GBP/USD Price Analysis: Seems vulnerable below 38.2% Fibo. amid stronger USD

- GBP/USD remains under some selling pressure for the second successive day on Thursday.

- The Fed’s hawkish outlook continues to underpin the USD and is seen weighing on the pair.

- The setup seems tilted in favour of bearish traders and supports prospects for further losses.

The GBP/USD pair attracts fresh sellers near the 1.2645 region during the Asian session and turns lower for the second straight day on Thursday. The pair is currently placed around the 1.2620 area, down just over 0.10% for the day, and remains well within the striking distance of a two-week low touched on Wednesday.

The US Dollar (USD) stands tall near a two-week high and continues to draw support from Federal Reserve (Fed) Chair Jerome Powell's overnight hawkish remarks, reiterating that two rate increases are likely this year. The British Pound (GBP), on the other hand, is weighed down by worries about economic headwinds stemming from a far more aggressive policy tightening by the Bank of England (BoE). This, in turn, is seen exerting some downward pressure on the GBP/USD pair and favours bearish traders.

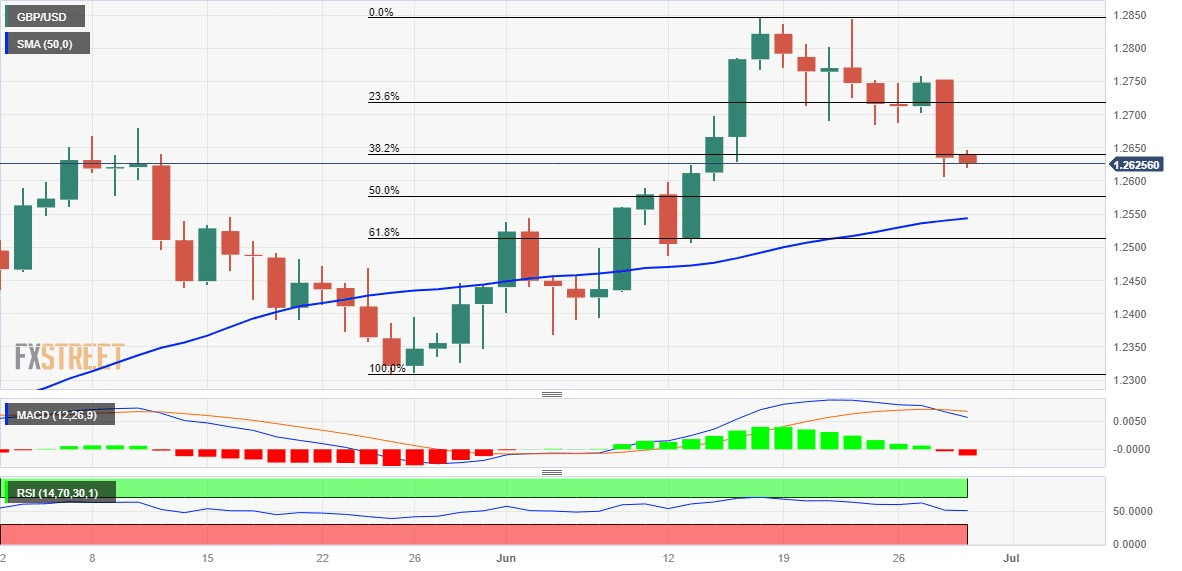

From a technical perspective, spot prices now seem to have found acceptance below the 38.2% Fibonacci retracement level of the May-June rally. This validates the near-term negative outlook and supports prospects for an extension of the GBP/USD pair's recent sharp retracement slide from a 14-month peak, around the 1.2848-1.2850 region set on June 16. That said, oscillators on the daily chart - though have been losing traction - are yet to confirm the bearish bias and warrant some caution for aggressive traders.

Hence, it will be prudent to wait for some follow-through selling below the 1.2600 mark, or the overnight swing low, before positioning for any further losses. The GBP/USD pair might then slide to the 50% Fibo. level, around the 1.2580 region, en route to the 50-day Simple Moving Average (SMA), currently pegged near the 1.2540 zone. This is followed by 61.8% Fibo. level, around the 1.2515 region and the 1.2500 psychological mark, which if broken decisively should pave the way for a further depreciating move.

On the flip side, any positive move above the 1.2640-1.2645 area, coinciding with the 38.2% Fibo. level, is likely to confront stiff resistance near a horizontal support breakpoint, just ahead of the 1.2700 mark. This is closely followed by 23.6% Fibo. level, around the 1.2715-1.2720 region. A sustained strength beyond the latter will negate the negative bias and lift the GBP/USD pair beyond the 1.2760-1.2765 intermediate hurdle, towards the 1.2800 mark en route to the YTD peak, near the 1.2840-1.2850 region.

GBP/USD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.