EUR/USD Price Analysis: Next on the downside comes 1.1185

- EUR/USD drops to new cycle lows in the boundaries of 1.1200.

- A breach of 1.1200 exposes a deeper pullback to 1.1185.

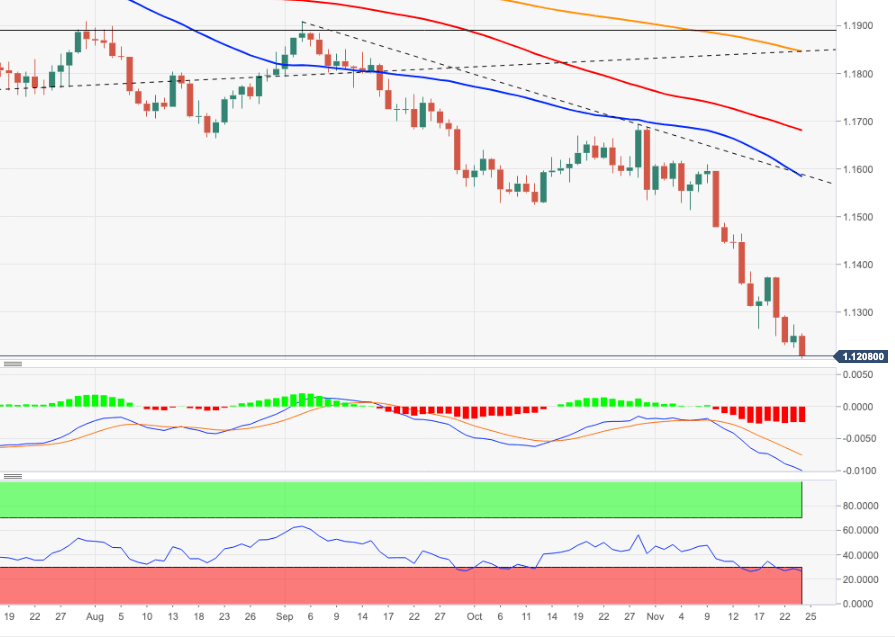

EUR/USD extends the selloff further and flirts with the 1.1200 barrier on Wednesday, or new 16-month lows.

If the 1.1200 region is cleared in the near term, then the pair is seen shifting the attention to July’s 2020 low at 1.1185 (July 1) ahead of 1.1168 (June 19 2020). Of note, however, is that the pair navigates the oversold territory, which carries the potential to spark a technical correction in the not-so-distant future.

The probability of further losses remains unchanged as long as EUR/USD trades below the 2-month resistance line (off September’s peak) near 1.1580. In the longer run, the offered stance in spot is expected to persist while below the 200-day SMA at 1.1847.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.