Gold Price Forecast: XAU/USD bears remain keen on $1,825

- Gold price sinks to fresh bear cycle lows and there could be more to come from the Gold price bears.

- US Dollar is on the bid following United States of America data that is firming.

- US Retail Sales, services and Consumer Price Index all came in hot in a series of releases of late, flipping the script on the Federal Reserve pivot narrative.

Gold price was pressured on a firmer US Dollar on Wednesday. The United States Retail sales jump 3% in January, smashing expectations despite an inflation increase that might have otherwise kept consumers' hands in their pockets. Gold price dropped, popped, dropped again and is now slowly correcting from the day's lows and has so far held in familiar post-data ranges around $1,835.

United States Retail Sales data

With the latest data showing that retail sales rebounded more than expected in January, and rose the most since March 2021, highlighting the strength of the economy, the US Dollar has still not been able to take off which is giving the Gold bulls a lifeline currently:

The data arrived as follows:

- US Retail Sales Advance (MoM) Jan: 3.0% (est 2.0%; prev -1.1%).

- US Retail Sales Ex Auto (MoM) Jan: 2.3% (est 0.9%; prev -1.1%).

- US Retail Sales Ex Auto And Gas Jan: 2.6% (est 0.9%; prev -0.7%).

- US Retail Sales Control Group Jan: 1.7% (est 1.0%; prev -0.7%).

The Retail Sales data suggest a healthy rise in Personal Consumption for the month, which is likely to be reflected in a more optimistic round of economists’ estimates for the United States of America's first quarter Gross Domestic Product. Manufacturing production also lifted 1.0% MoM in January, and the Empire Manufacturing index rose to -5.8 (-18.0 previously).

''It was not all good news today insofar as the US industrial production data for January recorded a worse than expected flat m/m, with a drop in utilities dragging down was otherwise a better picture for manufacturing,'' analysts at ANZ Bank said.

'' Even so,'' the analysts added, ''the disappointment of the production data has not been enough to put much more than a small dent in the strength exhibited in January US labour and the retail sales data, particularly given the robustness demonstrated in this week’s US January Consumer Price Index inflation report.''

Federal Reserve outlook

On Tuesday, the annual Consumer Price Index inflation rate in the US slowed slightly to 6.4% in January from 6.5% in December, the lowest since October 2021 but above market expectations of 6.2%. The latest Federal Reserve commentary also underpinned that Federal Reserve policymakers largely backed more rate increases, fueling a bid in the greenback after what was an indecisive show from markets around the inflation data initially. The markets are starting to have second thoughts as to whether there will be cuts in 2023.

Federal Reserve rates currently stand at 4.5% to 4.75% but Fed board members' median projection foresaw interest rates peaking at 5.1% this year. However, interest rate futures markets have still priced a peak above 5.2%, based on late Tuesday's prices.

Federal Reserve officials have been mostly consistent in their warnings that rates are set to be higher for longer. ''On the back of the inflation report yesterday, Fed futures have already adjusted higher to reflect the risk of more Fed rate hikes this cycle,'' analysts at Rabobank explained.

''It is our view that the top of the target band for Fed funds will be 5.5%. Given that the market had cut it long USD positions at the end of last year and into January, the risk of a higher peak for Fed funds is suggestive of the potential for further USD gains into the middle of the year,'' the analysts added.

Gold price technical analysis

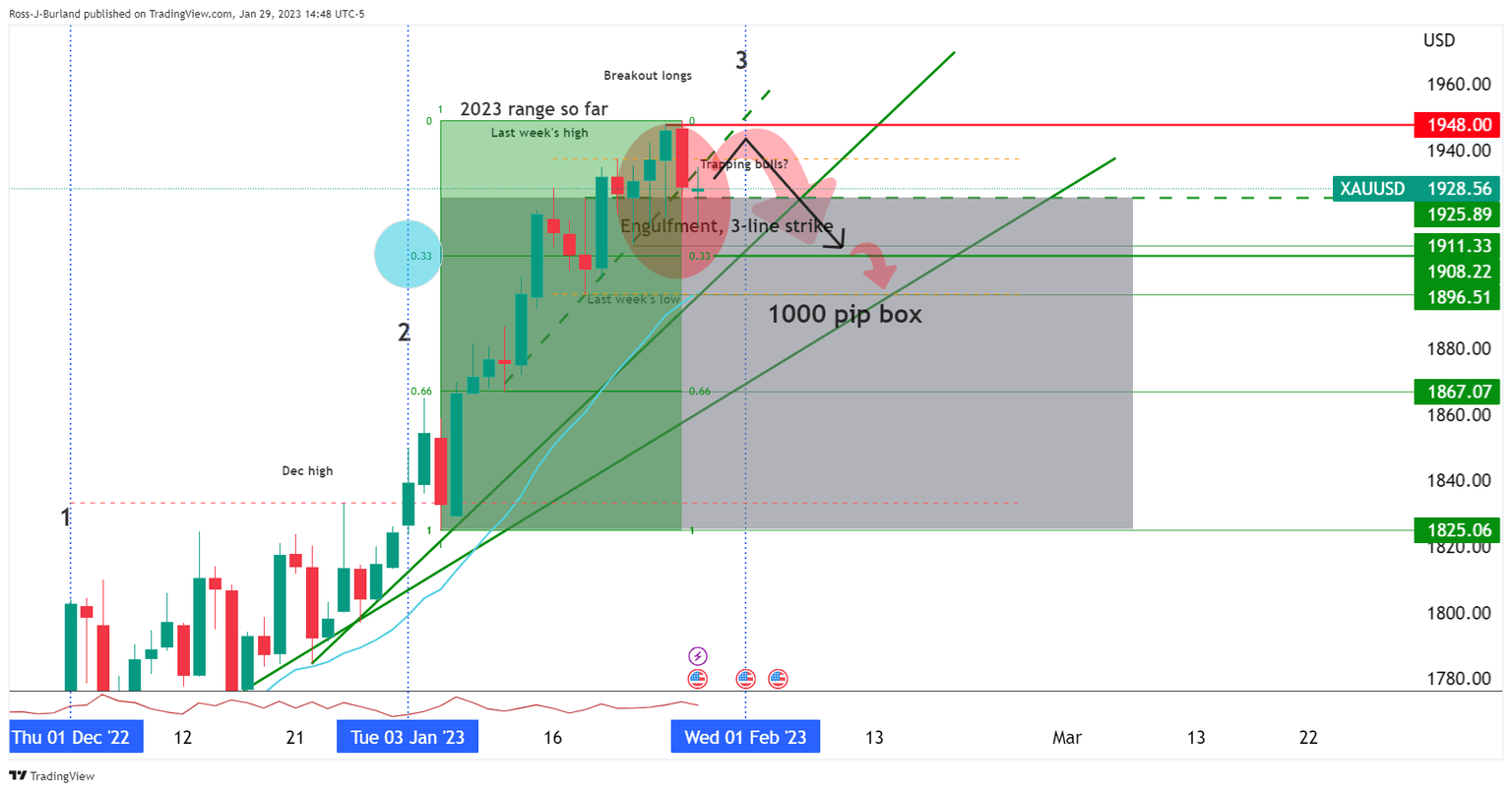

There is scope for a move in Gold price to the 1000 box destination this week as prior analysis has been targeting:

in prior Gold price analysis, it was stated that we were in the upper third of the 2023 range and on the backside of the first trendline that is broken and acting as a counter-trendline. A break of Gold price $1,925 was expected to open the risk of a move to test $1,896 and then $1,867 as the top of the lower third of the range that guarded a 1000 pip Gold price box low of $1,825:

The above chart was analysis drawn at the end of January and below is where we are up to date ahead of the week commencing 12 February open:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.