EUR/USD: ''The first P in PEPP stands for Pandemic, not Permanent''

- EUR/USD bears step in as the US dollar firms.

- All eyes will be on the ECB this week and prospects of a taper.

EUR/USD has been a slow burner in holiday thin markets but managed to sustain a comeback in the greenback as European traders bid up the single unit from a low of 1.855 to a high of 1.1886.

In early Asia, the price is oscillating near 1.1870 while traders will get set for a busy week ahead with the European Central Bank the main highlight.

In recent days, since the Jackson Hole where Philip Lane first touted the idea of tapering, members of the European Central Bank emerging from the flanks with a hawkish narrative.

Lane has started a hard-fought and lengthy discussion amongst members on how to dismantle the crisis-fighting measures that have acted as the life support machine to the eurozone throughout the crisis.

This, in contrast to the dovish twist at the Federal Reserve, has seen EUR/USD rally by near to 2.10% since 20 Aug and from its lowest point of the US dollar bull cycle.

ECB day on Thursday

The ECB is due to make its next policy decision on Thursday.

In a recent Reuters poll, around 42 surveyed said, “The European Central Bank will announce a cut to the pace of its emergency bond purchases from next quarter at its meeting this month but will keep buying bonds through 2024 at least under its main program, and possibly much longer.”

However, “We are monitoring euro-area inflation, we should monitor it very accurately, but without making conclusions too soon,” EU's commissioner Paolo Gentiloni said during the Ambrosetti Forum in Cernobbio, Italy.

The commissioner is just one of member key officials that warn that a hasty cut in support would risk undoing the bank’s unprecedented work when the pandemic is far from over.

Nevertheless, it is widely expected that the ECB on Thursday will reduce bond purchases.

Without anything in the way of a public push back from the doves at the ECB, the centrist French central bank chief Francois Villeroy de Galhau had also argued for such a move to be included on the agenda this week.

“The first P in PEPP stands for pandemic, not permanent, and for a good reason,”

Bundesbank President Jens Weidmann said last week.

Analysts at Barclays stated, “we expect the ECB to announce a reduction of PEPP purchases for the fourth quarter because the macro backdrop is much improved. Growth and inflation forecasts will be revised upward.”

Moreover, European markets have been performing well despite growing expectations that the ECB will soon start to dial back its asset purchases. This will have been taken note of by ECB members and give the green light to make a move. The Euro Stoxx 50 was up 1.1% today.

EUR/USD technical analysis

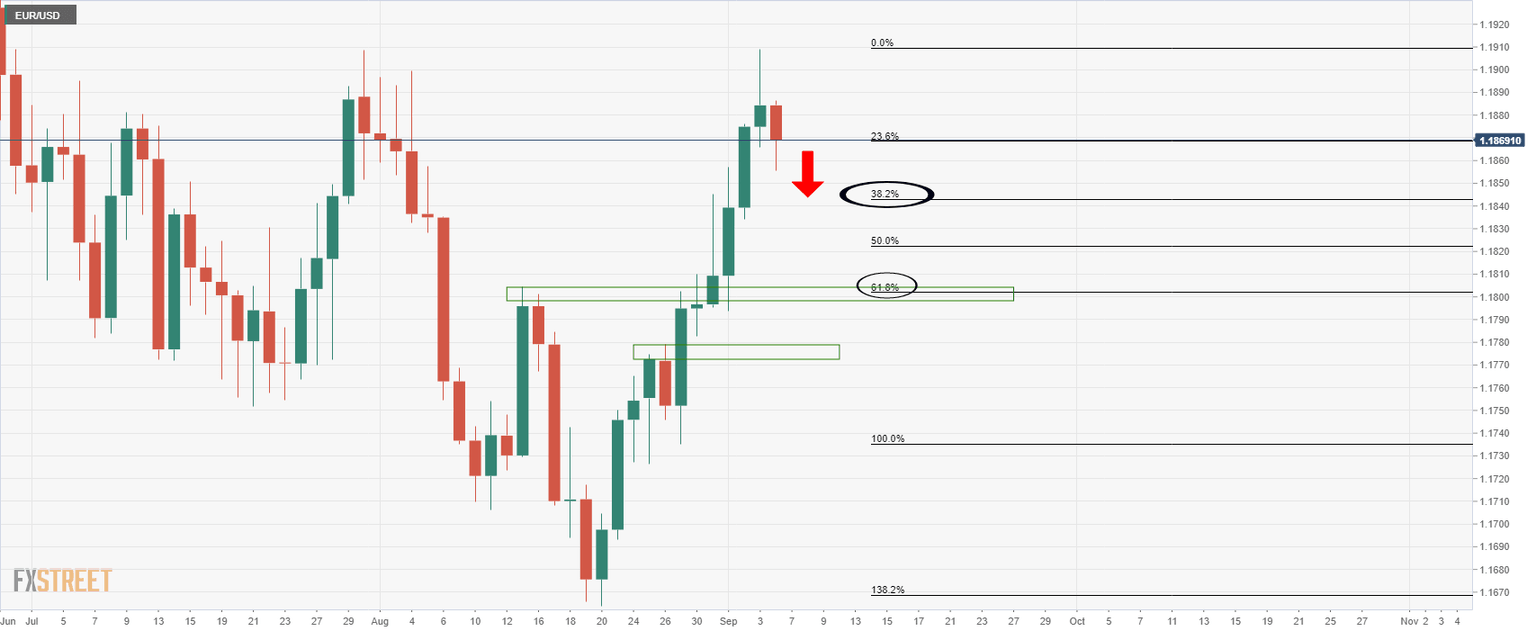

On failures to break higher from here, the bears will be keen to test the 38.2% ratio ahead of the 61.8% and then structure lower down towards 1.1780.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.