Gold Price Analysis: XAU/USD stalls within bull flag at weekly resistance

- Gold extends the downside as the US dollar perks up within a corrective phase.

- Xmas holiday's profit taking playing into the offer of gold prices.

- Bull flag spells out the prospects for a $400 breakout.

The price of gold is trading at $1,867.52, down some 0.5% on the day having travelled between $1,860.82 and $1,884.33.

Holiday-thin markets on a shortened week are making for unusual price behaviour across the spectrum of instruments, not least in the precious metals arena.

However, the US dollar is perky within its corrective phase within the fresh bearish cycle and despite the passage of a new $900 billion stimulus package.

Following weeks of negotiations, Congress overwhelmingly approved billions of dollars for American households and businesses that have been hurt by the pandemic.

The coronavirus package restores a supplemental unemployment benefit for millions of unemployed Americans for 11 weeks and includes money for another round of $600 direct payments.

In the Senate, the bill passed 92 to 6. It will now go to President Trump for his signature.

Instead, there seemed to be a risk-off tone in the market, with US stocks down, including the Nasdaq, and US Treasuries are rallying with the 10-year yields down some 1.4% at the time of writing.

The coronavirus variant raging in Britain has sparked a flight to safety and the US dollar is picking up a familiar bid on the back of it despite weaker than expected US data.

The Conference Board's consumer confidence index fell to a reading of 88.6 this month.

The data was the worst since of August, from 92.9 in November. Economists polled by Reuters had forecast the index ticking up to 97.0 in December. The index was at 132.6 in February.

Covid mutation, vaccines to save the day

Two vaccines have since been approved for use to combat the respiratory illness, which economists believe will limit further downside in consumer confidence.

Also, some initial concerns were eased as medical experts seemed to indicate that the vaccines currently being deployed would be effective against the new variant.

US Health Secretary Alex Azar was interviewed by Fox News on Tuesday and said that both the Pfizer/BioNTechand Moderna vaccines, which received the US emergency use authorizations this month, should be effective at preventing illness from the recently discovered variant of the virus. ''It did not seem to have different physical effects on individuals,'' he added.

Reuters reports that Moderna Inc MRNA and BioNTech SE BNTX, which worked with Pfizer Inc PFE to develop its vaccine, are scrambling to test their shots against the variant but expressed confidence in them.

"Scientifically it is highly likely that the immune response by this vaccine can also deal with this virus variant,” BioNTech Chief Executive Ugur Sahin told reporters.

That all being said, what we are seeing is a typical year-end bout of profit-taking.

Those who have ridden the bullish trend in the stock markets will be keen to wrap up ahead of the New Year which, so in part, the US dollar's appreciation can be attributed to that also, feeding into gold's deterioration.

However, analysts at TD Securities argued, ''given gold's relative cheapness and the ongoing algorithmic buying flow, we could imminently see a breakout.''

''The Federal Reserve's decision to tie QE to economic outcomes still supports the notion of a growth and inflation overshoot, which should provide macro tailwinds for gold in the longer-term,'' the analysts argued.

Gold technical analysis

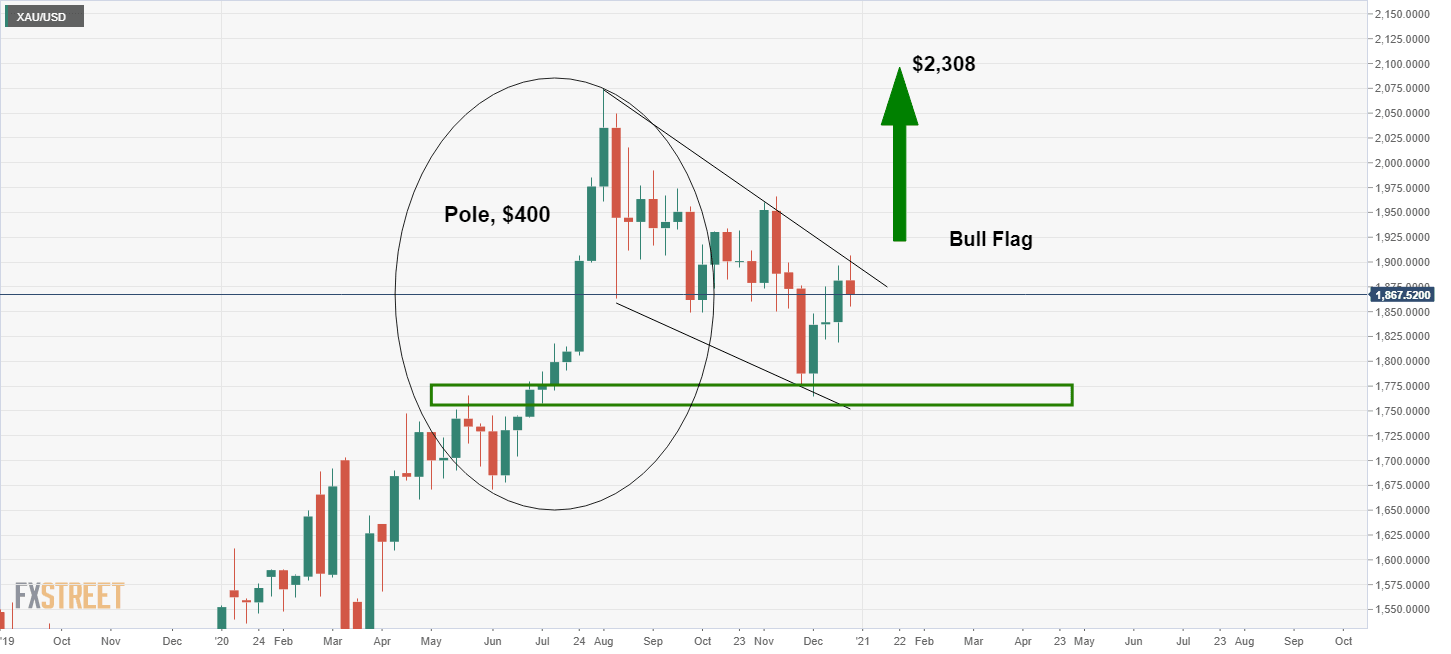

''Gold bugs are also looking for a break north of the $1920/oz range, which would technically represent the end of the consolidation period with prices breaking away from the bull flag.''

The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole.

In this case, in using the analyst's ay TD securities $1920/oz as a breakout level, there would be $400 at stake to the upside.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.