Gold Price Analysis: Bears to target a run to weekly support at $1,765

- Gold is testing the bear's commitments at the resistance structure.

- Weekly support could be their target if bulls capitulate at this juncture.

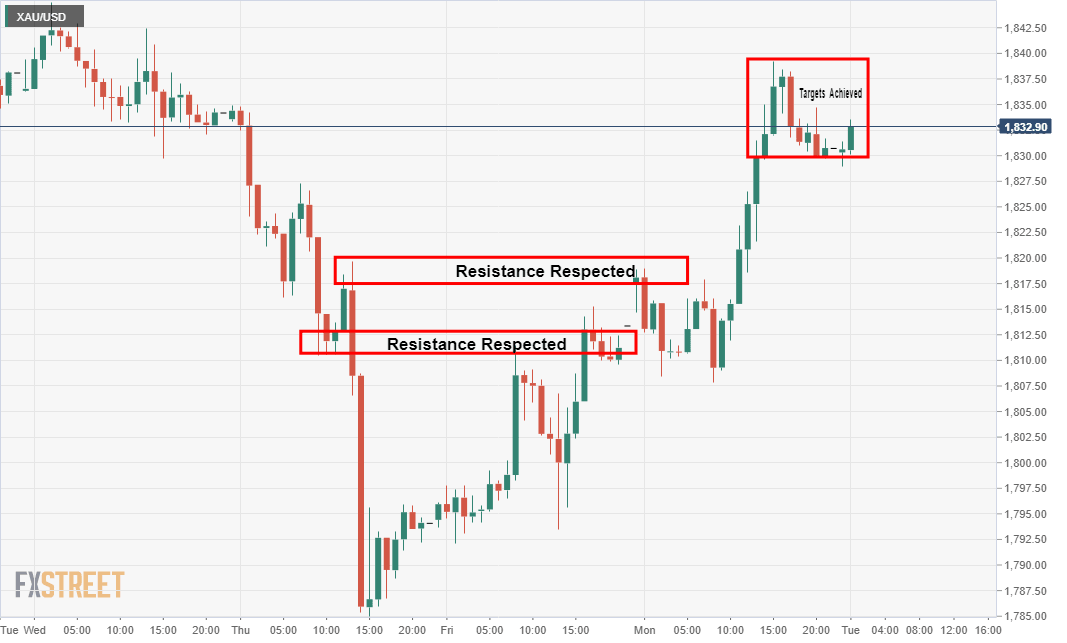

As per the prior analysis, where gold was presumed to move higher given the structure and bullish chart formation, explained here, the bulls did indeed extend to the target:

Live market, 1-hour chart

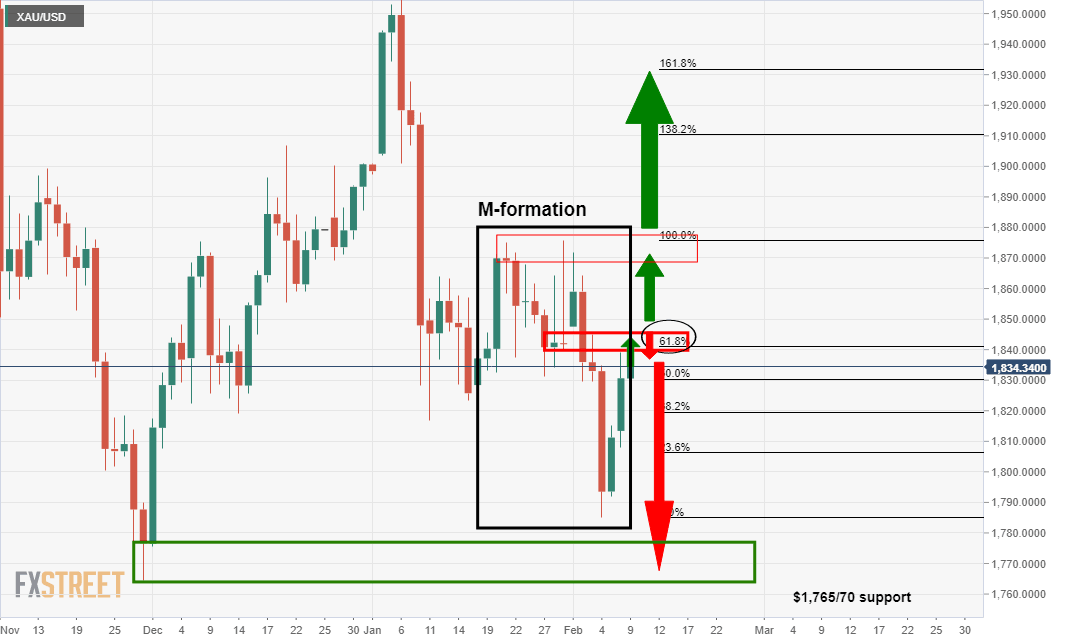

Here was the prior analysis:

And here it was from a daily perspective, noting the M-formation and target at the neckline:

What now?

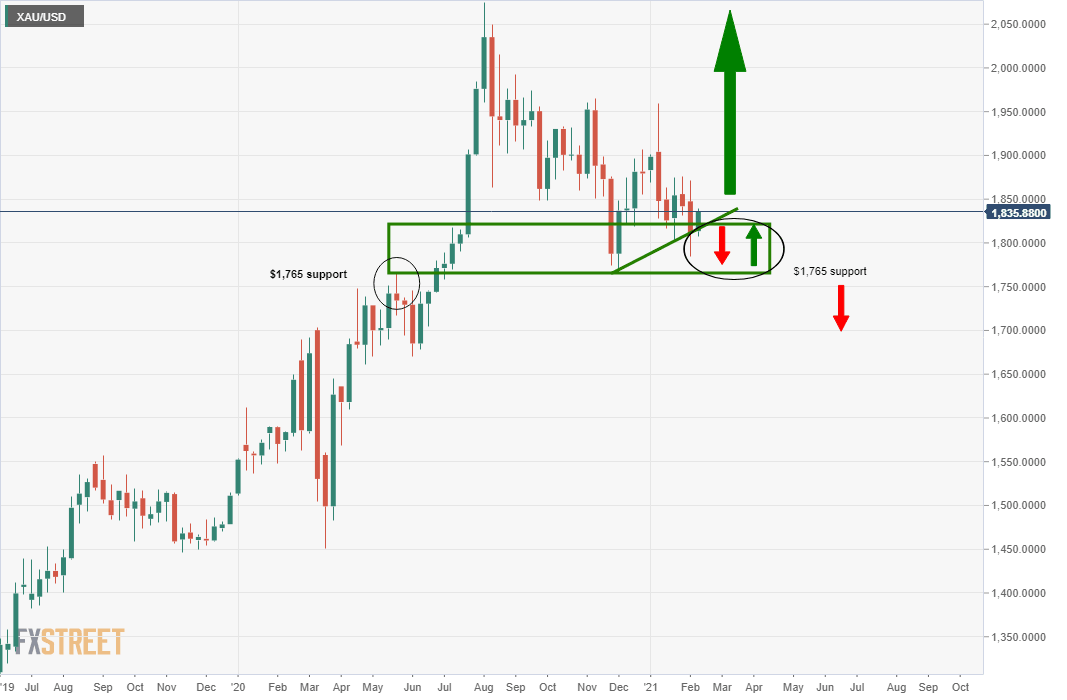

There is still room for some additional gains to the upside from where it will be make or break time.

Daily chart, gold

An extra push deeper into the bear's lair could be on the cards in a fuller test of the resistance area.

A break of which will open prospects of a run to the prior highs and/or higher still.

If the bears jump on this from there, then a strong possibility will be for a downside extension of the last bearish impulse from which the price has been correcting to a 61.8% Fibonacci retracement.

However, from that juncture, the bulls will most probably step up to the plate to protect weekly support at $1,765:

Weekly chart, gold

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.