EUR/USD Price Analysis: Outlook keeps pointing to extra gains near term

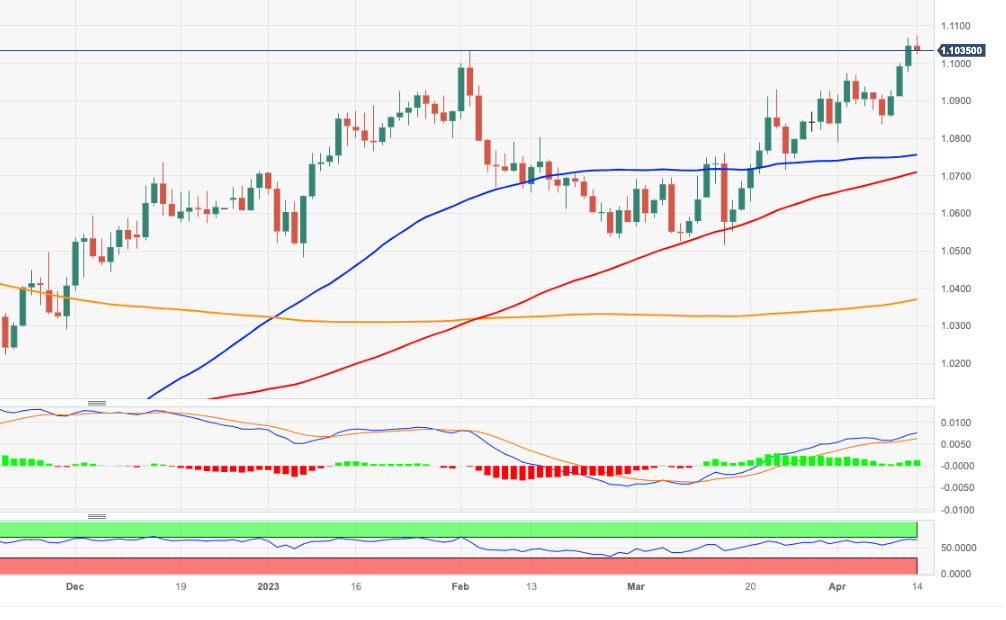

- EUR/USD clinches new YTD peak before sparking a corrective decline.

- The continuation of the Euro uptrend could revisit the round level at 1.1100.

EUR/USD deflates from earlier 2023 highs around 1.1075 at the end of the week.

Despite the knee-jerk, the outlook for the Euro keeps favouring the continuation of the uptrend for the time being. Against that, the surpass of the YTD high at 1.1075 (April 14) could then dispute the round level at 1.1100 prior to the weekly high at 1.1184 (March 21 2022).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0368.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.