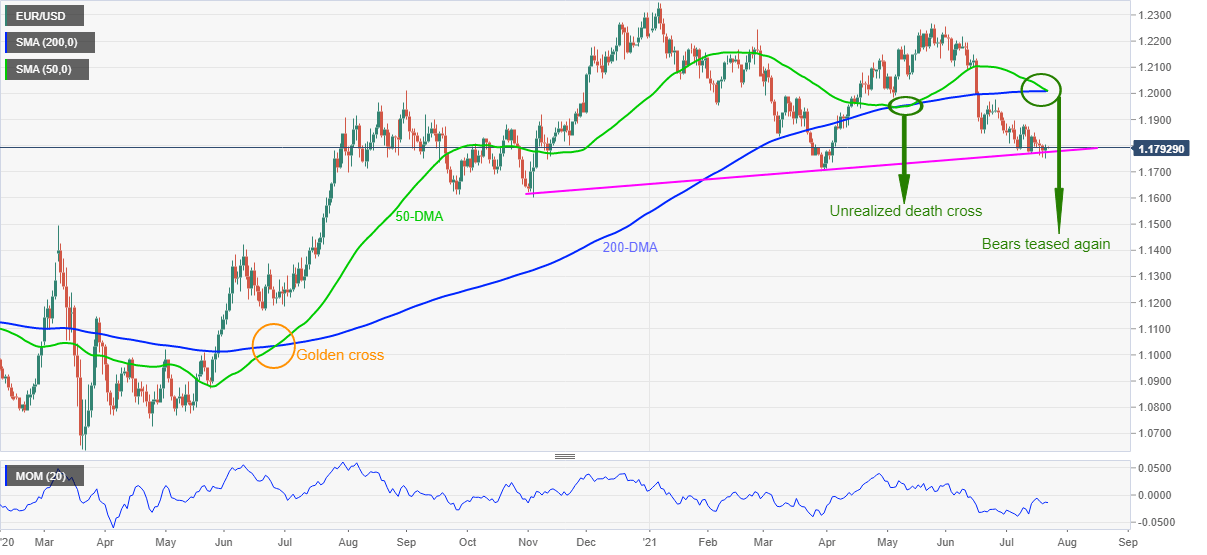

EUR/USD Price Analysis: Impending death cross teases bears around 1.1800 on ECB day

- EUR/USD edges higher after bouncing off three-month low.

- Bearish pattern is underway near the key support line, Momentum line also favors sellers.

- Corrective pullback needs fresh monthly high to reject bearish hopes.

EUR/USD flirts with 1.1800, after a rebound from early April levels, amid the initial Asian session on Thursday.

The major currency pair bounced off an ascending support line from November the previous day but the looming bearish cross, a condition where 50-DMA drops below 200-DMA and signals further downside, tested the recovery moves.

Given the downward sloping Momentum line, coupled with the failures to recover, EUR/USD stays ready to welcome the bears should the quote closes below the stated support line, near 1.1775.

In doing so, the pair will also confirm the bearish cross and will be well-set to challenge the yearly low near the 1.1700 threshold. Following that, lows marked during September 2020 and high of March 2020, respectively around 1.1615 and 1.1500, could gain the market’s attention.

Alternatively, the pair’s recovery moves may aim for June’s low surrounding 1.1845 but the monthly top near 1.1900 will be the key for further upside.

Above all, the pair traders should keep their eyes on the European Central Bank (ECB) monetary policy meeting for fresh impulse.

Read: ECB Preview: Three reasons why Lagarde could hit the euro when it is down

EUR/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.