EUR/USD Technical Analysis: Early Wednesday buyers should watch out for falling bears

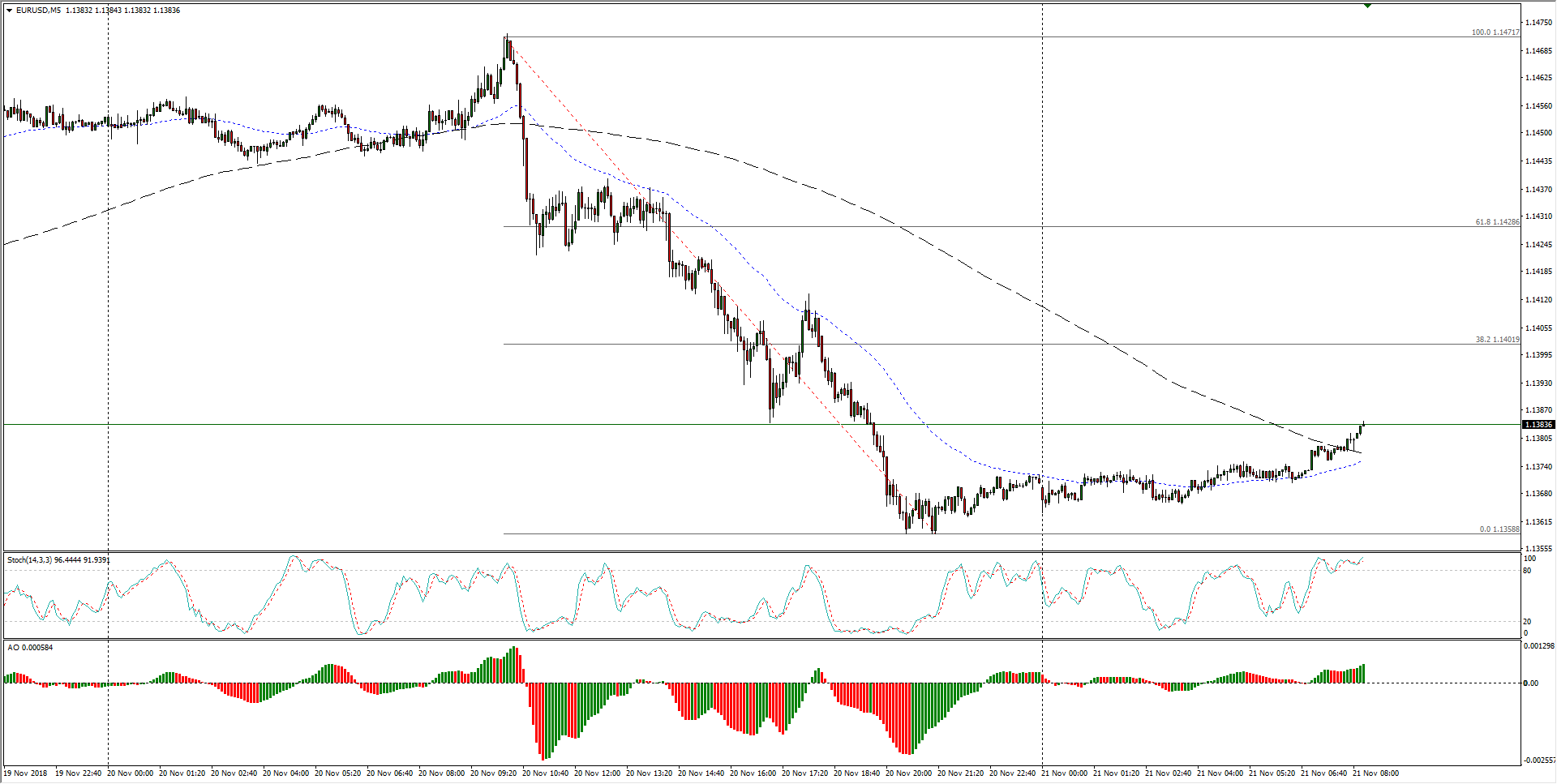

- After the EUR/USD's fantastic decline on Tuesday, the pair is seeing a mild bounceback into the 1.1385 region, though major intraday resistance rests at the 38.2% Fibo level of yesterday's contraction sits in confluence with the 1.1400 handle.

- EUR/USD Forecast: Overnight slump leads to a bearish bias ahead of EU's response to Italy

EUR/USD Chart, 5-Minute

- With the EUR/USD tracking back into previous swing highs, the pair runs the risk of descending into old bearish territory if bidders can't keep the price over the 1.1350 region.

EUR/USD Chart, 30-Minute

- The 4-hour candles show the Fiber making a rough rejection play off of both the 38.2% Fibo retracement level at 1.4445 as well as the 200-period moving average resting at 1.1430.

EUR/USD Chart, 4-Hour

EUR/USD

Overview:

Last Price: 1.1379

Daily change: 10 pips

Daily change: 0.0880%

Daily Open: 1.1369

Trends:

Daily SMA20: 1.1368

Daily SMA50: 1.1504

Daily SMA100: 1.1558

Daily SMA200: 1.1806

Levels:

Daily High: 1.1473

Daily Low: 1.1358

Weekly High: 1.142

Weekly Low: 1.1216

Monthly High: 1.1625

Monthly Low: 1.1302

Daily Fibonacci 38.2%: 1.1402

Daily Fibonacci 61.8%: 1.1429

Daily Pivot Point S1: 1.1327

Daily Pivot Point S2: 1.1284

Daily Pivot Point S3: 1.1211

Daily Pivot Point R1: 1.1442

Daily Pivot Point R2: 1.1515

Daily Pivot Point R3: 1.1558

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.