Gold Price Analysis: XAU/USD awaits fresh impetus ahead of FOMC minutes, levels to watch – Confluence Detector

Gold (XAU/USD) is on the defensive so far this Wednesday, as the US Treasury yields attempt a comeback, snapping a three-day rout. The US dollar wallows in multi-day lows, as investors rethink the Fed rate hike expectation this year. The FOMC minutes are likely to offer fresh direction to gold.

With the earnings season kicking in, markets turned cautious and triggered a pullback in the US stocks from record highs. The retreat in Wall Street indices offered some support to gold on Tuesday.

How is gold positioned on the technical graphs?

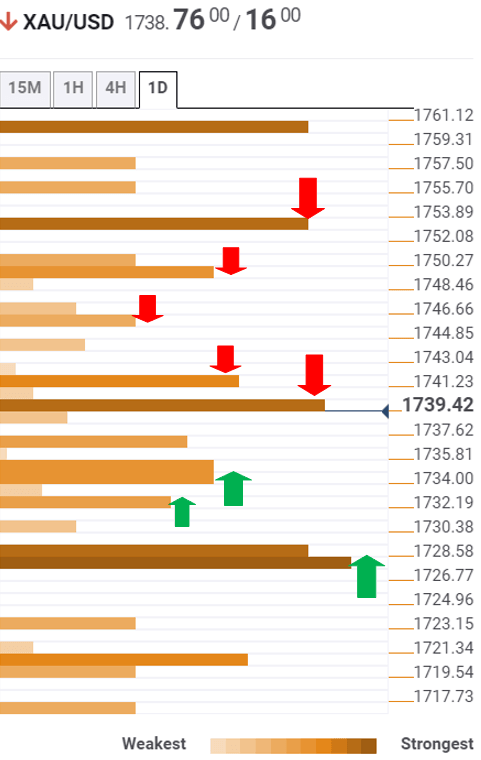

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold has failed to sustain above the $1,740 barrier, which is the confluence of the Fibonacci 38.2% one-day and SMA5 one-hour.

Therefore, the bears head for a test of a dense cluster of healthy support levels around $1,736, where the previous week high, Fibonacci 61.8% one-day and SMA200 four-hour coincide.

The next cushion awaits at $1731, which is the pivot point one-day S1.

Crucial support at $1727 could be the line in the sand for the XAU buyers. That level is the intersection of the Fibonacci 61.8% one-month, previous day low and SMA100 four-hour.

Alternatively, immediate resistance awaits at the Fibonacci 23.6% one day at $1742.

The previous day high at $1745 would challenge the bulls’ commitments.

If the buying interest picks up pace, the pivot point one-week R1 at $1749 could be tested.

Further up, strong resistance of the pivot point one-month R1 at $1753 could then contain the upside.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.