Gold Price Analysis: XAU/USD will have a bumpy road to the north unless crossing $2,032 – Confluence Detector

Although the US dollar fades the upside momentum, after rising for two days, gold prices print a three-day losing streak while declining to $2,016.60, down 0.56% on a day, ahead of Tuesday’s European session.

The reason could be traced from the market’s rush to equities that are cheering the hopes of further stimulus from the US. In doing so, the yellow metal ignores the US-China tussle as well as the coronavirus (COVID-19) woes. Recently, the South China Morning Post (SCMP) quoted American notice to convey that the goods made in Hong Kong for export to the United States will have to be labeled “Made in China” after September 25.

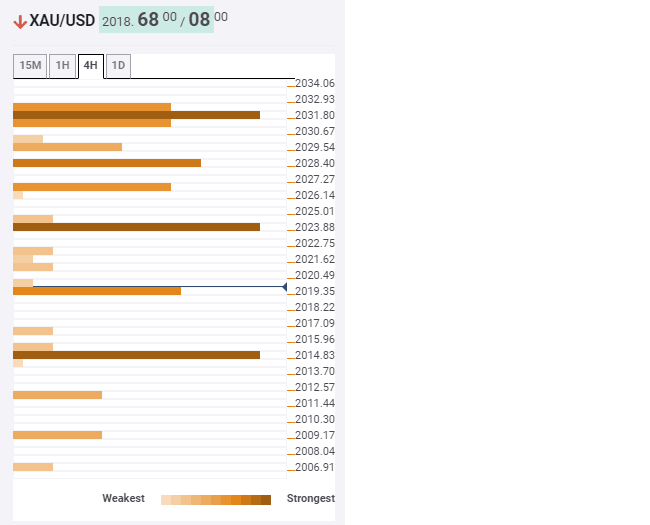

Our Technical Confluences Indicator also highlights the sluggish moves by gold even as it trades beyond the key support around $2,015 comprising previous low on 4H, 1H and Pivot Point 1 S1.

As a result, bears are waiting for a clear break below $2,015 to aim for the $2,000 threshold.

Alternatively, SMA 10 on an hourly chart restricts the bullion’s immediate upside around $2,025 ahead of minor resistances near $2,028 and $2,030.

Though, the precious metal’s rise beyond $2,030 will have to cross 38.2% Fibonacci retracement on the weekly chart, near $2,032, to aim for the further upside.

Here’s how it looks:

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.