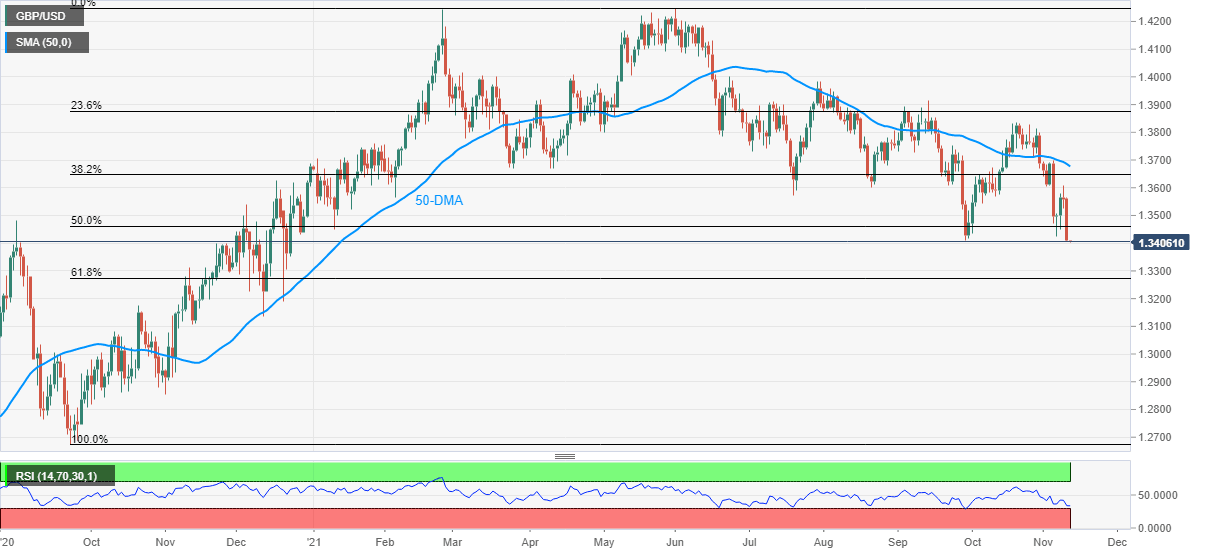

GBP/USD Price Analysis: Oversold RSI probes bears at yearly bottom of 1.3401

- GBP/USD sellers take a breather, indecisive after refreshing the yearly low.

- Sustained trading below September’s low of 1.3411, break of 1.3400 become necessary to keep bears on the table.

- Corrective pullback remains doubtful until crossing July’s trough.

GBP/USD defends the 1.3400 threshold amid Thursday’s initial Asian session, following the slump to refresh the yearly low.

The lackluster moves could be linked to the cable pair’s inability to extend the downside break of September month’s low near 1.3410, as well as the nearly oversold RSI conditions.

That said, the corrective pullback may aim for the 50% retracement (Fibo.) of the pair’s run-up from September 2020 to June 2021, around 1.3460.

However, the rebound remains doubtful until staying below July’s bottom near 1.3575, a break of which could direct the quote towards the 50-DMA level of 1.3677.

Meanwhile, a clear downside break of the 1.3400 mark will direct the GBP/USD prices towards December 2020 low near 1.3130, with the 61.8% Fibo. likely offering an intermediate halt around 1.3270.

GBP/USD: Daily chart

Trend: Corrective pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.