FuelCell Energy Stock News and Forecast: Why is FCEL stock up again?

- FuelCell stock charges ahead by over 18% on Monday.

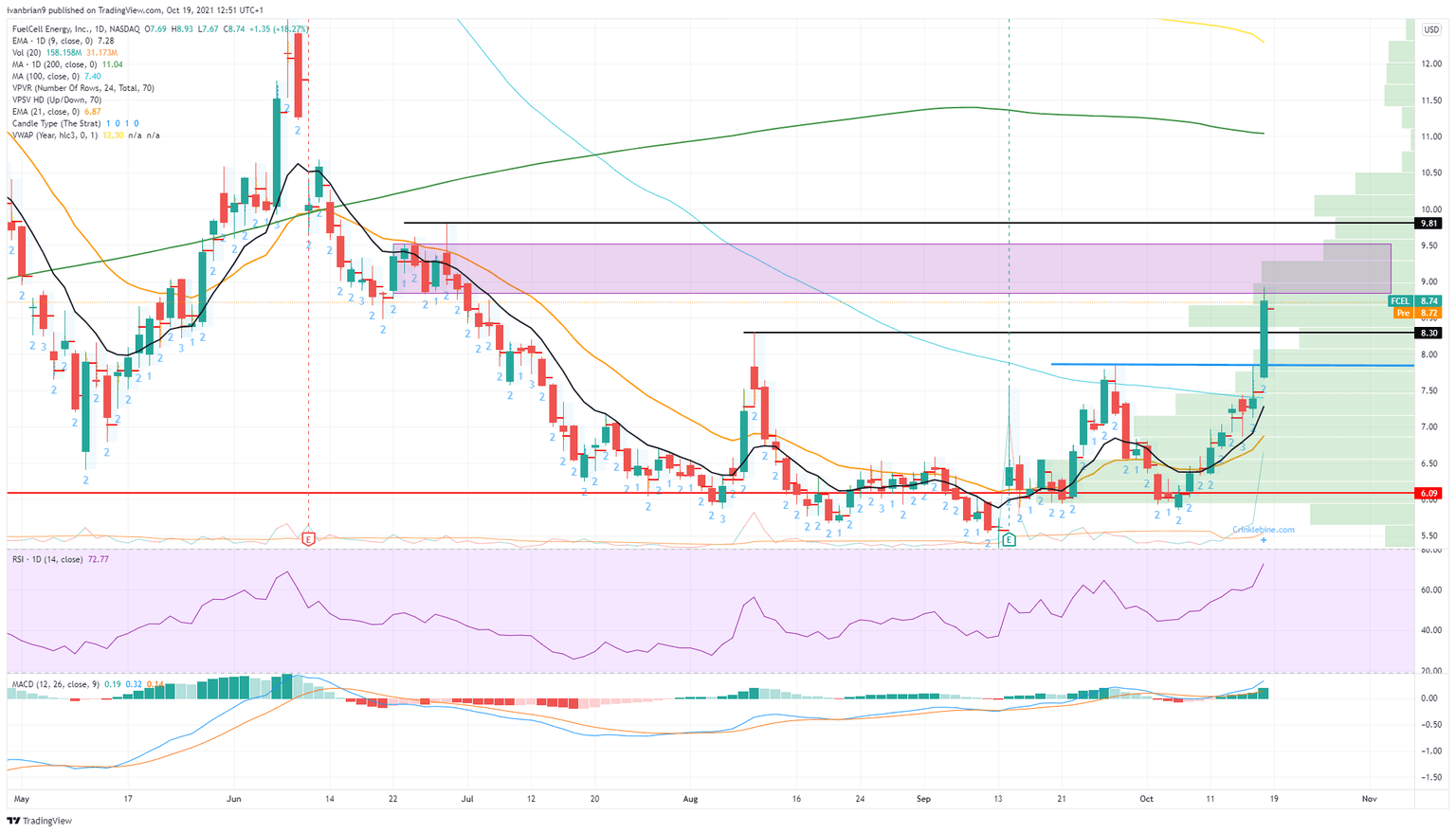

- FCEL price ends at $8.74 and breaks the September high.

- FCEL stock trending heavily on social media as momentum builds.

FuelCell Energy (FCEL) stock certainly popped on Monday with a massive 18% surge to close at $8.74. In the process, the stock took out the resistance from the September high at $8.30 and now looks to reach double figures with $10 an obvious psychological target. The sector certainly is strong – both sectors actually. FCEL is obviously a renewable energy stock but also a meme stock. Both sectors were strong on Monday. Risk was definitely back on in the stock market as yields fell. Last week saw Plug Power perform well with solid news of corporate tie-ups and a price target hike from Morgan Stanley. FCEL has now followed on with a big surge on Monday.

Fuel Cell (FCEL) stock news

There is growing concern that the Democrats' clean energy provision may not make it through the Democrats' own proposed stimulus bill. Senator Joe Manchin, a Democrat, said he would not support the move to clean energy sources, according to an article in the New York Times last Friday. FCEL and solar and other clean energy stocks have been boosted by the likelihood of this bill passing, so this is a blow to the sector. However, Jeff Osborne from Cowen&Co told BNNBloomberg that "Investors are focused more” on other elements of Biden’s energy plan, including extensions of wind and solar tax credits, incentives for energy storage and support for electric vehicles."

Why is FuelCell (FCEL) stock up?

The move was started by social media mentions increasing dramatically after some notable accounts mentioned FCEL stock as a potential buy. Thus began the momentum play and that is likely to accelerate again on Tuesday after Monday's gains. Momentum creates momentum until it suddenly stops, and that is what is driving FCEL stock right now.

FuelCell (FCEL) stock forecast

FuelCell Energy (FCEL) shares have now spiked up into the consolidation area from back in late June. This briefly slowed the stock fall, and there is some volume here to provide resistance on the way up. The spike high from this time is at $9.81, and that is the next big resistance level. Once through that thicket, the next stop is the 200-day moving average and the massive volume shelf above $10.50. Holding above $8.30 keeps the stock bullish. Breaking below $7.85 turns it bearish in our view.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.