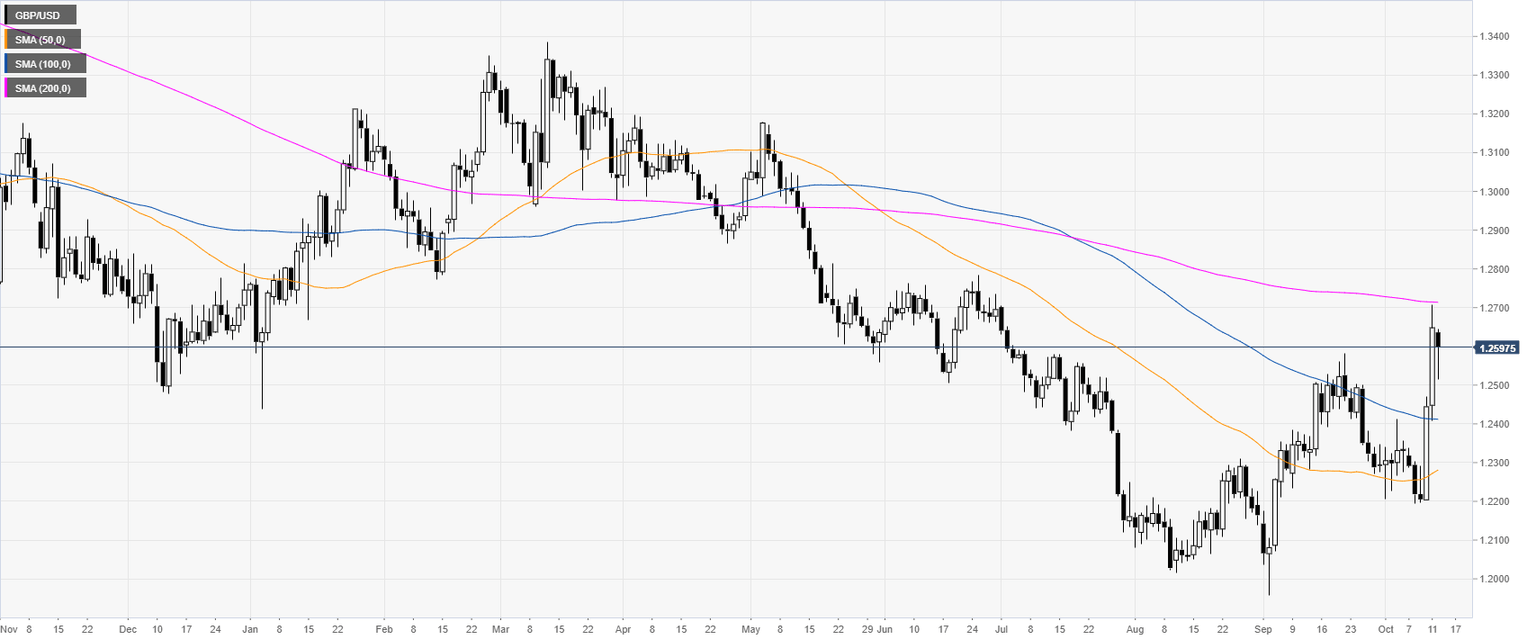

GBP/USD technical analysis: Cable bounces from daily lows and challenges the 1.2600 handle

- GBP/USD starts the week retracing part of the massive gains seen last weeks.

- GBP/USD is now battling with the 1.2600 handle in the last part of the London session.

GBP/USD daily chart

GBP/USD four-hour chart

GBP/USD 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst