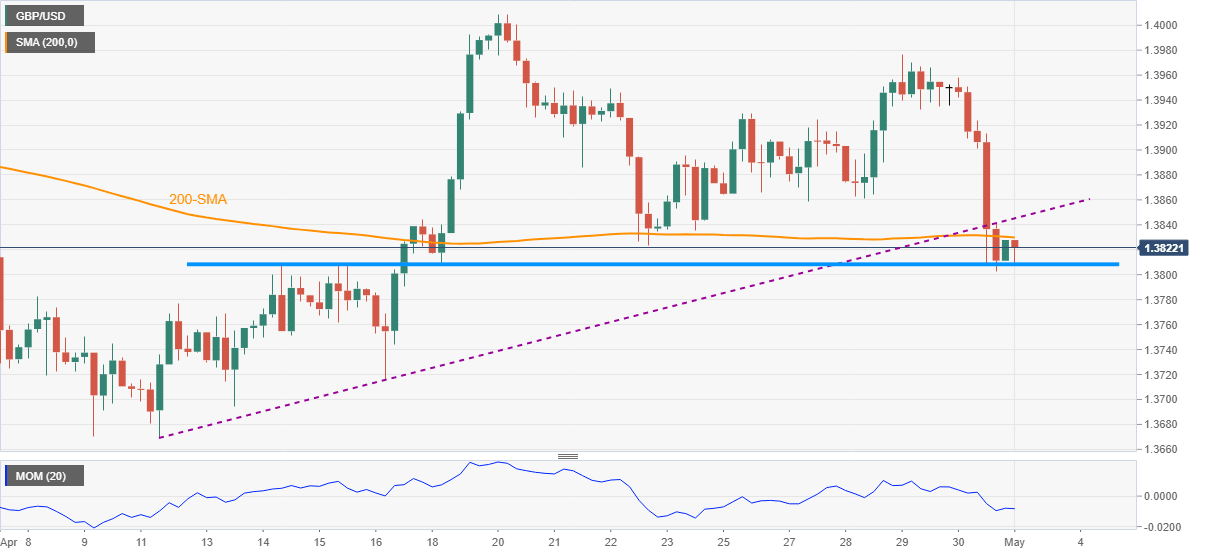

GBP/USD Price Analysis: Depressed inside 50-pips trading range above 1.3800

- GBP/USD remains pressured between previous support line from April 12 and a three-week-old horizontal area.

- Downside break of 200-SMA, sluggish Momentum back recent weakness.

GBP/USD drops back towards 1.3800, down 0.08% intraday around 1.3816 by the press time of Monday’s Asian session. Even so, the cable struggles for a clear direction inside a trading range of nearly 50-pips comprising the key horizontal support and a short-term resistance line, previous support.

The quote’s latest weakness below 200-SMA and downbeat Momentum indicator suggests another attempt to break below the mid-April tops surrounding 1.3810. However, sellers may wait for a fresh low beneath the latest 1.3802, as well as a clear break below the 1.3800 threshold, for confirmation.

Following that multiple supports around 1.3750 and 1.3720-15 can entertain GBP/USD bears ahead of directing them to the previous month’s low near 1.3669.

On the flip side, 200-SMA level of 1.3830 guards corrective pullback beneath the previous support line near 1.3845-50.

Even if the GBP/USD prices cross the 1.3850 hurdle, lows marked during the last week around 1.3860 act as extra upside filters before highlighting the 1.3930 resistance for the buyers.

GBP/USD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.