GBP/USD: Risk reversal jumps to two-month high ahead of BOE Super Thursday

One-month risk reversals on the British pound (GBP), a gauge of calls to puts, jumps to the highest since March 02 by the of Wednesday’s trading session, indicating investors are adding bullish bets to position for cable strength ahead of the key Bank of England (BOE) meeting.

Risk reversals jumped to +0.400 in favor of call or bullish bets according to the latest data provided by Reuters. The gauge peaked at +0.65 in favor of calls during February.

The positive reading indicates call options are drawing higher premium (option price) than calls or bullish bets. In other words, the options market is most bullish two months ahead of the key UK event.

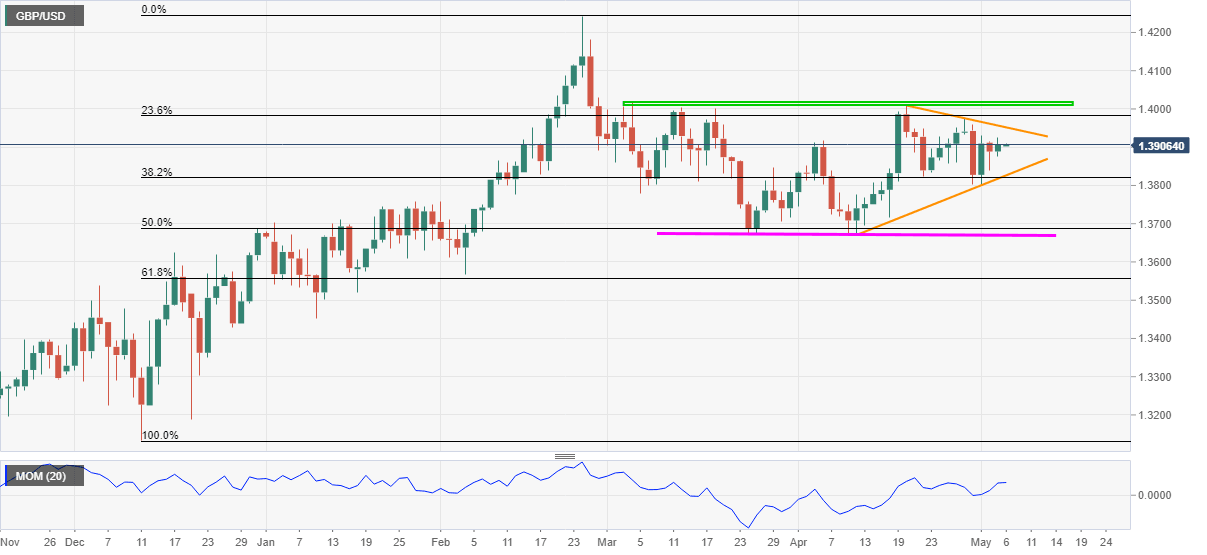

That said, GBP/USD wobbles inside a short-term triangle, not to forget the two-month-old trading range, despite recently picking up bids near 1.3905.

Given the bullish sentiment of the options market, coupled with the recovery in prices inside the stated triangle, GBP/USD buyers stay hopeful.

GBP/USD daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.