Gold Price Forecast: XAU/USD bulls aim for $1,850 on Russia news, softer USD

- Gold grinds higher around intraday top, consolidates two-week losses.

- Market sentiment dwindles, the US dollar remains pressured on rate hikes, recession woes.

- G7 leaders brace for banning imports of Russian gold, and crude oil.

- US Durable Goods Orders to decorate daily calendar, ECB Forum is important for the week.

Gold Price (XAU/USD) extends Friday’s recovery to $1,836 ahead of Monday’s European session. The precious metal’s upside moves could be linked to the softer US dollar, as well as chatters surrounding a ban on gold imports from Russia.

US Dollar Index (DXY) remains pressured around the intraday low of 103.95 as markets struggle for clear directions.

Market sentiment remains sluggish amid the fears of faster rate hikes and US economic slowdown, not to forget geopolitical concerns surrounding China and Russia. It should, however, be noted that the hopes of overcoming the tough time, as well as cautious optimism ahead of this week’s key debate among the policymakers of the European Central Bank (ECB), Fed and the Bank of England (BOE), seem to favor the gold buyers.

It’s worth noting that four of the Group of Seven (G7) rich nations moved to ban imports of Russian gold on Sunday to tighten the sanction squeeze on Moscow and cut off its means of financing the invasion of Ukraine, per Reuters.

Amid these plays, the S&P 500 Futures remain firmer around 3,920, up 0.20% intraday by the press time, whereas the US 10-year Treasury yields rise three basis points (bps) to around 3.16% after posting the first weekly loss in four.

Although mixed concerns and fears of the ban on Russian gold may underpin gold’s upside momentum, rate hike woes may recall the gold sellers. For that matter, today’s US Durable Goods Orders for May, expected 0.1% versus 0.5% prior, as well as Wednesday’s debate of the US and the UK and the European central bankers at the ECB Forum on Central Banking, will be important to watch.

Technical analysis

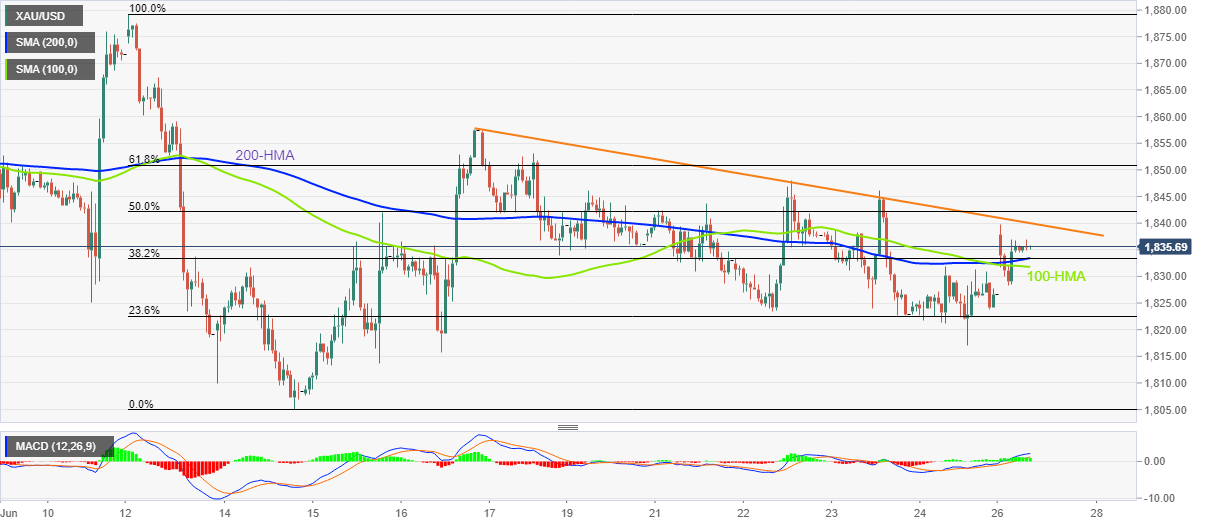

Gold buyers cheer a clear upside break of the 100-HMA and 20-HMA, as well as bullish MACD signals, as they approach a one-week-old resistance line near $1,840.

However, major attention is given to the 61.8% Fibonacci retracement level of the June 12-14 downturn, around $1,850, for further upside momentum. Also acting as resistance is the mid-June swing high near $1,858.

Meanwhile, pullback moves may initially aim for the stated HMAs, near $1,830, before revisiting the 23.6% Fibonacci retracement level surrounding $1,822.

In a case where XAU/USD drops below $1,822, the monthly low of $1,805 will appear as the last defense of buyers.

Gold: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.