GBP/USD slips back into negative territory, but keeps head above 1.3300 for now

- GBP/USD has again reversed sharply back from morning highs around 1.3380, but has managed to stay above 1.3300 support.

- The pair seems to be waiting for further evidence that the Brexit deal is close before continuing to the upside.

Amid a broad pick up in the US dollar in recent trade, GBP/USD has slipped back from earlier 1.3380 highs into negative territory on the day in recent trade, with the pair currently trading around just under 10 pips or 0.06% lower on the day just above the 1.3300 level.

GBP underperforms as markets unwind perhaps Brexit deal bets

Nothing new to report on the Brexit front, which might indeed be being taken as a negative given how much pumping GBP has received in recent days on near-constant updates from the UK press about how the EU and UK have been getting ever closer to a deal.

As things stand right now, UK PM Boris Johnson and EU Commission President Ursula von der Leyen are supposedly supposed to be talking at some point later in the week, with the PM seeing the conversation as an opportunity to push a deal over the line. There has also been some chatter surrounding 1) a mini-deal to give more time for a full deal to be agreed upon (in other words, an extension) and 2) a review clause after 10-15 years for both sides to assess whether or not they are happy with how things stand. The former suggestion goes strongly against the current rhetoric from the current Brexiteer UK government, while the latter suggestion might be interesting in so far as it might encourage more flexibility in negotiations if both sides know there will be a chance to tweak aspects of any deal they don’t like down the line.

But as markets wait for further updates, GBP is the underperforming G10 currency, in what seems to be nothing more than just a minor technical correction on what could be described as excessive optimism towards GBP in recent days despite no confirmation of a Brexit deal yet. Still, cable has is for now holding above 1.3300, nearly 400 pips above where it started the month.

Elsewhere, a few other factors to consider for GBP this morning; stronger than forecast CBI Distributive Trade data was out this morning and was a little less bad than expected at -25 (exp. -35).

Meanwhile, much attention is being paid in the UK press to what will happen when the national lockdown ends on 2 December and what tiers various parts of the country will be placed in (with a lot of focus on whether London will be placed in the more restrictive tier 2). As far as GBP is concerned, this ought not to matter too much; the long-term economic impact of the full-course of the Covid-19 pandemic and future EU/UK trading relationship take precedence over whether pubs are in London are allowed to open or not this side of Christmas.

Comments from Bank of England’s Haskel earlier on in the session regarding recent vaccine news (vaccines provide a light at the end of the tunnel, but it’s too early to say if will significantly improve 2021 growth prospects) have not shifted the dial for GBP.

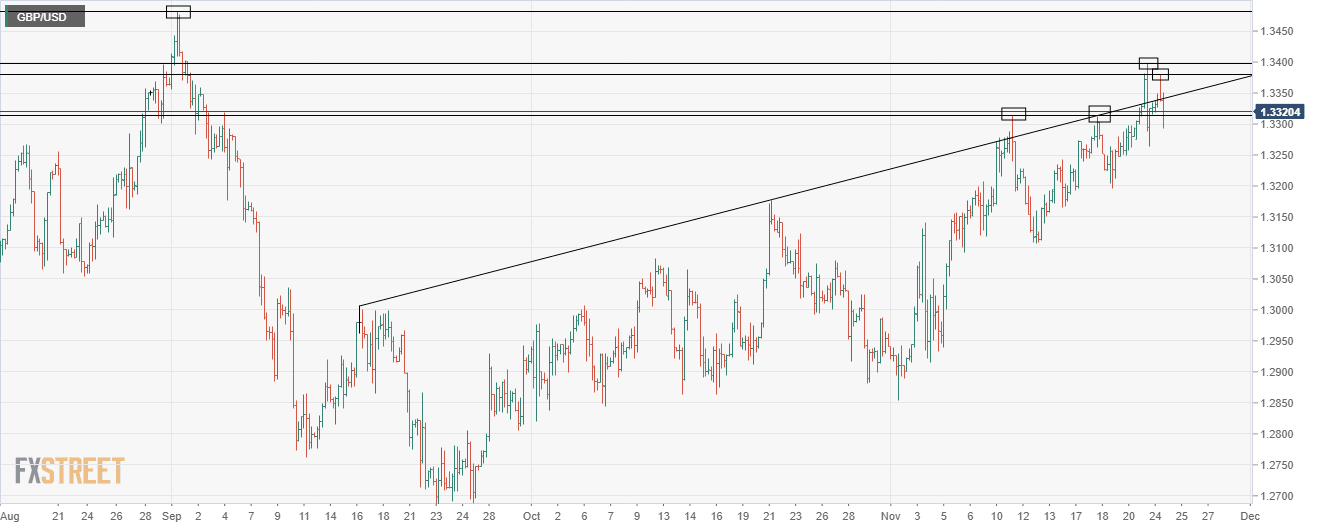

GBP/USD flirting with the upper bounds of its long-term upwards trend channel

GBP/USD again popped above the upper bounds of its long-term upwards trend channel (which comes into play around 1.3340) earlier on during Tuesday’s session but has recently slipped back to the 1.3300 level amid another pick up in USD during the European afternoon. For reference, the upper bound of this long-term upwards trend channel links the 16 September, 21 October and 10, 11 and 18 November highs.

The pair currently trades around the significant 1.3310-13 area (11 and 18 November highs). To the upside, key levels of resistance are Tuesday’s highs at 1.3380 and Monday’s highs at just under the psychological 1.3400 level.

To the downside, the 1.3300 level is holding for now and below that, there is Monday’s lows which come in around 1.3266.

GBP/USD four hour chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset