EUR/USD Price Analysis: Stays sidelined around 1.1650, monthly resistance line in focus

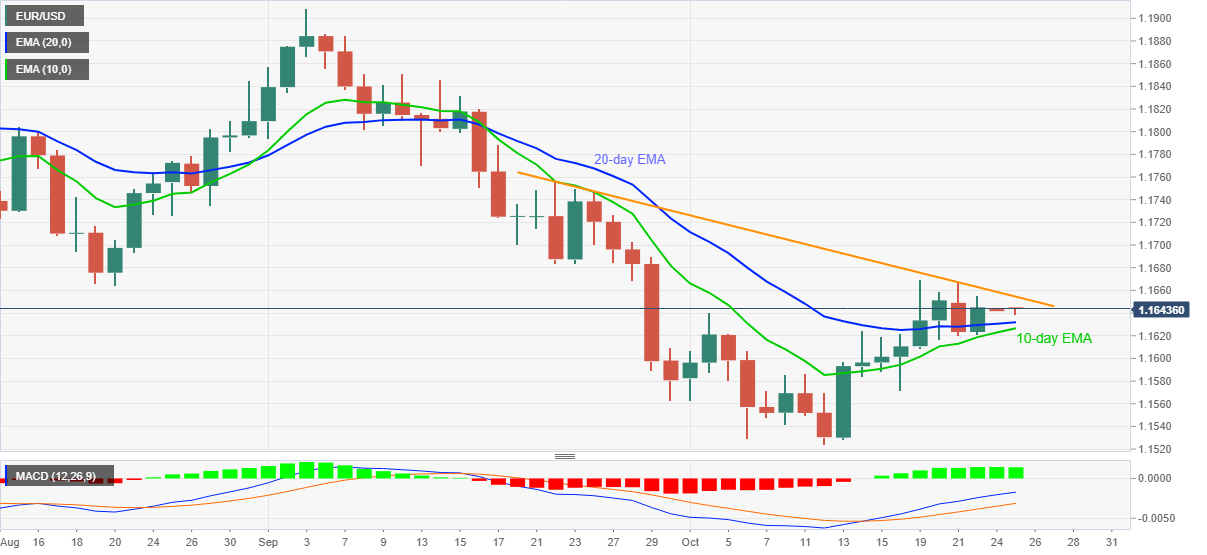

- EUR/USD keeps latest rebound from 10-day EMA, off intraday low.

- Bullish MACD, sustained trading beyond short-term moving averages favor buyers.

- August month’s low adds to the upside filters.

EUR/USD picks up bids to 1.1642, keeping the two-day advances intact during the early Asian session on Monday.

In doing so, the currency major pair stays firmer above 10-day and 21-day EMAs amid bullish MACD signals, suggesting further advances towards the downward sloping resistance line from September 22, near 1.1655.

It should be noted, however, that August month’s low around 1.1665 will validate the quote’s additional upside towards the late September’s peak near 1.1755.

Meanwhile, the stated EMAs, close to 1.1630-25, challenge the short-term EUR/USD declines ahead of the 1.1600 threshold and the 1.1570 support levels.

In a case where the pair bears dominate past 1.1570, the yearly low near 1.1525 and the 1.1500 round figure will be in focus.

Overall, EUR/USD gains upside momentum but bulls need validation.

EUR/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.