GBP/USD Price Analysis: Struggles around 1.3900 despite triangle breakout

- GBP/USD stalls the bounce as the US dollar resumes the upside.

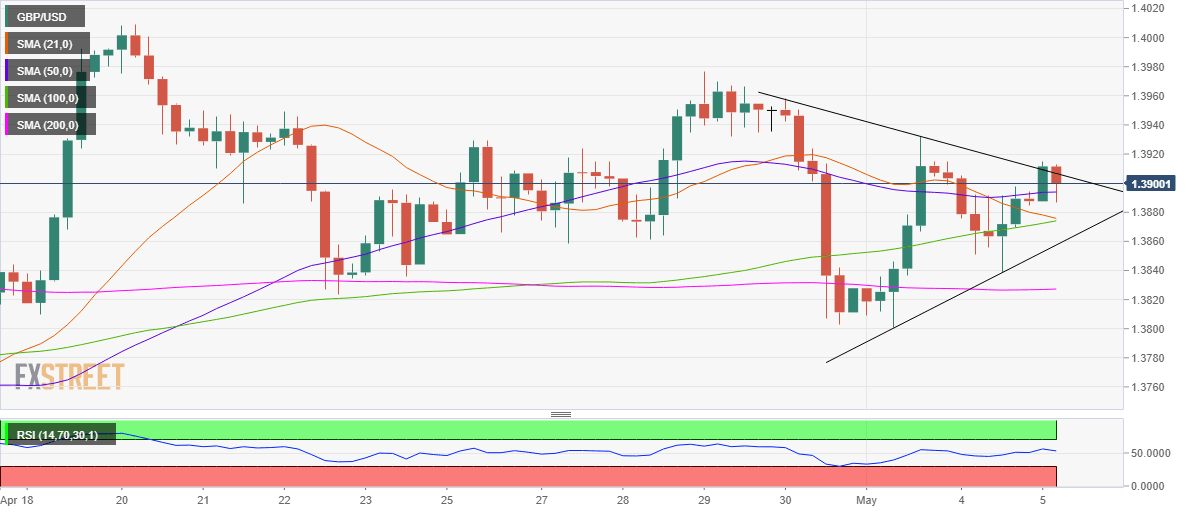

- Symmetrical triangle breakout on the 4H chart still keeps buyers hopeful.

- RSI has turned south but holds above the midline.

GBP/USD is battling 1.3900 in early European dealing, as the US dollar picks up bids and resumes Tuesday’s uptrend.

Ongoing Brexit concerns over the Northern Ireland border issues and strong US economic data also weigh on the cable.

The focus shifts towards the NFP hints, in the form of the US ADP jobs and ISM Services PMI for near-term trading opportunities.

From a near term technical perspective, the cable is struggling to hold at higher levels despite a symmetrical triangle bullish breakout confirmed on the four-hour chart earlier today,

The bulls need to take out the daily highs at 1.3915 on a sustained basis, in order the 1.3950 level in their stride.

The Relative Strength Index (RSI) has turned south but remains well above the midline, backing the recent pause in the bounce.

GBP/USD four-hourly chart

A four-hourly closing below the 50-simple moving average (SMA) at 1.3893 could revive the selling momentum.

The downside could be then exposed towards 1.3874, the intersection of the 21 and 100-SMAs.

Further south, Tuesday’s low of 1.3839 could be put to test.

GBP/USD additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.