EUR/USD takes a breather and returns to 1.1420

- EUR/USD fades part of the recent strong rebound to 1.1480.

- ECB’s Knot sees the central bank hiking in Q4 2022.

- ECB’s Lagarde will speak before the European Parliament.

The single currency starts the new trading week on the defensive and drags EUR/USD back to the 1.1420 region.

EUR/USD retreats from recent peaks

Fresh selling pressure around the European currency prompted EUR/USD to give away part of the recent advance to new YTD tops past 1.1480 (February 4), all amidst some mild recovery in the greenback.

On the latter, further upside in US yields, particularly in the belly and the long end of the curve lends support to the demand for the buck while market participants continue to digest Friday’s strong print from US Nonfarm Payrolls (+467K).

In the German money market, the selloff in bonds remains well and sound, lifting yields of the key 10y Bund to fresh highs near 0.24%. Recent comments from ECB’s K.Knot seem to have lent legs to German yields after he suggested the central bank could now move on rates as soon as in Q4 2022. His comments fall in line with the recent hawkish twist seen at the ECB event (February 3), where Chairwoman Lagarde left the door open to a probable lift-off sooner than anticipated.

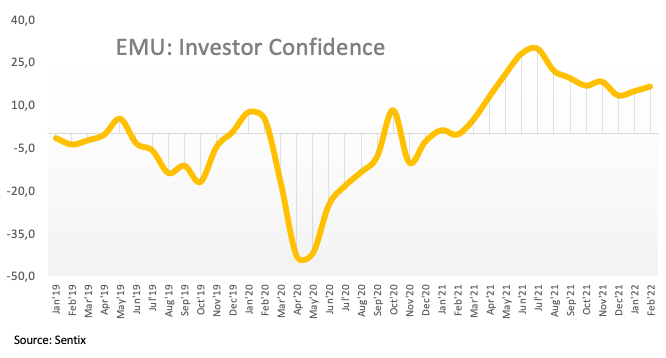

In the docket, the Investor Confidence in the euro area improved to 16.6 for the month of February (from 14.9). in the NA calendar, the only release of note will be the December Consumer Credit Change.

Later in the session, Chairwoman C.Lagarde is expected to speak before the European Parliament.

What to look for around EUR

EUR/USD now faces some downside pressure following recent peaks close to 1.1500 the figure. The optimism around spot seems threatened by the recovery in the greenback, which has particularly regained traction after US Nonfarm Payrolls surprised to the upside in January. The now improved outlook in the pair looks bolstered by prospects of a potential interest rate hike by the ECB at some point by year end, higher German yields, elevated inflation in the region and a decent pace of the rebound in the economic activity and other key fundamentals.

Key events in the euro area this week: Sentix Index, ECB Lagarde (Monday) - Germany Balance of Trade (Wednesday) - Germany Final January CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is retreating 0.22% at 1.1421 and faces the next up barrier at 1.1482 (2022 high Jan.14) followed by 1.1496 (200-week SMA) and finally 1.1673 (200-day SMA). On the other hand, a break below 1.1312 (55-day SMA) would target 1.1121 (2022 low Jan.28) en route to 1.1100 (round level).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.