EUR/USD advances toward 1.0900 on hot Eurozone HICP, soft US monthly core PCE Inflation

- EUR/USD recovers strongly as Eurozone inflation turns out hotter-than-expected.

- Eurozone annual headline and core HICP rose strongly by 2.6% and 2.9%, respectively

- US monthly core PCE inflation for April grew at a slower pace of 0.2%.

EUR/USD jumps to 1.0880 in Friday’s New York session. The major currency pair strengthens on hot annual preliminary Eurozone Harmonized Index of Consumer Prices (HICP) for May and a decline in monthly United States (US) core Personal Consumption Expenditure Price Index (PCE) data for April.

The Eurostat reported that annual preliminary Eurozone Harmonized Index of Consumer Prices (HICP) data grew at a faster pace than expected in May. Headline HICP rose by 2.6%, stronger than the estimates of 2.5% and April's reading of 2.4%. In the same period, the core HICP data – which excludes volatile components such as food, energy, alcohol and tobacco – accelerated to 2.9%, from expectations of 2.8% and the prior reading of 2.7%. The monthly headline and core HICP rose at a slower pace of 0.2% and 0.4%, respectively, from their former readings.

It was expected that the Eurozone inflation data for May isn’t likely to impact market speculation for European Central Bank (ECB) rate cuts in the June meeting as it appears to be a done deal. ECB policymakers have remained comfortable with rate-cut speculation for June due to consistently easing price pressures and resumed progress in service disinflation.

However, the inflation data will impact the pace at which the ECB will follow the rate-cut path beyond June. A hot inflation reading is expected to force officials to adopt a more gradual approach. Investors should note that the majority of ECB policymakers have been emphasizing the need to remain data-dependent and have been reluctant to offer any pre-defined rate trajectory.

Daily digest market movers: EUR/USD strengthens further on slower monthly US inflation growth

- EUR/USD extends its upside as the monthly US core PCE inflation data, which is the Federal Reserve’s (Fed) preferred inflation gauge, grew at a slower pace of 0.2% from the estimates and the prior reading of 0.3%.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls further to 104.50. However, the US Dollar could bounce back as the annual underlying inflation data rose by 2.8%, in-line with estimates and the prior release. Lower-than-expected growth in the monthly core PCE inflation won't be sufficient to prompt expectations for the Federal Reserve (Fed) reducing interest rates from the September meeting.

- Currently, the CME FedWatch tool reflects that traders are indecisive about the US central bank reducing interest rates in the September meeting. The reason behind this deepening uncertainty is the strong labor market outlook and upside risks to inflation.

- Fed policymakers emphasize the need to maintain interest rates at their current levels for long until they get sufficient evidence that price pressures will sustainably return to the desired rate of 2%. Officials worry that the progress in the disinflation process has stalled even though the April’s Consumer Price Index (CPI) report showed that price pressures abated.

- On Thursday, the US Dollar faced a sell-off move due to slower United States Q1 Gross Domestic Product (GDP) growth. the revised GDP estimates report showed that the economy expanded at a slower pace of 1.3% against the 1.6% initially estimated.

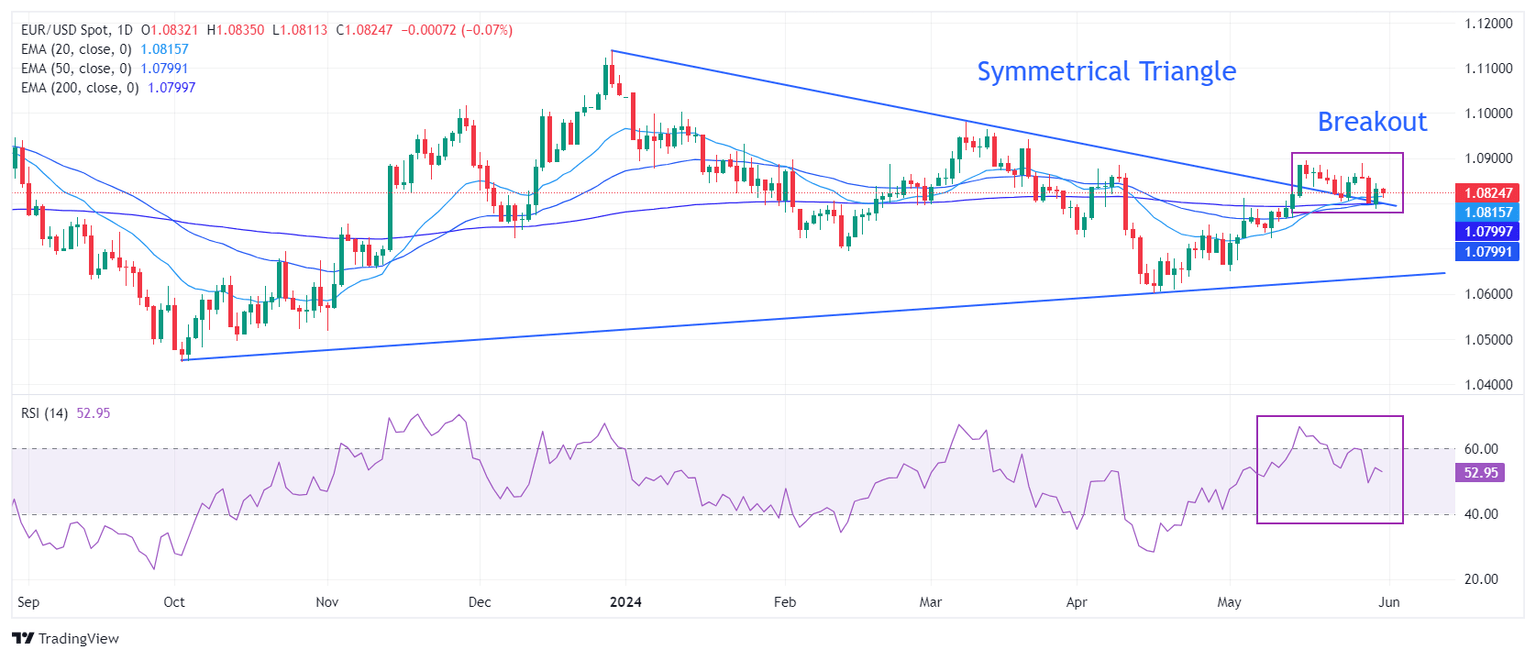

Technical Analysis: EUR/USD approaches 1.0900

EUR/USD rallies to 1.0880 after soft monthly US core PCE inflation data. The shared currency pair holds the breakout of the Symmetrical Triangle chart pattern formed on a daily time frame, which is in the region of 1.0800. The near-term outlook of the shared currency pair remains uncertain as it struggles to sustain above all short-to-long-term Exponential Moving Averages (EMAs).

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the momentum, which was leaned toward the upside, has faded for now.

The major currency pair would strengthen if it recaptures a two-month high around 1.0900. A decisive break above this level would drive the asset towards the March 21 high, around 1.0950, and the psychological resistance of 1.1000. However, a downside move below the 200-day EMA at 1.0800 could push it further down.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri May 31, 2024 12:30

Frequency: Monthly

Actual: 2.8%

Consensus: 2.8%

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.