EUR/USD Price Analysis: Weakness seen as temporary

- EUR/USD once again lost momentum in the upper-1.2100s.

- Further downside should falter around 1.2000.

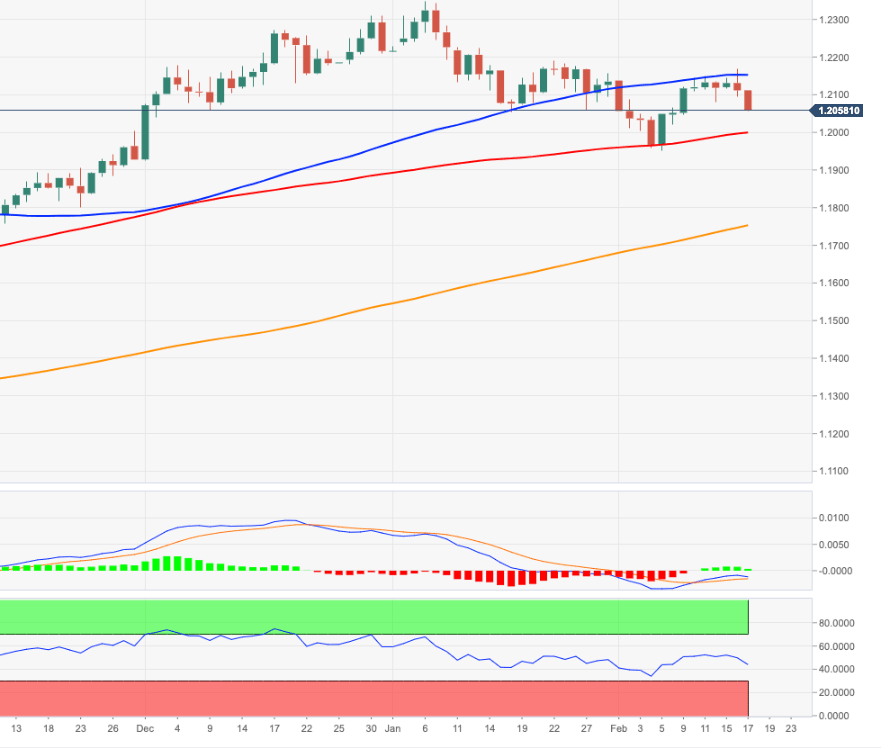

EUR/USD recedes from multi-day highs and slips back below the key 1.2100 support on Wednesday.

The pair now flirts with a Fibo level in the 1.2060/65 band. A breach of this area could lead to a probable visit to the psychological 1.2000 level, which is expected to hold the initial test in the near-term.

If bulls return to the markets, the recent tops around 1.2170 line up as an interim hurdle. This area is also reinforced by another Fibo retracement. Further up comes in the weekly highs near 1.2190 (January 22). The selling pressure should alleviate above the latter, opening the door to a probable visit to the YTD highs in the 1.2350 zone.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1738.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.