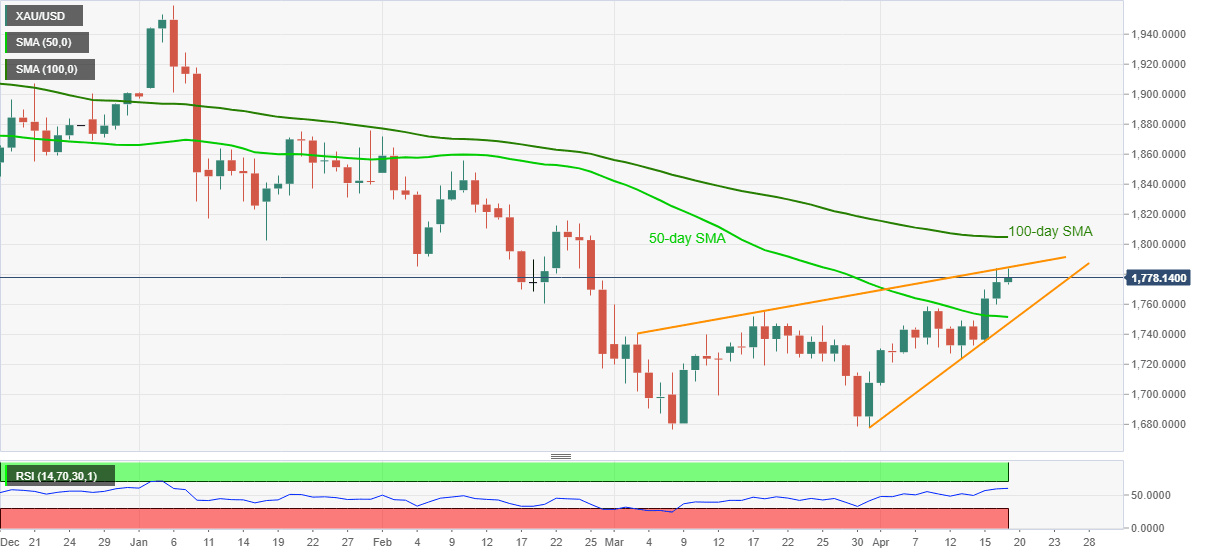

Gold Price Analysis: XAU/USD buyers attack six-week-old resistance line around $1,780

- Gold keeps recovery moves from intraday low to print mild gains, picks up bids off-late.

- Ascending resistance line from early March tests bulls.

- 50-day SMA, monthly support line could offer bounces in case of pullback, any further weakness will recall the bears.

Gold rises 0.18% intraday while picking up bids near $1,777-78 ahead of Monday’s European session open. In doing so, the yellow metal flirts with the key hurdle stretched from March 03.

While strong RSI conditions and sustained trading above 50-day SMA favor gold buyers to cross the immediate resistance around $1,785, the $1,800 threshold and 100-day SMA near $1,805 will be the key upside barriers for the commodity.

Even if the bullion crosses the $1,805 SMA resistance, late February tops near $1,816 should be watched closely for fresh impulse.

Meanwhile, pullback moves remain less problematic above the 50-day SMA level of $1,751, as well as an ascending support line from March 31 around $1,746.

However, a clear downside break of $1,746 will confirm a rising wedge bearish chart pattern on the daily play and suggests further declines towards challenging the double bottoms marked in March, close to $1,676-77 before highlighting the theoretical target near $1,630.

Gold daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.