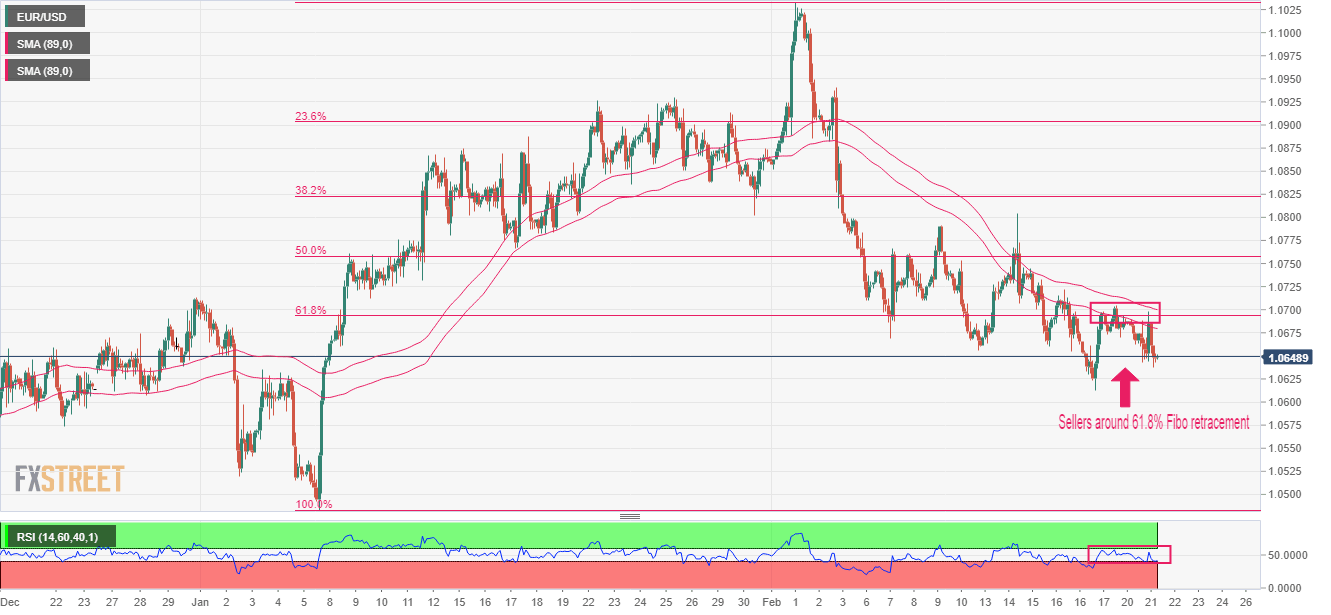

EUR/USD Price Analysis: Retreats from 1.0650 amid dismal market mood

- EUR/USD is continuously facing selling pressure from 61.8% Fibo retracement around 1.0700.

- The 89-period (High-Low) SMA band is barricading the Euro consistently.

- A slippage by the RSI (14) into the bearish range of 20.00-40.00 will trigger a downside momentum

The EUR/USD pair has retreated after facing selling interest around 1.0650 in the early Tokyo session. The major currency pair remained extremely volatile as upbeat United States preliminary S&P PMI data resulted in accelerating odds for the continuation of the policy tightening spell by the Federal Reserve (Fed).

Risk-perceived assets like S&P500 witnessed a vertical sell-off as upbeat US PMI data strengthened recession fears. The Fed is going to consider the rebound in the scale of economic activities as a threat to the declining trend in the Consumer Price Index (CPI), which will be addressed by more rate hikes. This pushed the alpha provided on the 10-year US Treasury bonds to 4%.

Meanwhile, the upbeat Eurozone ZEW Survey- Economic Sentiment failed to provide support to the Euro. Higher-than-anticipated sentiment data indicates that the majority of institutional investors are holding an optimistic view on the economic projections.

The presence of potential sellers at the 61.8% Fibonacci retracement (placed from January 6 low at 1.0483 to February high at 1.1033) at 1.0693 is heavily deploying pressure on EUR/USD. This could drag the shared currency pair further.

The 89-period (High-Low) Simple Moving Average (SMA) band is barricading the Euro consistently.

Meanwhile, the Relative Strength Index (RSI) (14) is on the verge of slipping into the bearish range of 20.00-40.00. An occurrence of the same will trigger a downside momentum.

A decisive downside move below February 17 low at 1.0613 will drag the asset toward December 22 low at 1.0573. A slippage below the latter will extend the downside toward January 6 low at 1.0483.

In an alternate scenario, a break above February 16 high at 1.0722 will drive the asset toward 50% Fibo retracement at 1.0758, followed by February 14 high around 1.0800.

EUR/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.