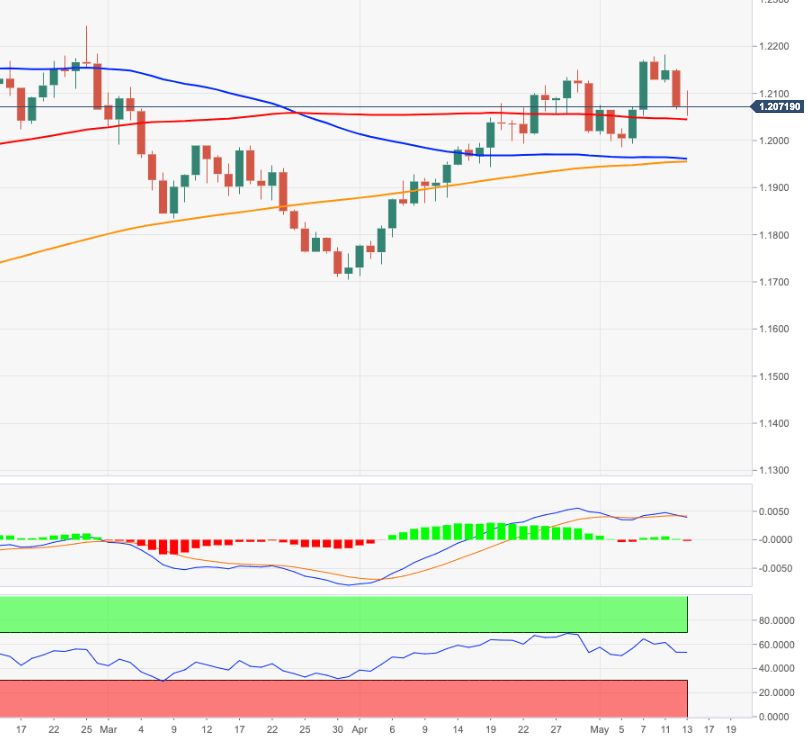

EUR/USD Price Analysis: The 100-day SMA holds the downside…for now

- EUR/USD remains offered and trades in multi-day lows.

- Further south comes in the 100-day SMA near 1.2040.

EUR/USD accelerates the weekly leg lower following a failed move to retake the 1.2100 mark and above earlier on Thursday.

If the selling impetus picks up further pace, then the pair could attempt to re-visit the 1.2040 zone, where is located the 100-day SMA. There is, however, a minor contention area around 1.2060, where coincide the 20-day SMA and a Fibo level (of the November-January rally).

The constructive stance on EUR/USD is forecast to remain intact as long as it trades above the 200-day SMA, today at 1.1950.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.