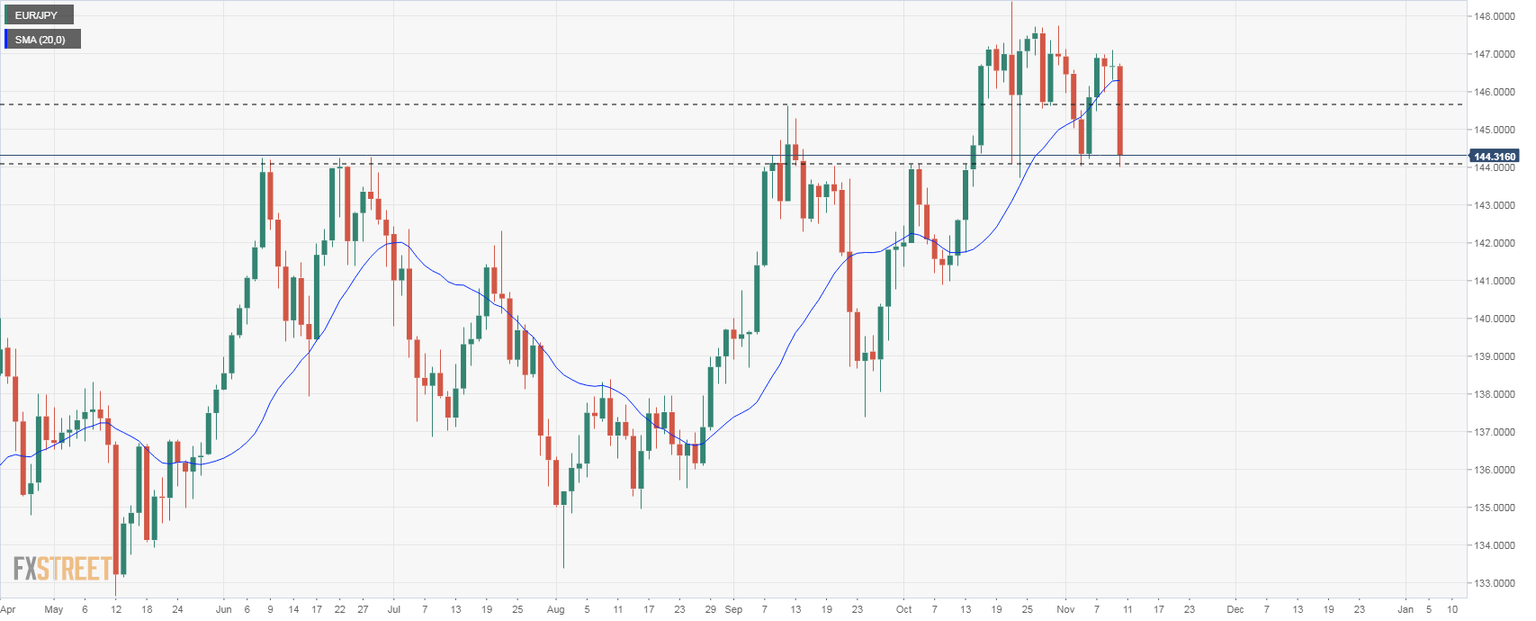

EURJPY under pressure, testing 144.00 as Yen soars across the board

- Japanese yen soars after US CPI numbers on expectations of a less aggressive Fed.

- US Dollar tumbles, USDJPY is down more than 400 pips.

- EURJPY testing critical support area 144.00.

The EURJPY cross is having the biggest daily decline in months on the back of a stronger Japanese yen across the board amid lower US yields. It bottomed 143.98, the lowest since October 24.

The US October CPI showed numbers below expectations and triggered a rally in Wall Street and Treasuries. The sharp decline in US yields strengthened the Japanese Yen, the best performer on Thursday, with USDJPY falling more than 450 pips.

Acceleration below 144.00?

EURUSD’s rally is keeping losses limited in EURJPY. The cross is testing a critical support area around 144.00. A break lower would open the doors more losses. The euro needs to keep that level in order to avoid deterioration in the already negative technical outlook.

On the upside, resistance in EURJPY emerges at 145.50; although the cross needs to rise and hold above 147.00 for the euro to strengthen. If EURUSD keeps rising and risk appetite prevails, the on-course correction could find some reasons to slow down. The resumption of the uptrend would need US yields to turn to the upside again.

EURJPY daily chart

Technical levels

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.