EUR/USD drops as traders reassess impact of Trump's victory

- EUR/USD faces significant offers near 1.0800 as the US Dollar resumes its upside trend.

- Trump’s victory has improved the US Dollar’s long-term outlook.

- The Euro is down amid Trump tariffs’ threats, German political uncertainty, and doubts over the Eurozone economic outlook.

EUR/USD faces selling pressure near the key resistance of 1.0800 in North American trading hours on Friday. The major currency pair fails to extend Thursday’s recovery as the US Dollar (USD) resumes its upside journey after a sharp correction.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, bounces back to nearly 104.70. The index had retraced to nearly 104.20 on Thursday following the more than four-month high of 105.50 registered after Donald Trump won the presidential election in the United States (US).

The reasoning behind the US Dollar’s recovery can be attributed to the victory of Trump, who vowed to raise import tariffs by 10% and lower corporate taxes in his election campaign. Market experts suggest that Trump’s fiscal policy, if implemented, would result in higher investment, spending and labor demand, which will elevate upside risks to inflation and force the Federal Reserve (Fed) to opt for a restrictive monetary policy stance.

Fed Chair Jerome Powell said on Thursday that he doesn’t see any near-term effect of Trump’s return to the White House regarding the central bank’s policy decisions. “We don’t guess, speculate and we don’t assume what future government policy choices will be,” Powell said after the bank decided to cut interest rates by 25 basis points (bps) to 4.50%-4.75%, as expected.

When asked about the interest rate path ahead, Powell sounded confident about the continuation of the policy-easing cycle by saying he is optimistic about inflation remaining on track to the bank’s target of 2% with some softness in labor market conditions.

Daily digest market movers: EUR/USD weakens as US Dollar bounces back

- EUR/USD is also facing pressure due to the Euro’s (EUR) underperformance against its major peers, except for Asia-Pacific currencies. The Euro is down as investors are worried about the Eurozone economic outlook due to Trump’s victory, the dissolution of Germany’s three-party coalition, and growing risks of inflation remaining below the European Central Bank’s (ECB) target of 2%.

- Higher tariffs by the US would strain the Eurozone’s export sector, likely hitting economic growth. “Uncertainty is high on many levels, from the exact impact of US tariffs to the timing of their implementation to how and when Europe responds,” Deutsche Bank analysts said.

- Meanwhile, the Deutsche Bank also sees the ECB’s Deposit Facility rate heading to 1.5%, down from the 2.25% previously projected, due to weakening macroeconomic conditions and inflation risks falling below target.

- The collapse of the German coalition after Chancellor Olaf Scholz dismissed Federal Minister of Finance Christian Lindner has paved the way for snap elections in early 2025. The scenario of political uncertainty limits the growth potential of an economy due to the postponement of fiscal spending by the government.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.42% | 0.30% | -0.11% | 0.37% | 1.03% | 0.73% | 0.18% | |

| EUR | -0.42% | -0.12% | -0.49% | -0.07% | 0.60% | 0.31% | -0.24% | |

| GBP | -0.30% | 0.12% | -0.36% | 0.05% | 0.72% | 0.43% | -0.12% | |

| JPY | 0.11% | 0.49% | 0.36% | 0.46% | 1.12% | 0.81% | 0.27% | |

| CAD | -0.37% | 0.07% | -0.05% | -0.46% | 0.65% | 0.37% | -0.18% | |

| AUD | -1.03% | -0.60% | -0.72% | -1.12% | -0.65% | -0.29% | -0.84% | |

| NZD | -0.73% | -0.31% | -0.43% | -0.81% | -0.37% | 0.29% | -0.55% | |

| CHF | -0.18% | 0.24% | 0.12% | -0.27% | 0.18% | 0.84% | 0.55% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

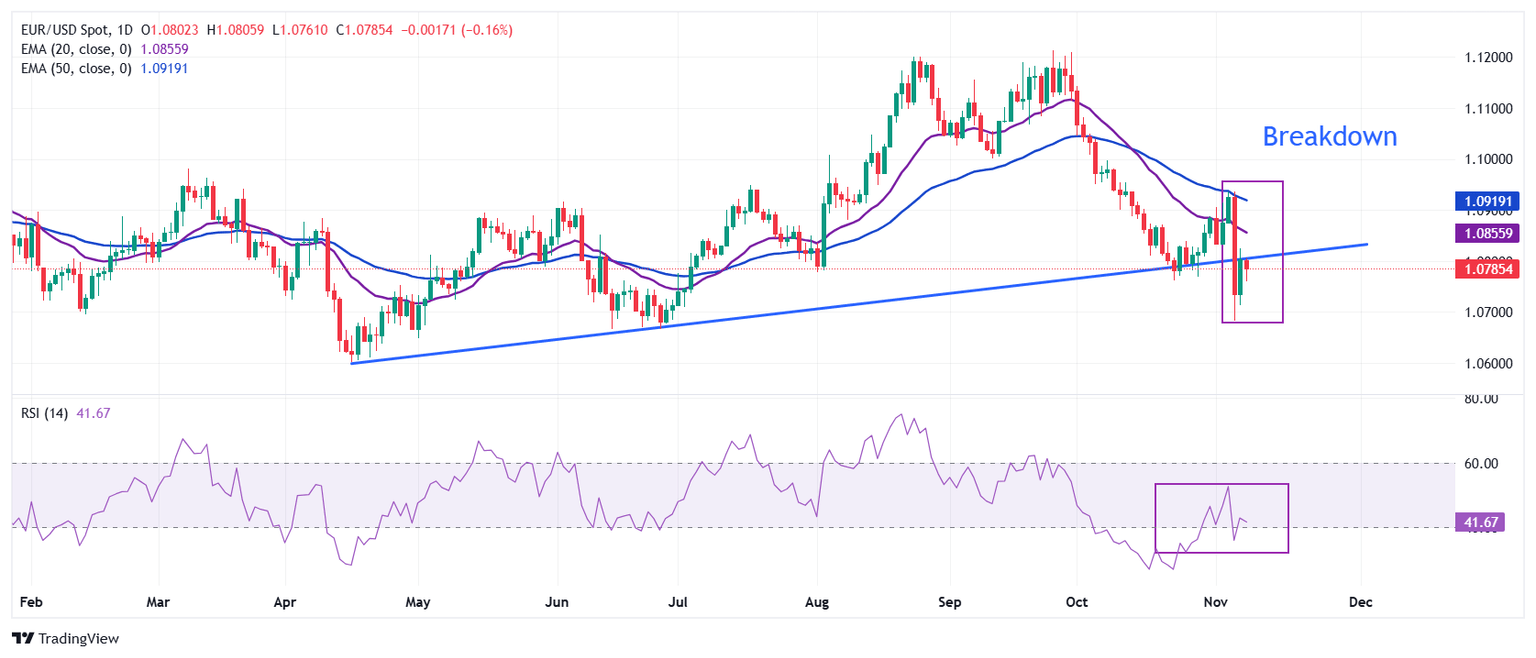

Technical Analysis: EUR/USD fresumes decline from 1.0800

EUR/USD resumes decline after a short-lived recovery to near 1.0800 in Friday’s European session. The near-term trend of the major currency pair remains bearish as the 20-day and 50-day Exponential Moving Averages (EMAs) near 1.0860 and 1.0920, respectively, continue to decline.

The 14-day Relative Strength Index (RSI) wobbles near 40.00. A bearish momentum would resume if the RSI (14) slides below the above-mentioned level.

The upward-sloping trendline, plotted from the April 16 low of around 1.0600, will act as a key resistance zone for Euro bulls around 1.0800. Looking down, the shared currency pair could decline to the year-to-date (YTD) low of 1.0600

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.