GBP/USD Price Analysis: Off weekly bottom above 1.3800 but not out of woods

- GBP/USD struggles to defend the bounce off weekly low.

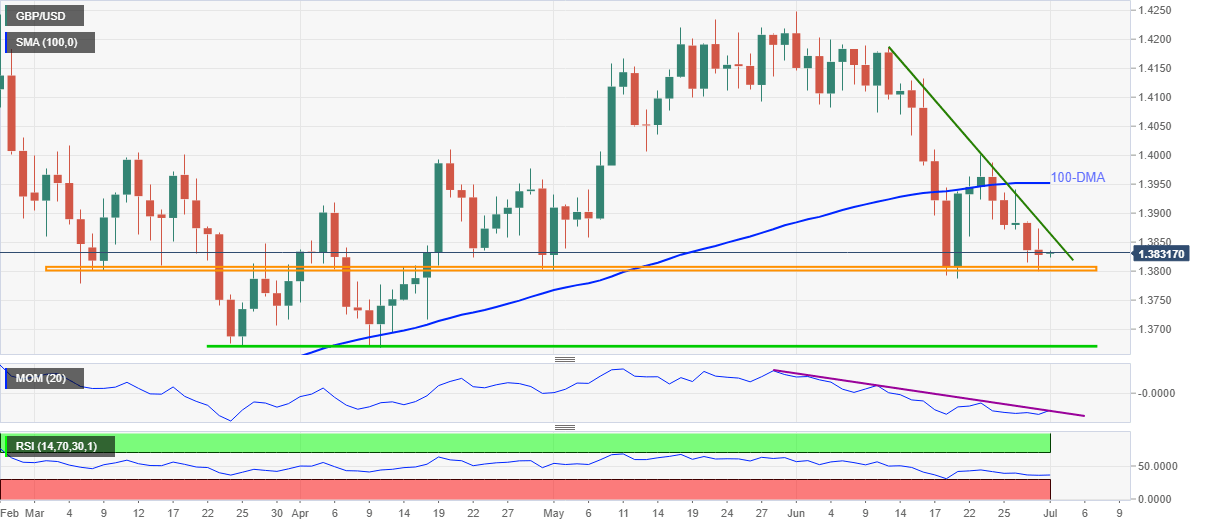

- Four-month-old horizontal area restricts immediate downside, monthly resistance line tests corrective pullback.

- Cap on Momentum line, sustained trading below 100-day SMA keeps sellers hopeful.

The GBP/USD pair’s bounce off weekly bottom remains capped around 1.3835-40 during the early Asian session on Thursday. In doing so, the cable pair justifies its sustained trading below one-month-old resistance line and bearish Momentum, as well as downbeat RSI.

However, the bears have a tough nut to crack on hand as multiple levels marked since early March, around 1.3810–3800, challenge the further declines targeting the yearly low surrounding 1.3670.

During the fall, the 1.3745-50 and the 1.3700 threshold may offer an intermediate halt during the quote’s weakness between 1.3800 and 1.3670.

Alternatively, a daily closing beyond the stated resistance line near 1.3865 will aim for the 100-DMA level of 1.3952. Though, the early April top surrounding 1.3920 can act as a buffer.

Should the GBP/USD bulls manage to cross the 1.3952 hurdle, multiple resistances between the 1.4000 round figure and 1.4010 can test the quote’s advances.

It’s worth noting that the Momentum line probes a five-week-old resistance and a breakout may favor the pair’s latest corrective pullback.

GBP/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.