GBP/USD Technical Analysis: Bull flag breakout could pull away from 1.2800

- GBP/USD is trading towards the upside, spurred on by a dovish Fed showing late on Wednesday, and bidders are looking to capitalize on continued Greenback weakness, marking in fresh intraday swingpoints as bulls try to mark in a new floor at the 1.2800 major technical level.

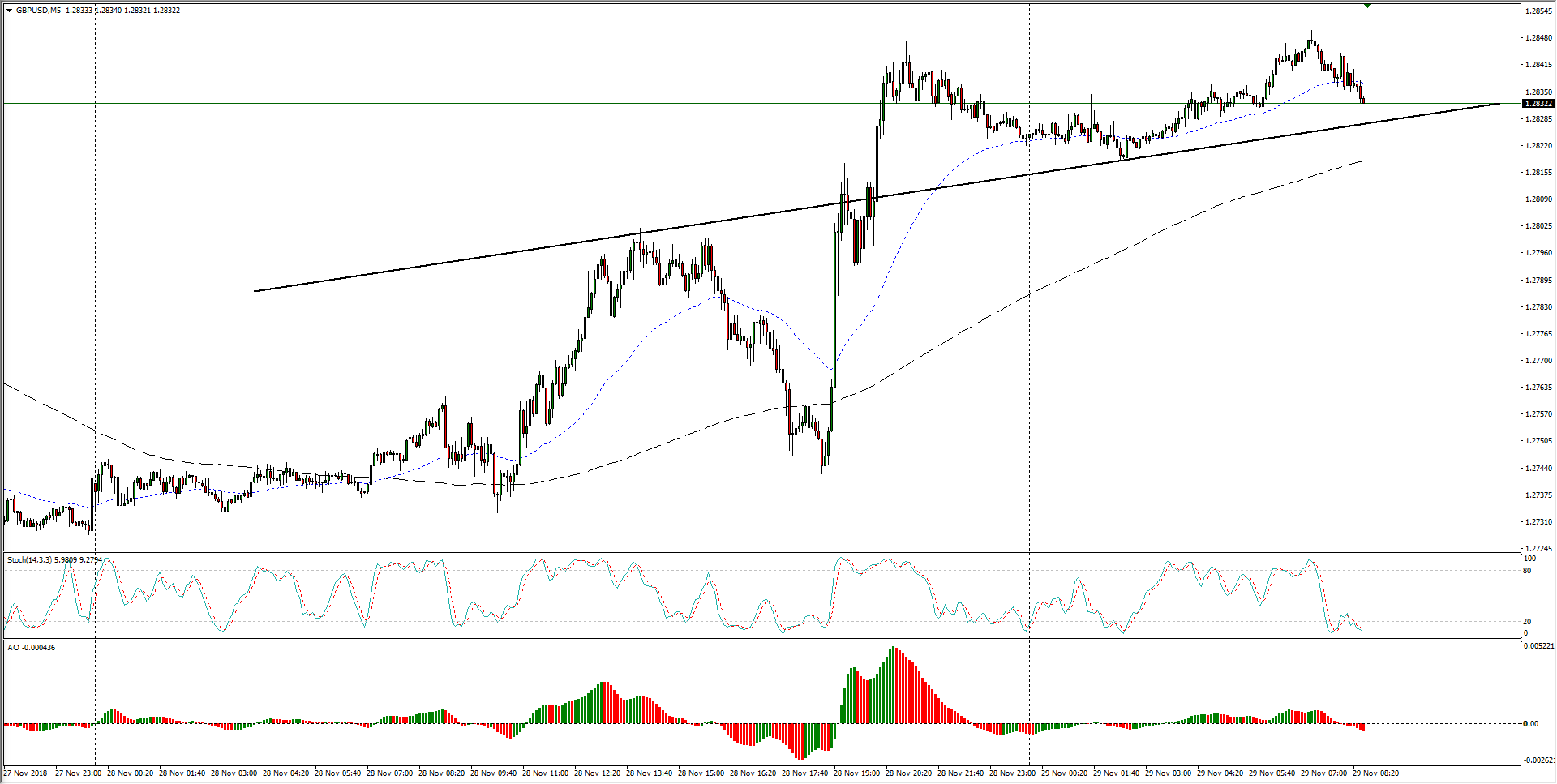

GBP/USD, 5-Minute

- The Cable has been exposed to plenty of fundamental-based volatility recently, getting whipped and spiked on various Brexit headlines, and taking a ride on the collapsing Greenback yesterday. High volatility but a lack of general direction has left the GBP/USD pairing broadly directionless in the near-term, cycling around the 200-period moving average near 1.2800.

GBP/USD, 30-Minute

- 4-Hour candles show the Cable may be in the middle of an upside breakout from a bullish flag, but stiff resistance from the 200-period moving average near 1.2925 could hamper progress to the upside if bidders are able to continue the US Dollar's bearish stance.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.284

Today Daily change: 14 pips

Today Daily change %: 0.109%

Today Daily Open: 1.2826

Trends:

Previous Daily SMA20: 1.2909

Previous Daily SMA50: 1.2986

Previous Daily SMA100: 1.2986

Previous Daily SMA200: 1.3329

Levels:

Previous Daily High: 1.2848

Previous Daily Low: 1.2728

Previous Weekly High: 1.2928

Previous Weekly Low: 1.2764

Previous Monthly High: 1.326

Previous Monthly Low: 1.2696

Previous Daily Fibonacci 38.2%: 1.2802

Previous Daily Fibonacci 61.8%: 1.2774

Previous Daily Pivot Point S1: 1.2753

Previous Daily Pivot Point S2: 1.2681

Previous Daily Pivot Point S3: 1.2634

Previous Daily Pivot Point R1: 1.2873

Previous Daily Pivot Point R2: 1.292

Previous Daily Pivot Point R3: 1.2992

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.