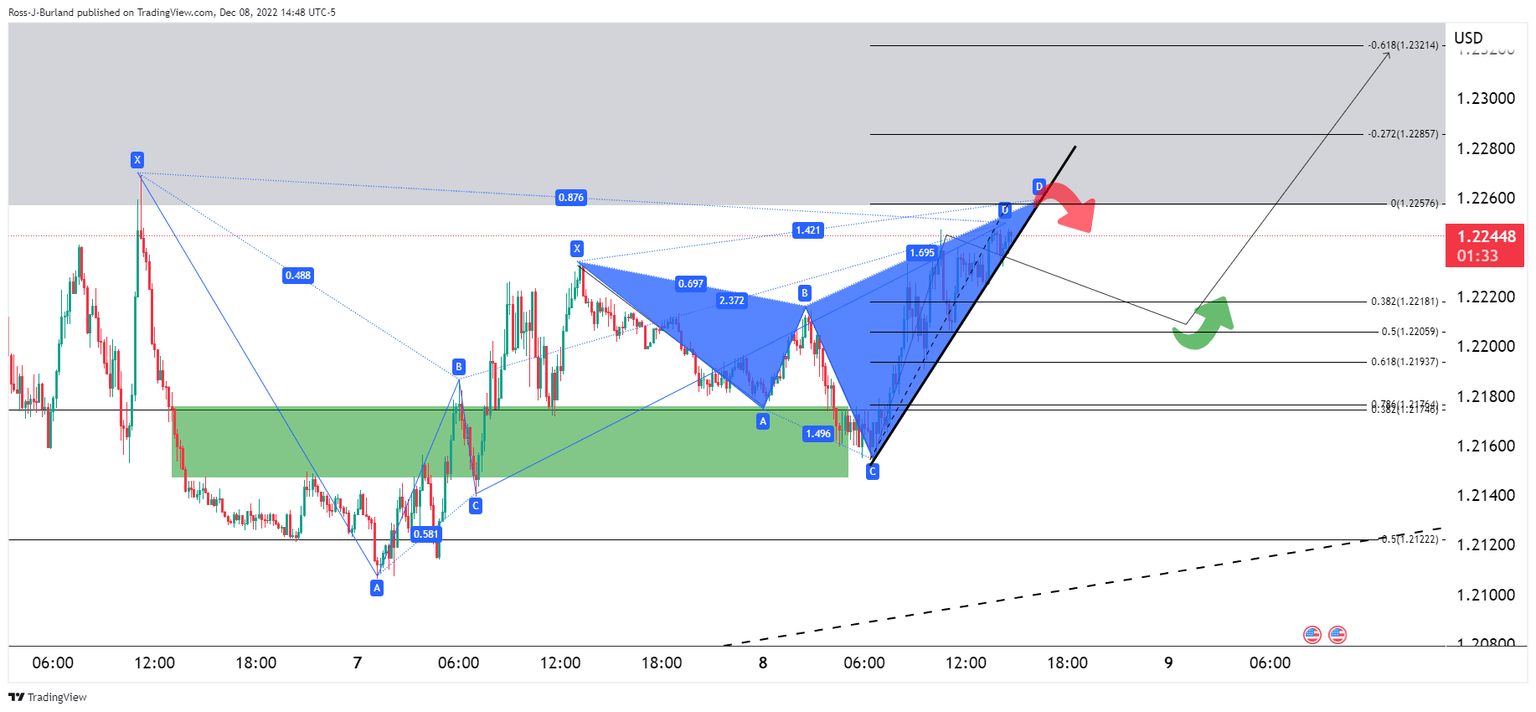

GBP/USD Price Analysis: Harmonic bearish patterns expose 1.2200

- GBP/USD's combination of harmonic patterns is a bearish feature.

- A trip into the Fibonacci scale could be on the cards for the remainder of the week with 1.22 eyed.

In the prior analysis, GBP/USD Price Analysis: Bulls in control and eye 1.2350, it was explained that the bulls took out a key resistance and so long as 1.2150 holds, there would be prospects of a rally towards 1.2350 and then 1.2450 for the days ahead:

GBP/USD prior analysis

GBP/USD update

The price respected the support area and subsequently moved higher. However, another W-formation has formed which could see the Gold price move into the neckline prior to the next bullish impulse:

GBP/USD M10 chart

The combination of the harmonic patterns is a bearish feature for the near term and a trip into the Fibonacci scale could be on the cards for the remainder of the week with 1.22 eyed.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.