GBP/USD Price Analysis: Pound tests the descending triangle breakout below 1.2100

- Test of the descending triangle breakout will provide a buying opportunity at bargain prices.

- Fed’s view of policy moderation has infused fresh blood into risk-sensitive currencies.

- Oscillation in the bullish range of 60.00-80.00 by the RSI (14) adds to the upside filters.

The GBP/USD pair is displaying a lackluster performance after dropping from the round-level resistance of 1.2100 in the Asian session. Exhaustion in the upside momentum has faded Cable’s rally for a while, however, the upside bias is still intact amid the risk appetite theme.

Meanwhile, the US Dollar Index (DXY) is aiming to build a cushion around 105.50 as Federal Reserve (Fed) chair Jerome Powell has supported moderation of policy tightening to safeguard the United States economy from any crash.

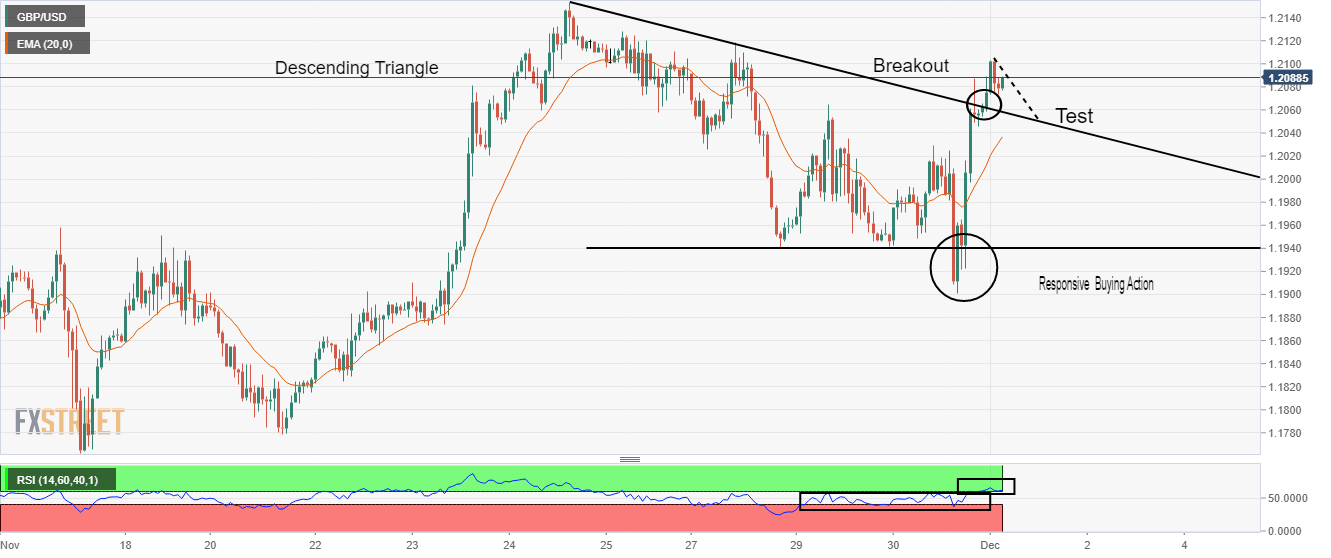

On an hourly scale, the Cable is expected to test the breakout of the descending triangle chart pattern near 1.2060. The downward-sloping trendline of the aforementioned chart pattern is placed from November 24 high at 1.2154 while the horizontal support is plotted from November 28 low at 1.1941.

It is worth noting that Cable witnessed a responsive buying action on Wednesday around 1.1900 that safeguarded the descending triangle breakdown. This has also strengthened the odds of an upside move ahead.

Advancing 20-period Exponential Moving Average (EMA) at 1.2030 adds to the upside filters. Also, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which indicates a continuation of bullish momentum.

Going forward, a corrective move near the 1.2060 area will present a bargain buying opportunity for the market participants, which will drive the Cable towards Monday’s high at 1.2118, followed by November 24 high at 1.2154.

Alternatively, a decisive drop below Wednesday’s low at 1.1900 will drag the Cable toward November 22 low at 1.1825. A slippage below the latter will drag the pair to near November 21 low at 1.1779.

GBP/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.