Gold Price Analysis: Multi-year highs at $1818 to test bulls’ commitment – Confluence Detector

Gold has held onto solid gains above $1800 despite the broad-based US dollar rebound, as investors remain unnerved amid looming coronavirus risks and ahead of the critical US data due later this week. Will the bulls retest the eight-year highs at $1818.17?

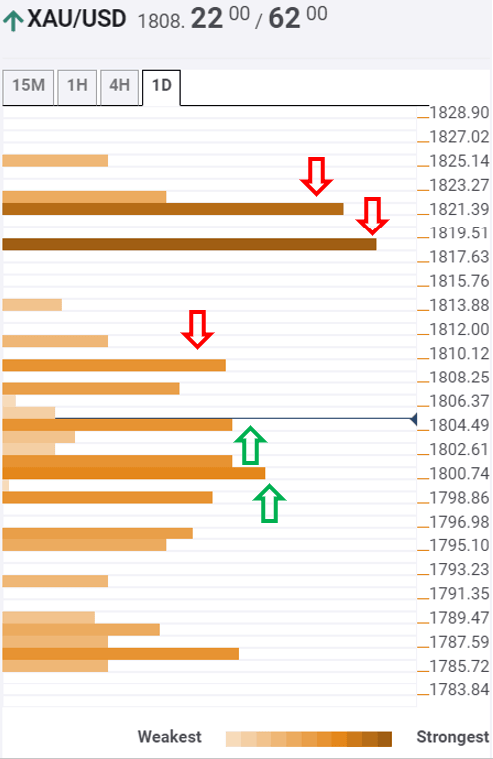

The Technical Confluences Indicator shows that the buyers continue to face stiff resistance at $1809, which is the convergence of the pivot point one-day R1, previous high on four-hour and Bollinger Band one-hour Upper.

A break above the latter will see a rally towards $1818, where the multi-year high, pivot point one-day R2 and Bollinger Band one-day Upper coincide.

The next resistance awaits at $1821.40, the confluence of the pivot point one-month R1 and Fibonacci 161.8% one-day.

On the downside, $1804.50 will limit any pullbacks, as the SMA50 and 10 one-hour intersect Fibonacci 61.8% one-day at that level.

Further south, a cluster of healthy support levels are seen at $1802/01, which is the confluence of the SMA100 one-hour, Fibonacci 38.2% one-day and Fibonacci 38.2% one-week.

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.