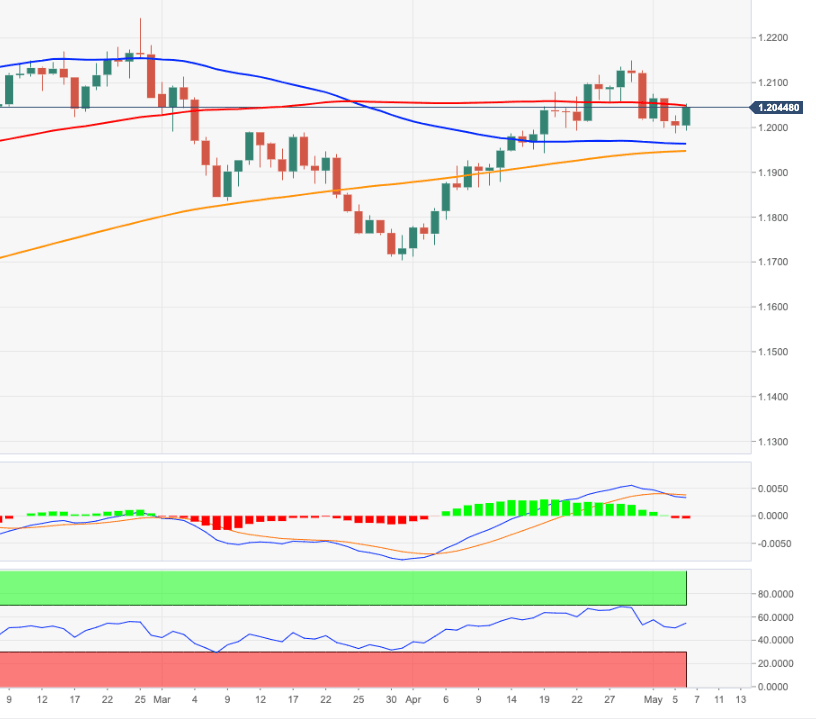

EUR/USD Price Analysis: Rebound targets the 1.2150 level

- EUR/USD bounces off lows near 1.1980 recorded on Wednesday.

- The Fibo level at 1.1976 reinforces this initial contention area.

EUR/USD manages to find fresh buying interest and regains the 1.2000 mark and beyond in the second half of the week.

The continuation of the move higher lower is seen meeting the initial support at the Fibo level (of the November-January rally) at 1.2064 on its way to the monthly peak at 1.2150 (April 29).

Below the 200-day SMA (1.1942) the stance for EUR/USD is seen shifting to negative.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.