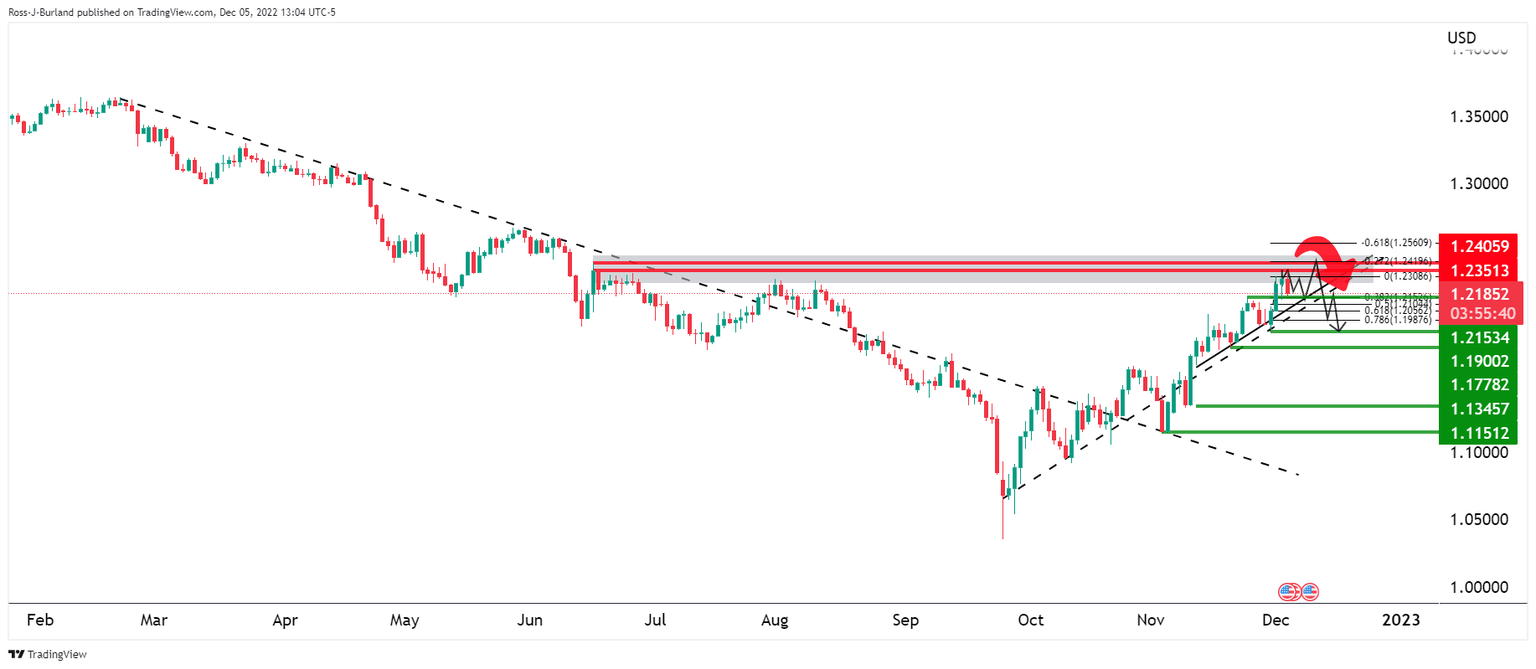

GBP/USD Price Analysis: Bulls look to 1.2450 while bears eye test of 1.2100

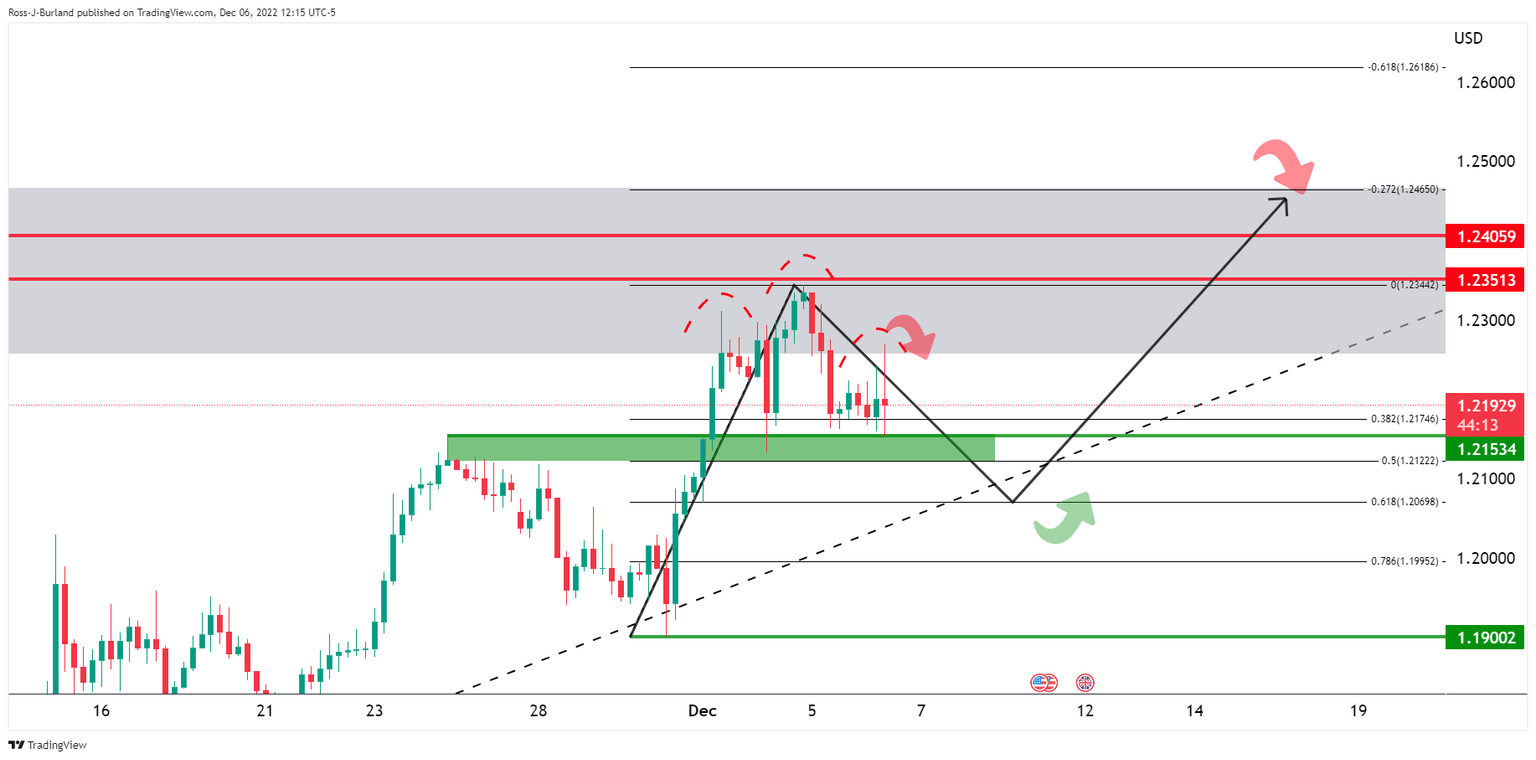

- In the 4-hour chart, we can see that the price is forming a head & shoulders pattern.

- A break of structure in the 1.2150s is required for a move into testing the trendline support and commitments at 1.2100.

- If the bulls were to commit, then the case for a higher bull cycle high would be on the cards with 1.2450 eyed.

As per the prior analysis, GBP/USD bears step up the pace, eye break of 1.2150s, the British Pound remains within the bullish trend but is testing the commitments below 1.2200 and at 1.2150. The low of the week so far has been 1.2152 and the following illustrates the prospects of a deeper correction should the bears stay the course.

GBP/USD prior analysis

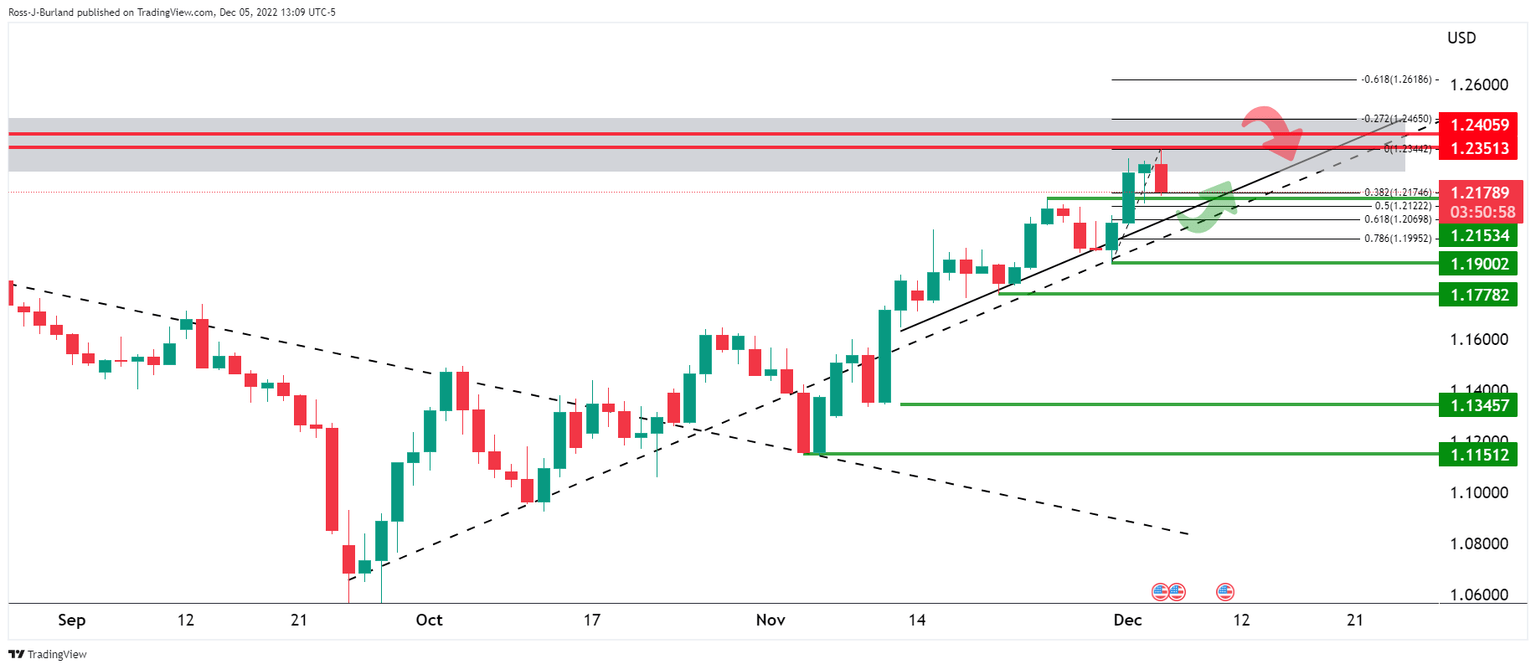

It was stated that GBP/USD has been potentially starting to move into a phase of distribution below the 1.2350, 1.2400 areas on the daily chart as illustrated above.

However, the British Pound's bullish trend would still be intact while structures 1.2150 and 1.1900 are yet to be broken:

A move below 1.2150 could, however, result in a deeper correction through the Fibonacci scale with eyes on a 50% mean reversion at 1.2120 and then a 61.8% ratio confluence with the upper quarter of the 1.20 area near 1.2070.

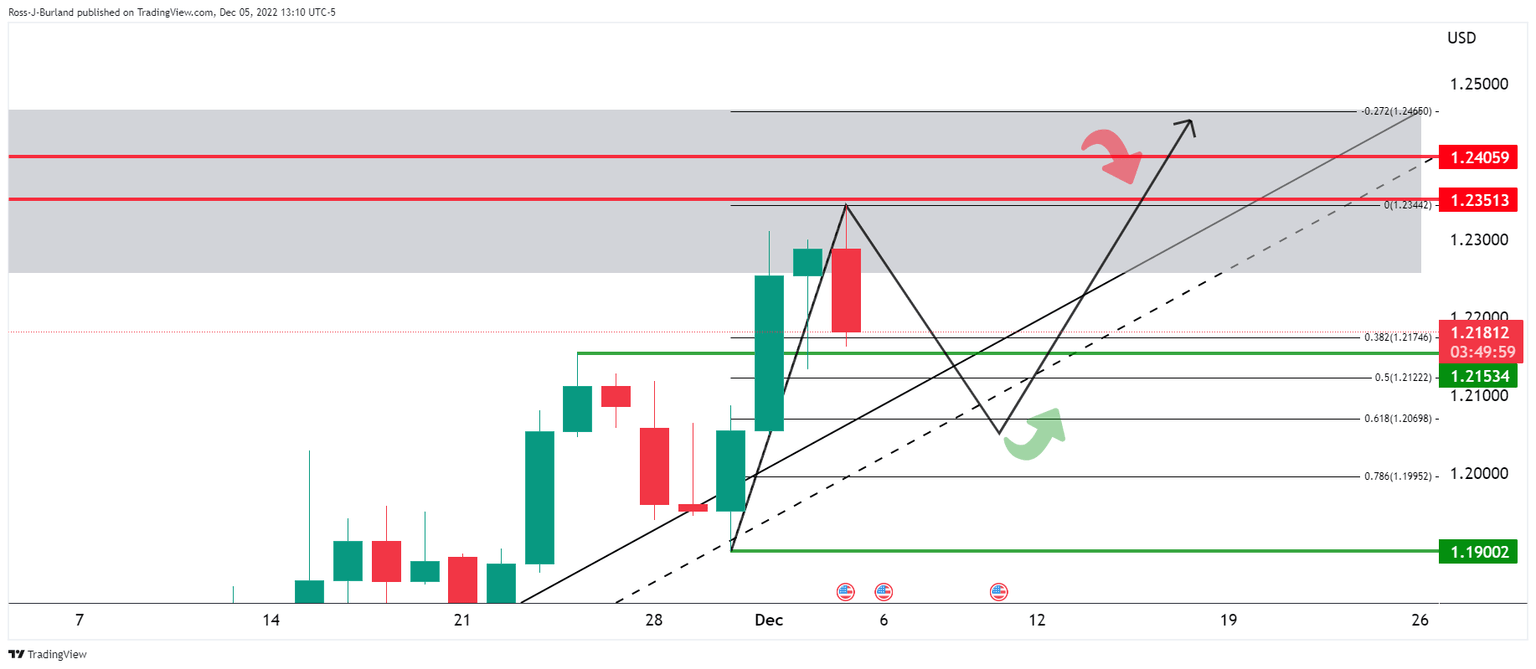

GBP/USD update, H4 chart

In the 4-hour chart, we can see that the price is forming a head & shoulders pattern with lower highs in the right-hand shoulder. This gives rise to the prospects of a break of structure in the 1.2150s for a move into testing the trendline support and commitments at 1.21 the figure for other sessions ahead.

If the bulls were to commit around the dynamic support of the trendline, then the case for a higher bull cycle high would be on the cards with 1.2450 eyed.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.