Gold Price Analysis: XAU/USD bulls start to throw in the towel as US dollar rallies to fresh highs

- Gold price retreats some of the day's gains into the close.

- US dollar prints a fresh cycle high in the DXY index despite core CPI miss.

- A correction in gold would be expected to restest prior resistance.

Spot gold price (XAU/USD) has ended in North American markets some 0.6% higher on Tuesday despite a strong rebound in the US dollar in the latter part of the US session. Initially, the US dollar crumbled due to the miss in the US core Consumer Price Index, which excludes food and energy prices. It moved up by just 0.3%, which was below the 0.5% expectations and the smallest increase since September.

Consequently, Wall Street's benchmarks climbed after government bond yields fell as money market traders pondered as to whether price increases have peaked at multi-decade highs. The gold price thrived in these conditions as the US 10-year yield slumped by 7.4 basis points to 2.71%, falling back from a three-year high marked-up at the start of the week.

The dollar index DXY fell 0.146% and reached a low of 99.74. However, it soon bounced back to score a fresh cycle high at 100.333 before the close on Wall Street. This forced some of the bid out of the gold price, moving down from a high of $1,978.68 to end near $1,967, albeit wat of the lows of $1,949.75.

Gold price supported by Ukraine crisis

Meanwhile, gold also derived support from geopolitics, after Russian President Vladimir Putin referred to the Russo-Ukraine peace talks as being at a dead-end, dampening hopes of a ceasefire. Now that spot gold prices have broken convincingly above late March highs in the $1960s, the gold bulls will set their sights on the $2000 level once again.

But further Fed commentary this week and US Producer Price Inflation data on Wednesday could present downside risks, particularly if Fed policymakers continue the hawkish chatter and producer prices don’t also moderate as expected. That might send US yields higher, which could stymie gold’s advances, though traders note that gold has been unusually resilient in the face of rising yields in recent weeks.

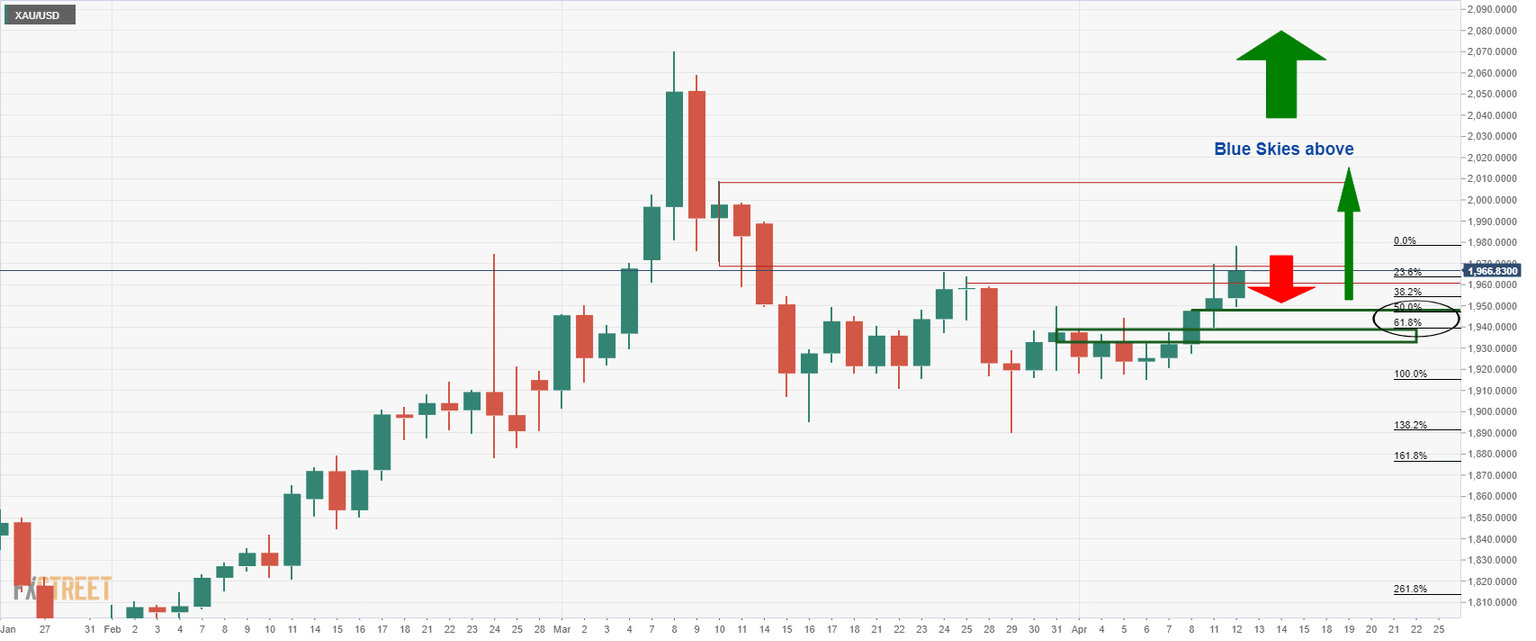

Gold technical analysis

The gold price has been range-trading since mid-March, potentially accumulating the 2022 rally and could now be ripening for a bullish continuation as per the daily chart:

However, should a strong US dollar prevail, $1,930 could come under pressure again and if that were to give out, the near term prospects of a move higher will be severely diminished.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset