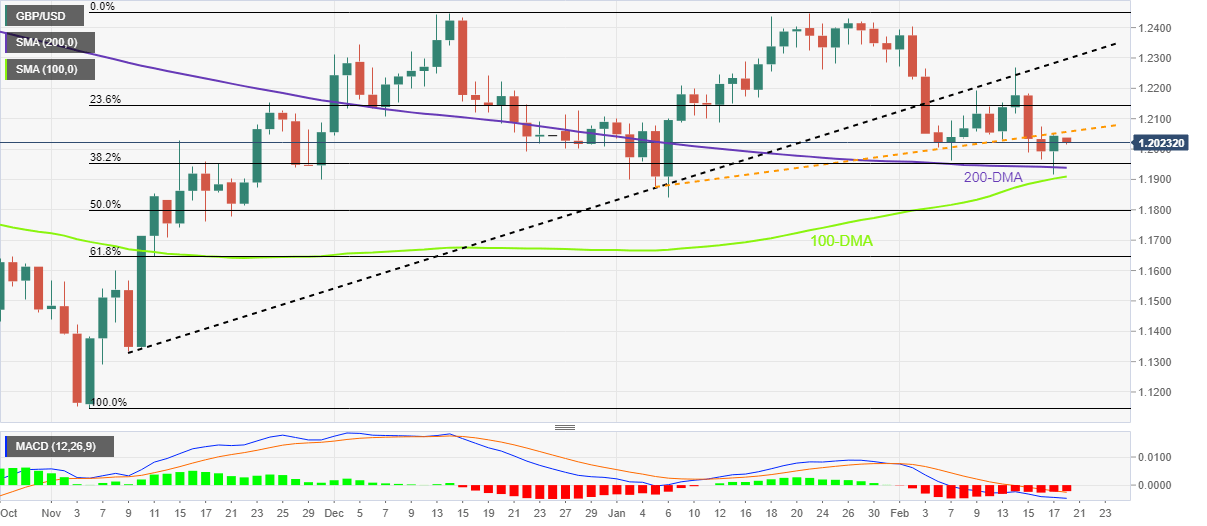

GBP/USD Price Analysis: Slides towards 1.2000 as bears eye another battle with key DMAs

- GBP/USD takes offer to refresh intraday low, fades bounce off six-week low.

- Bearish MACD signals, sustained trading below the previous key support lines keep sellers hopeful.

- 200-DMA, 100-DMA restrict Cable pair’s short-term downside ahead of January’s low.

GBP/USD bears return to the desk, after the previous day’s absence, as they approach the 1.2000 psychological manget, down 0.20% intraday near 1.2020 during early Monday.

In doing so, the Cable pair retreats from the previous support line stretched from early January amid the bearish MACD signals. it’s worth noting that the quote’s failure to cross the support-turned-resistance line from November 09, 2022, adds strength to the downside bias.

With this, the GBP/USD bears are all set to revisit the 200-DMA support surrounding 1.1940. However, the 1.2000 psychological magnet could act as immediate downside support.

Following that, the 100-DMA, close to the 1.1900 round figure, may become the last defense of the GBP/USD bulls before giving control to the bears, who can aim for January’s low of 1.1840 during the further downside.

Meanwhile, the GBP/USD pair’s run-up beyond the immediate resistance line, previous support near 1.2055, isn’t the confirmation of further advances as a 3.5-month-old previous support line, close to 1.2300, could challenge the buyers afterward.

Should the quote remains firmer past 1.2300, the monthly high near 1.2400 and the double tops marked around 1.2450 will be crucial to watch.

GBP/USD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.