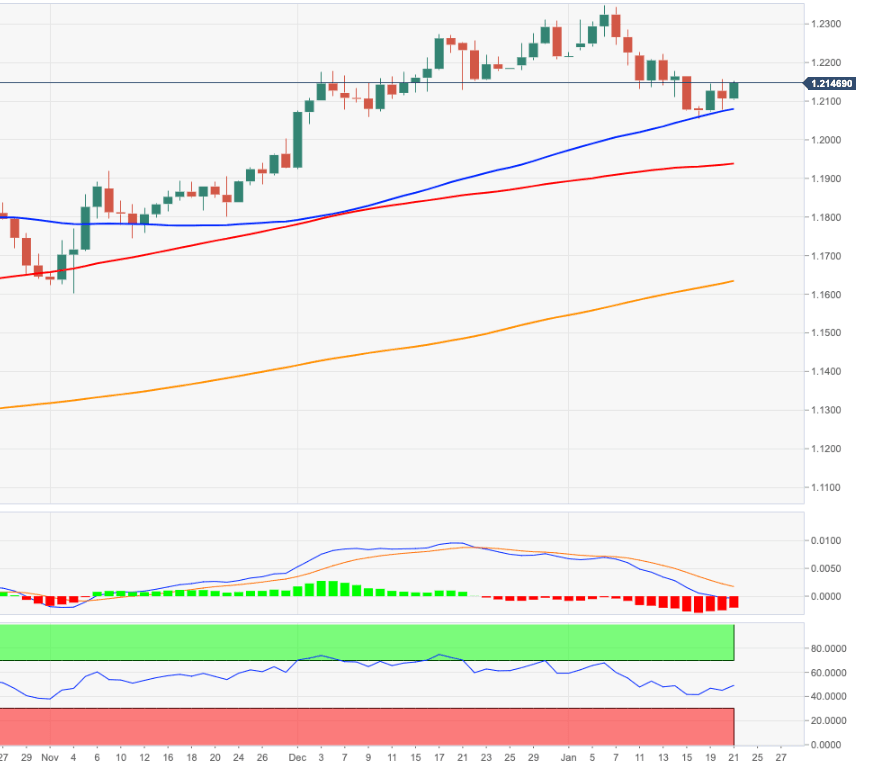

EUR/USD Price Analysis: Interim hurdle aligns at 1.2173/92

- EUR/USD retakes the 1.21 mark and beyond on Thursday.

- Minor hurdles emerge in the 1.2173/92 band so far.

EUR/USD manages to reclaim the area above the 1.2100 level on Thursday amidst a broad-based selling bias in the greenback.

If the rebound gathers extra steam, then the next interim hurdle emerges at the Fibo retracement (of the November-January rally) at 1.2173 ahead of the 21-day SMA, today at 1.2192. Further up, there are no relevant levels until the YTD peaks in the 1.2350 zone.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1620.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.