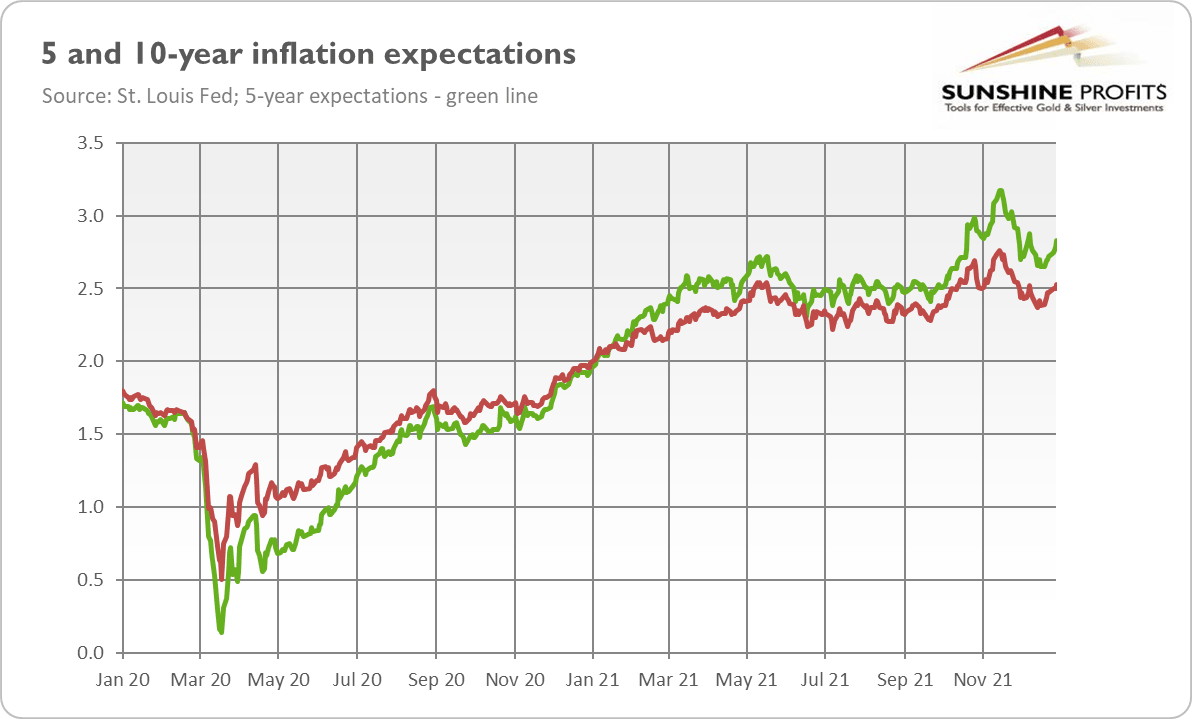

As you can see, bond yields haven’t returned to their pre-pandemic level yet. Although they don’t have to fully recover, they do have room for further increases. The issue here is that when inflation peaks and disinflation starts, inflation expectations could decline, boosting the real interest rates. Actually, market-based inflation expectations already peaked in November, as shown in the chart below. This indicates that worries about inflation had calmed and investors had regained some confidence in the US central bank’s ability to contain upward price pressure.

Implications for Gold

Will 2022 be better for gold than 2021? It’s possible, but I’m not an optimist. I mean here: macroeconomic conditions will turn more bearish for gold. Despite the spreading of Omicron variant of coronavirus, 2022 could mark the end of the global Covid-19 epidemic with a full economic recovery and a return to normal conditions. Fiscal policy will tighten, while the Fed will adopt a more hawkish monetary policy than in 2021. Supply shocks are easing, so inflation may peak, while real interest rates go up further. Moreover, the US dollar may strengthen against the euro, as the ECB is slower with its monetary policy tightening.

On the other hand, there are also some factors that could support gold prices. In 2021, GDP rebounded greatly after the economic crisis of 2020, and financial markets also recovered robustly. 2022 may be more challenging for economic growth and the financial sector, though. One thing is the base effect, while another is central banks’ policy normalization and rising interest rates. With massive public and private debts, the Fed’s tightening cycle could deflate asset and credit bubbles and even trigger a recession, or at least a market correction.

However, there are no signs of market stress yet, so a financial crisis is not in my baseline scenario for the next year. 2023 (or even later) is a more probable timeframe. Hence, I believe that the end of 2022 may be better for gold than the beginning of the year, as mere expectations of the Fed’s tightening cycle could be replaced by worries about the consequences of interest rate hikes.

Anyway, 2021 is (almost) dead. Long live 2022! I wish you a return to normalcy, shining profits and all the golden next year!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Arkadiusz Sieroń

Sunshine Profits

Arkadiusz Sieroń received his Ph.D. in economics in 2016 (his doctoral thesis was about Cantillon effects), and has been an assistant professor at the Institute of Economic Sciences at the University of Wrocław since 2017.