GBP/USD bulls take on the dynamic resistance ahead of critical NFP data

- GBP/USD breaks dynamic resistance as the US dollar continues to fall.

- Traders are getting set for the next key jobs report from the US.

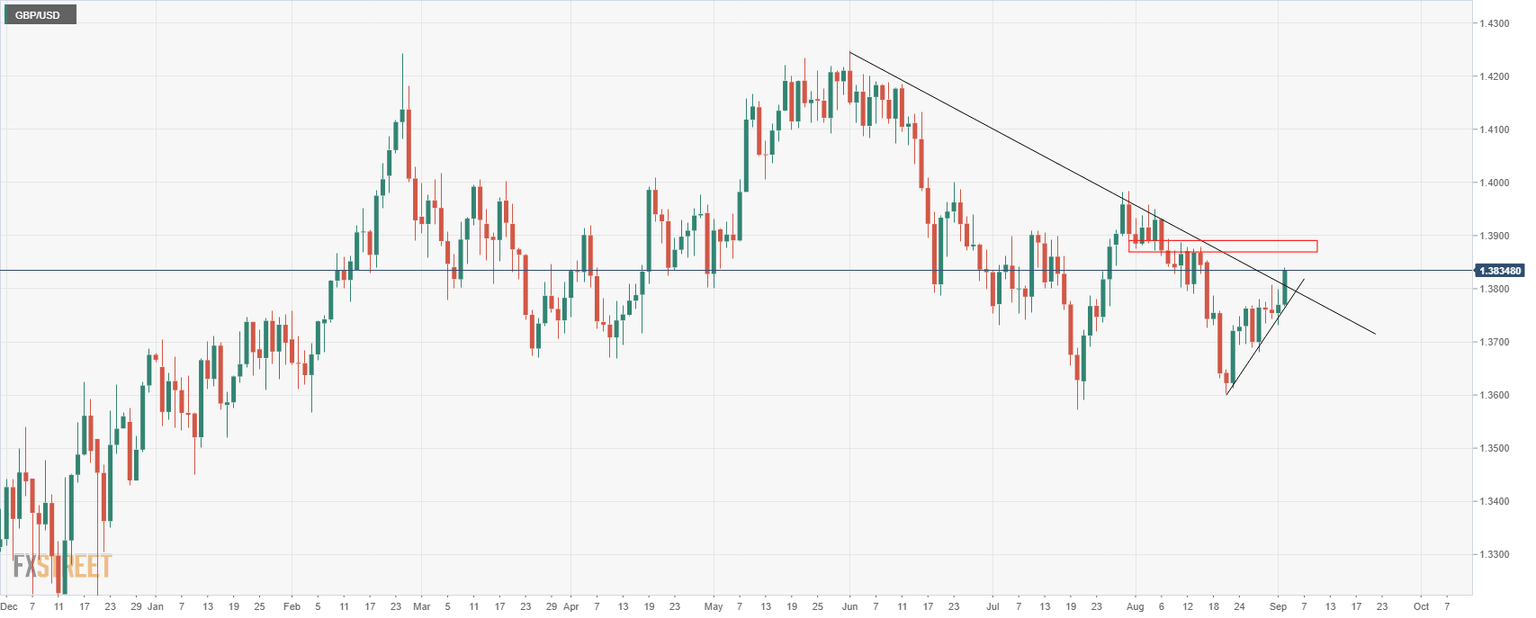

GBP/USD is trading at 1.3830 and is firmly through a critical dynamic resistance on Thursday's price action so far.

The pound, in the absence of UK-specific data releases or Bank of England speakers this week, has been moved by flows in the greenback.

Cable rallied from a low of 1.3767 and reached a high of 1.3837, higher by almost 0.50% at the time of writing, as the US dollar sinks into bearish territory on the forex board.

According to the Currency Strength Index, the US dollar has fallen well behind as investors move into risk following Friday's dovish tilt in the Fed's narrative and US data disappointments earlier this week.

On Friday in a speech made at the Jackson Hole, the Federal Reserve's Chair, Jerome Powell, said that while the central bank has probably got to the point where “substantial further progress” has been made on inflation “we have much ground to cover to reach maximum employment”.

Powell said, “ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired”. In an environment of “substantial” labour market slack, this could be “particularly harmful”.

Meanwhile, yesterday's ADP report, which missed expectations by a long way, has been taken as a potential prelude to Nonfarm Payrolls in Friday's data.

ADP private-sector jobs came in soft at 374k vs. 625k expected.

As for NFP, the consensus currently sees 725k jobs added vs. 943k in July, while the Unemployment Rate is expected to fall two ticks to 5.2%.

Meanwhile, investors are also watching the UK's COVID-19 infection data.

In the last week of August, Britain reported the highest number of new COVID-19 cases in just over a month which could be a headwind for the pound going forward.

GBP/USD technical analysis

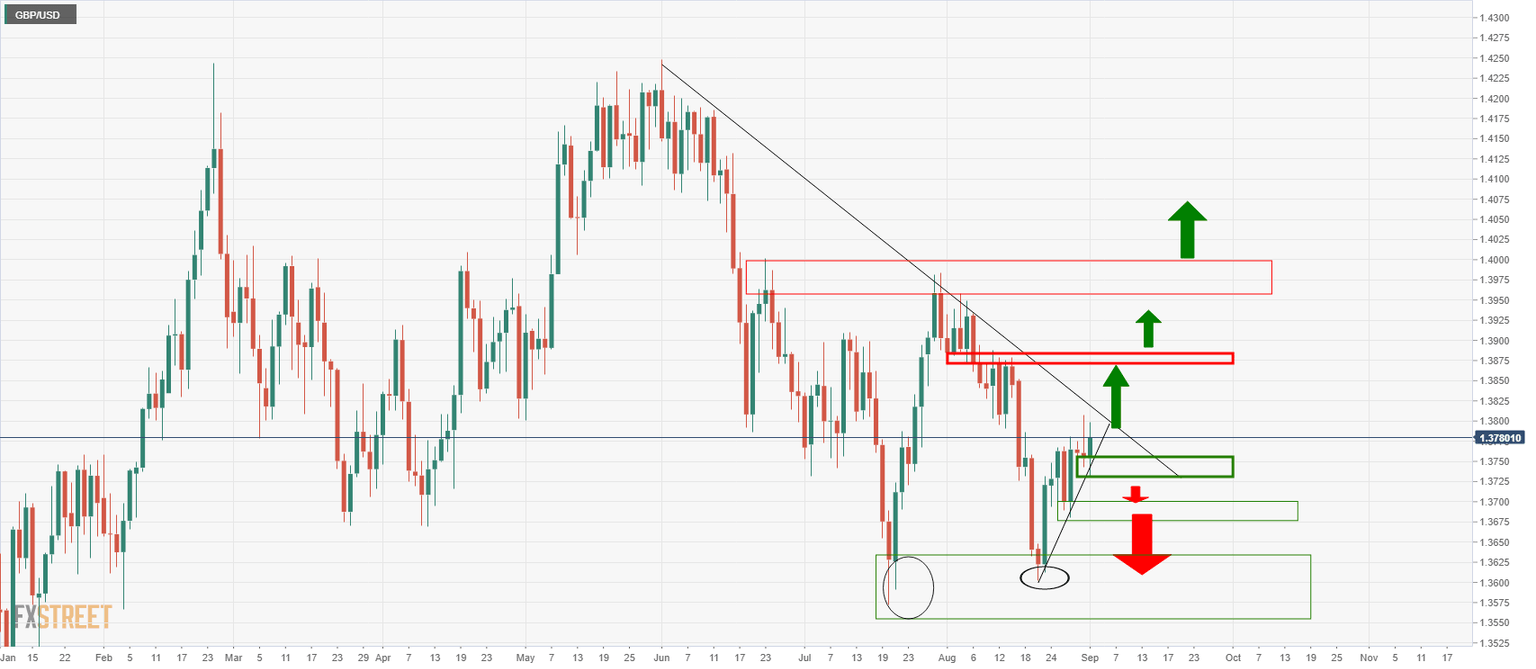

As per the prior day's analysis, illustrated above, cable has taken out the resistance as follows:

The 1.3880s are next resistance.

On the downside, a break of the support structure and then the recent lows near 1.3680 opens prospects of a test to the August swing lows of 1.3602.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.