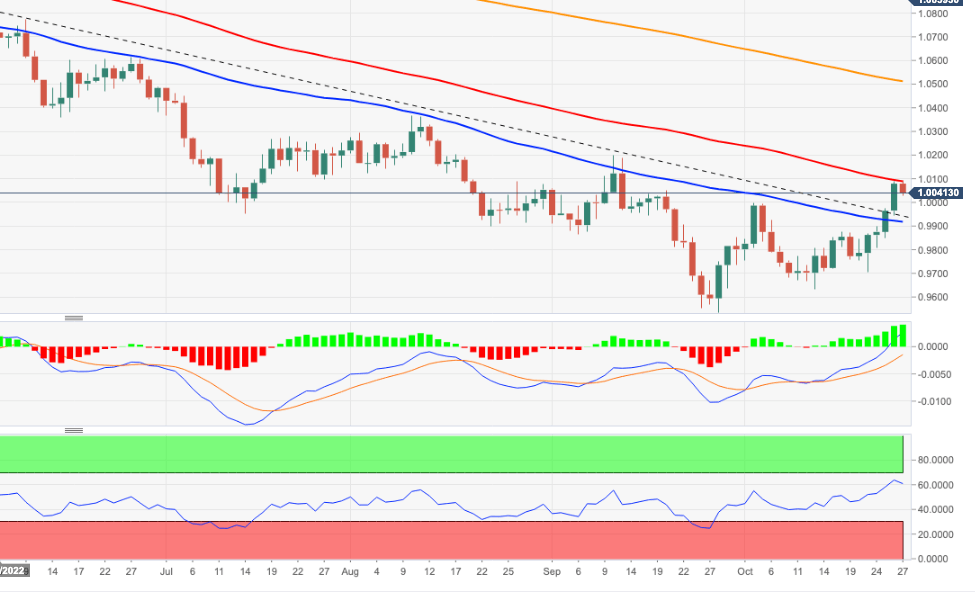

EUR/USD Price Analysis: Extra upside could revisit 1.0200

- EUR/USD’s rally meets initial resistance around 1.0100 on Thursday.

- The continuation of the uptrend could see 1.0200 retested.

EUR/USD meets a tough hurdle around the 1.0100 neighbourhood on Thursday, returning to the negative territory after five consecutive daily advances.

Surpassing the 1.0100 zone could spark a more serious recovery in the short-term. Weighed against that, however, is the fact that an immediate barrier is now expected at the September top at 1.0197 (September 12) ahead of the August peak at 1.0368 (August 10).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0510.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.