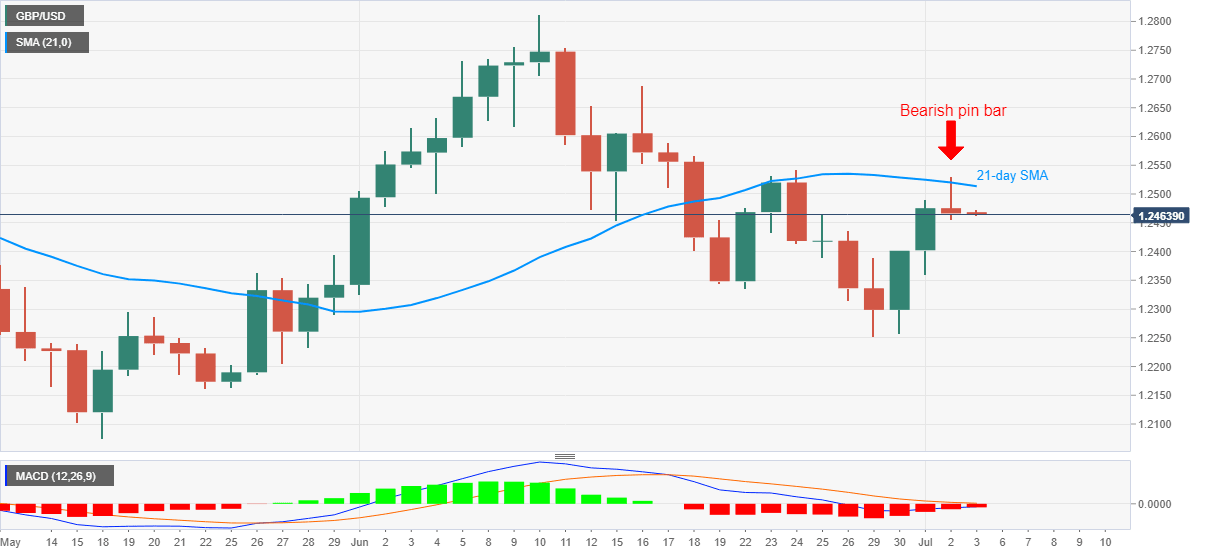

GBP/USD Price Analysis: Thursday’s bearish pin bar keeps sellers hopeful below 1.2500

- GBP/USD remains redundant between 1.2455/75 area following its U-turn from 1.2530.

- A bearish candlestick formation below 21-day SMA increases the odds of the pair’s further weakness.

- Bulls may seek validation from June 24 top before entry.

GBP/USD takes rounds to 1.2470 amid Friday’s Asian session. The Cable turned south from over one-week top the previous day, which in turn portrayed a bearish pin bar candlestick formation on the daily chart. Also favoring the sellers is the pair’s sustained trading below 21-day SMA and MACD signals.

Hence, the quote is likely to revisit June 29 top surrounding 1.2390 during the fresh downside. However, the last month’s low close to 1.2252 could restrict further weakness.

Given the GBP/USD prices fail to recover from 1.2252, May 22 low of 1.2162 might offer an intermediate halt before dragging the quote towards May 18 bottom around 1.2075 and 1.2000 threshold.

On the contrary, the pair’s upside break of 21-day SMA level of 1.2514 won’t immediately call the bulls as June 24 high close to 1.2545 will become additional resistance to watch.

Though, the pair’s further rise past-1.2545 might not hesitate to challenge the June monthly top of 1.2813 with June 16 peak around 1.2690 likely being an intermediate halt.

GBP/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.