Gold Price Forecast: XAU/USD bulls target $1,820 after the breakout – Confluence Detector

- Gold has broken above $1,800, this time in a more significant manner.

- The upbeat mood in markets and the breather in the rise of US yields is helping.

- Gold Price Forecast: XAU/USD eyes a firm break above $1795 amid growing inflation fears

Bitcoin has reached all-time highs, stocks have followed – is it time for gold to break higher? XAU/USD is, at least, moving above $1,800. Last week's upside move proved indecisive, but this latest surge is more substantial. The precious metal is already valued at $1,805.

How is XAU/USD positioned on the technical chart?

Gold Price: Key levels to watch

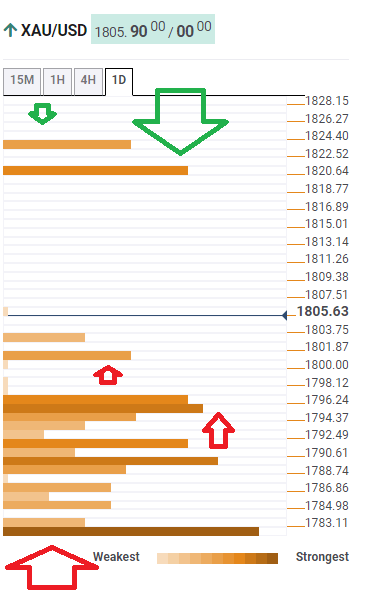

The Technical Confluences Detector is showing that the precious metal faces resistance at $1,820, which is where the Pivot Point one-month Resistance 1 hits the price.

It is followed by $1,823, which is where another pivot point awaits, the one-week Resistance 2.

Looking down, some support is at $1,801, where the previous week's top converges with the PP one-day Resistance 3.

Another cushion awaits at $1,795, which is the confluence of the Simple Moving Average 10-15m, the previous 4h-high and the PP one-week R1.

Much lower, a barrier against bearish attacks is at $1,783, which is where the Fibonacci 38.2% one-week and the BB 4h-Middle meet up.

XAU/USD Confluence levels

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.