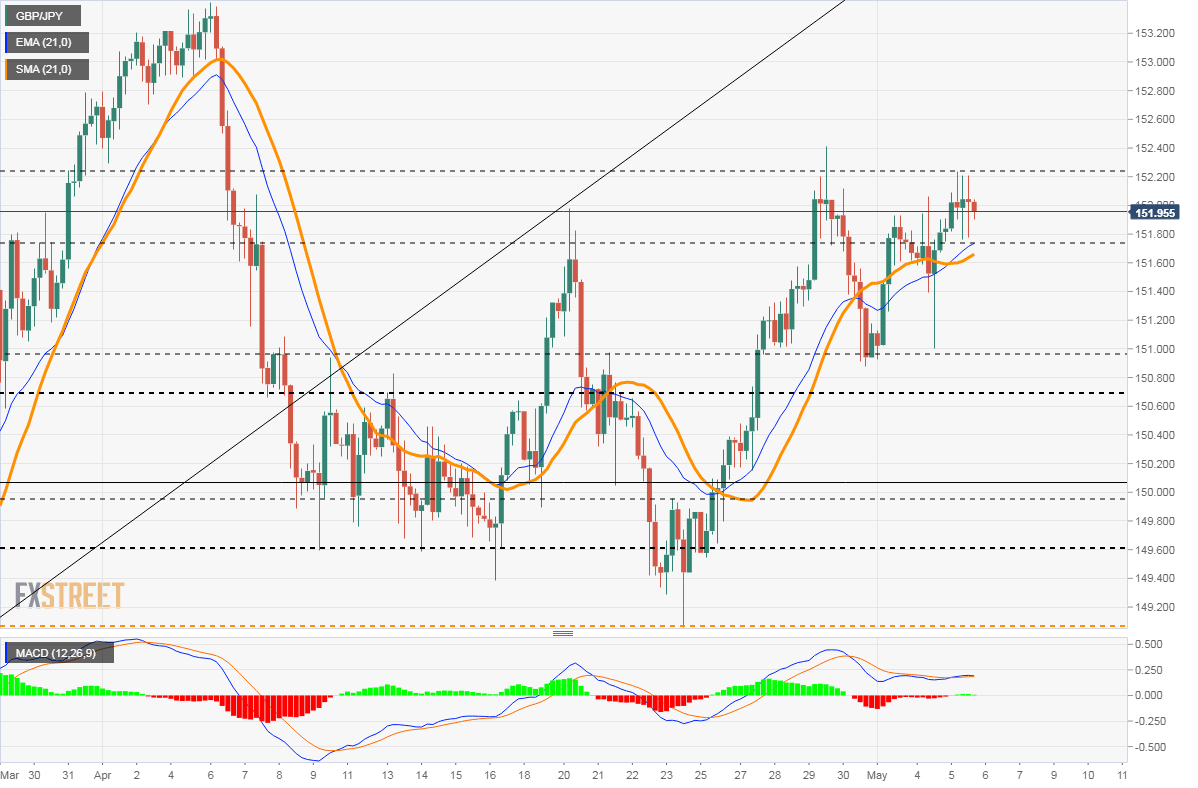

GBP/JPY Price Analysis: Pound again challenges 152.00/20

- GBP/JPY bullish in the short-term while above 151.65.

- A consolidation above 152.20 is needed to clear the way to more gains.

The GBP/JPY pair is again facing a strong barrier at the 152.00/152.20 band. A break higher would likely clear the way to more gains, probably targeting 152.80.

If the pound fails to break clearly above 152.00, it could correct lower under 151.60, holding in the 152.00-151.00 range. A decline below 151.00 should point to more weakness ahead for GBP/JPY.

Technical indicators favor the upside in GBP/JPY but it needs to surpass 152.20 over the next sessions; if not, the key level to watch will be 150.75, the 20-day moving average.

GBP/JPY 4-hour chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.