GBP/JPY Price Analysis: Bounces off 100-SMA to snap three-day downtrend

- GBP/JPY seesaws around intraday high, takes a U-turn from two-week low.

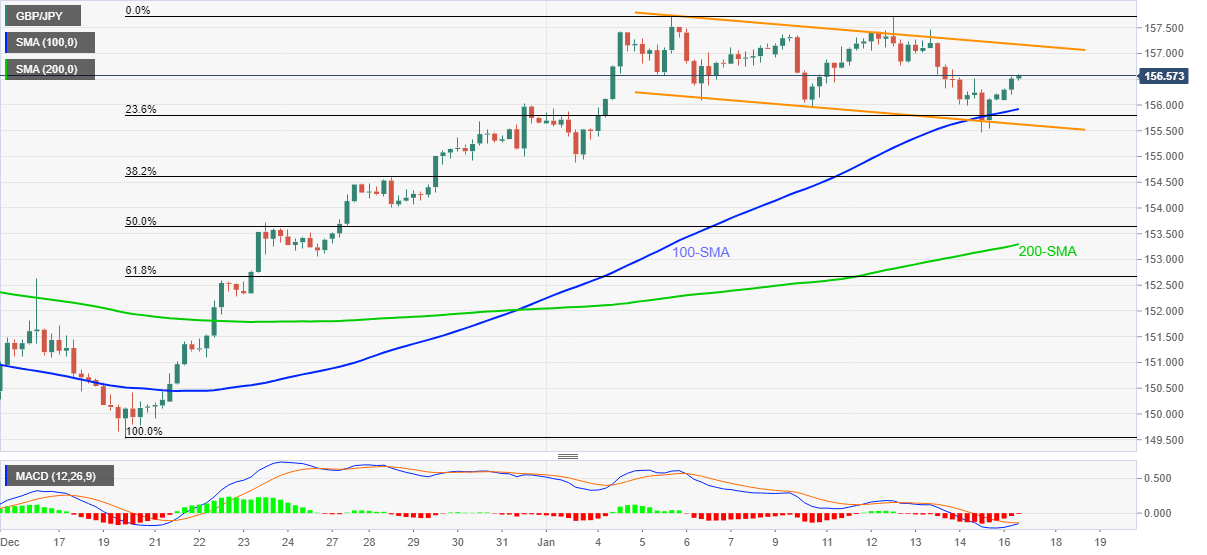

- Bull flag, MACD conditions keep buyers hopeful, 157.20 is the key level.

- Sellers may refrain from fresh entry beyond 200-SMA.

GBP/JPY grinds higher around an intraday peak, up 0.22% on a day near 156.55 heading into Monday’s London open.

The cross-currency pair rises for the first time in the last four days while picking up bids inside a bull flag chart pattern, not to forget mentioning the bounce off 100-SMA.

Given the recently firmer MACD line supporting the quote’s rebound, the GBP/JPY prices are likely to remain firmer for a while. However, a confirmation of the bull flag, by a clear upside break of 157.20 resistance, becomes necessary for the pair buyer’s dominance.

Following that, tops marked so far in January 2022 and October 2021, respectively around 157.80 and 158.25, may act as intermediate hurdles during the theoretical rally targeting the May 2016 peak of 163.90.

Meanwhile, pullback moves may initially test the 100-SMA level of 155.90 before challenging the lower line of the stated flag, around 155.60.

Even so, 50% Fibonacci retracement of December 20, 2021, and January 05, 2022 upside, around 153.65 and 153.30 in that order, will act as important challenges for the GBP/JPY bears before giving them the controls.

GBP/JPY: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.