GameStop (GME) Stock Price and Quote: GameStop Corp pops 20%, technical levels to watch

- GameStop is overshadowed by shiny new toy COIN!

- GME shares decide to show who is the real retail boss and pop 18%.

- GME shares still look fundamentally overbought.

GameStop, remember that one? All the hype over the Coinbase launch (see more) has seen people, traders and commentators overlook Wednesday's near 20% pop in GameStop. That one was supposed to have retreated lower now that a capital raise is in the cards. Well, sometimes dead cats can bounce!

GME stock news

GameStop announced on Wednesday that it will try to reduce all of its debt pile. GameStop wants to achieve this by early redemption of senior notes due in 2023. The outstanding amount of notes due is $216.4 million. GameStop will try to achieve this it announced by using cash on hand.

Separately, GameStop is reportedly looking for a new CEO, according to Reuters. Ryan Cohen has recently been named as Chairman-elect and is tasked with leading the company's transformation into a digital powerhouse. Existing CEO George Sherman has forfeited 587,000 shares in GameStop due to failure to meet performance targets, GameStop said in an SEC filing made on Wednesday. Those must be some targets given GME share price appreciation. That is $97 million worth of forfeited shares based on Wednesday's closing price!

GME technical analysis

So where to from here? Is this a dead cat bounce? Fundamentally, GME is way overvalued based on traditional metrics. But these metrics are for long-term investors and value chasers! GameStop and Ryan Cohen may deliver impressive growth going forward and grow into the valuation.

Short-term traders are more concerned with key levels trading the right side of momentum, etc. Careful risk management should always be implemented, especially in the case of GameStop, which is highly volatile.

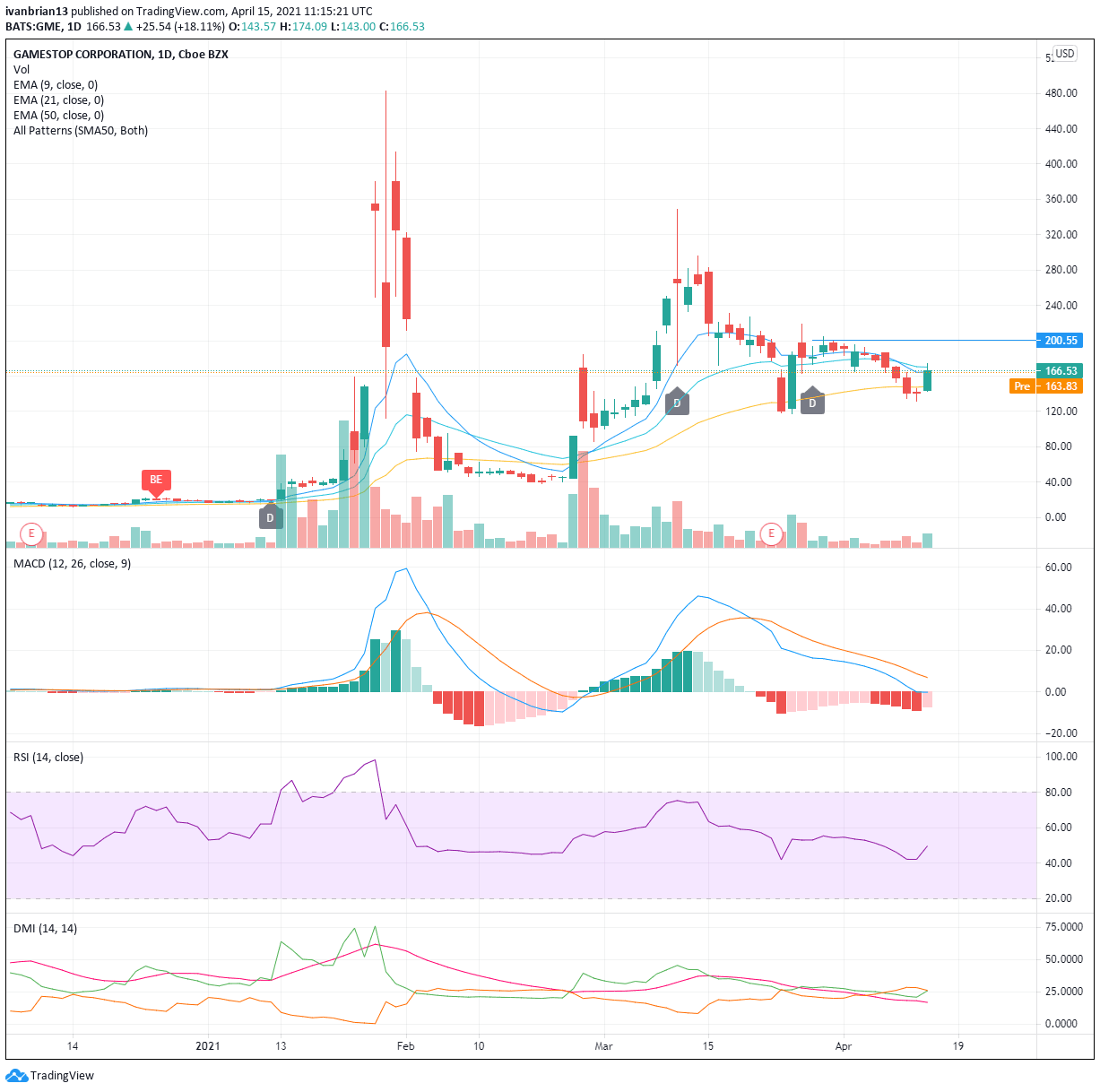

We do have some worrying trends in the technical side of things as well. Monday saw a strong rally, but GME shares still failed to break the 9 or 21-day moving averages. The Moving Average Convergence Divergence (MACD) indicator is still crossed from late March, a bearish signal. The Directional Movement Index (DMI) barely moved yesterday despite the strong price appreciation. Traders looking to take a long position should wait for confirmation of a break of 9 and 21-day moving averages, which would then bring $200 as the first target. The Relative Strength Index (RSI) is not showing either overbought or oversold conditions.

Using the 9 and 21-day moving averages can be used to instigate a short position with a stop just above. Taking a short position in GameStop is what started this whole thing, so it is not advised and actually not possible with most brokers. But the technical picture is still weighted to bearish factors. Failure to break 9 or 21-day moving averages will lead to a test of the 50-day support at $148.14. A break here leads to $120 as the next target.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.