Gold steady as softer US Dollar limits downside

- Gold holds range as traders reassess the Fed’s monetary policy outlook after the latest 25 bps rate cut.

- Fed Chair Jerome Powell’s cautious tone and data-dependent message keep XAU/USD confined to its familiar range.

- Softer US Dollar and easing Treasury yields help limit downside pressure on the metal.

Gold (XAU/USD) regains ground on Thursday, giving back part of earlier losses as the US Dollar (USD) weakens broadly. At the time of writing, the metal is trading around $4,235, with investors reassessing the Federal Reserve’s (Fed) monetary policy outlook after the latest interest rate cut.

The Fed delivered another 25 basis point (bps) rate cut on Wednesday, bringing the policy range to 3.50%-3.75%, in line with expectations. The decision passed on a 9-3 vote, with Stephen Miran once again advocating a larger 50 bps move, while Austan Goolsbee and Jeffrey Schmid preferred to leave policy unchanged.

However, the lack of conviction in the forward guidance limited Gold’s upside. Fed Chair Jerome Powell reiterated that the central bank is “well-positioned to wait and see how the economy evolves."

Powell’s remarks were widely interpreted as confirmation that the Fed is adopting a wait-and-see approach after delivering 75 bps of rate cuts this year. Even so, policymakers remain divided on the need for additional easing in 2026, leaving investors uncertain about the policy path and keeping the precious metal confined to the familiar range that has dominated trade for more than a week.

Market movers: Markets digest Fed outlook and updated projections

- US Initial Jobless Claims increased to 236K for the week ending December 6, surpassing expectations of 220K, while the 4-week average ticked up to 216.75K, and Continuing Jobless Claims fell to 1.838 million.

- A broadly weaker US Dollar (USD) and softer Treasury yields are helping limit downside in Gold. The US Dollar Index (DXY), which tracks the Greenback against a basket of six major currencies, is trading near 98.25, its lowest level since October 17. Meanwhile, the benchmark 10-year Treasury yield is hovering around 4.10%, easing after briefly climbing to three-month highs ahead of Wednesday’s Fed decision.

- The Federal Open Market Committee (FOMC) statement highlighted that economic activity is expanding at a moderate pace, with job gains slowing and unemployment edging higher, while inflation has moved up and remains somewhat elevated. Policymakers highlighted rising downside risks to employment and acknowledged elevated uncertainty around the economic outlook. The Committee said it will carefully assess incoming data, the evolving outlook, and the balance of risks when determining the extent and timing of any further policy adjustments, reaffirming its commitment to maximum employment and returning inflation to the 2% objective.

- The updated Summary of Economic Projections (SEP) placed the median forecast for real Gross Domestic Product (GDP) at 1.7% in 2025 and 2.3% in 2026, compared with 1.6% and 1.8% in the September projections. The unemployment rate outlook was largely unchanged at 4.5% for 2025 and 4.4% for 2026. PCE inflation is now projected at 2.9% for 2025 and 2.4% for 2026, slightly below the prior estimates of 3.0% and 2.6%, while core PCE is seen at 3.0% in 2025 and 2.5% in 2026, compared with earlier projections of 3.1% and 2.6%.

- Dot plots were unchanged, with the FOMC median rate forecast still implying one cut for both 2026 and 2027, no change in 2028, and the same longer-term rate of 3.0%.

- In the post-meeting press conference, Powell said inflation remains somewhat elevated and noted weakening labour-market sentiment. He highlighted upside risks to inflation and commented that risks are tilted against both sides of the Fed’s mandate. Powell added that the normalization achieved over the last three meetings should help stabilise the labour market and maintain downward pressure on inflation. He reiterated that interest rates are now within the range of plausible neutral estimates and emphasized that policy decisions will continue to be made on a meeting-by-meeting basis.

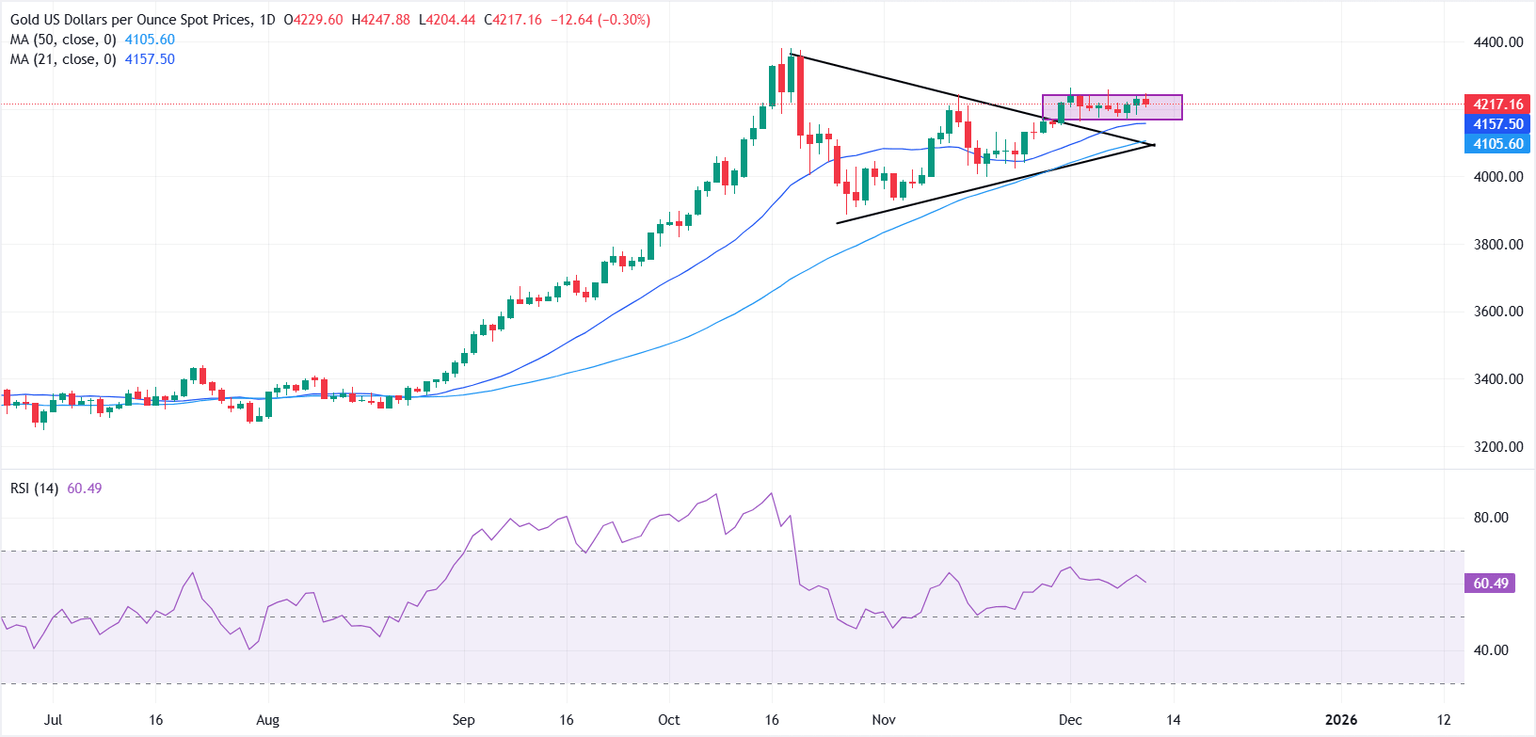

Technical analysis: Gold stays supported above rising SMAs in a tight range

Gold (XAU/USD) remains range-bound, with repeated dip-buying interest emerging in the $4,200-$4,180 zone and consistent selling pressure capping gains near $4,250.

In the daily chart, the 21-day Simple Moving Average (SMA) at $4,157.36 stands above the 50-day SMA at $4,105.55, both rising as price holds above them, underscoring a bullish bias. The Relative Strength Index (14) prints 60.03, above the midline, reinforcing positive momentum without overbought signals.

A daily close above the upper boundary of the consolidation zone would expose $4,300 and potentially open the path toward the all-time high near $4,381. On the downside, a break below $4,180 would weaken the near-term bias and shift attention toward the rising SMAs as initial support.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.