EUR/USD Price Analysis: Bulls take on a critical hourly resistance in New York trade

- EUR/USD bulls are correcting last week's bearish closing candle.

- Bears are moving aside at critical hourly resistance.

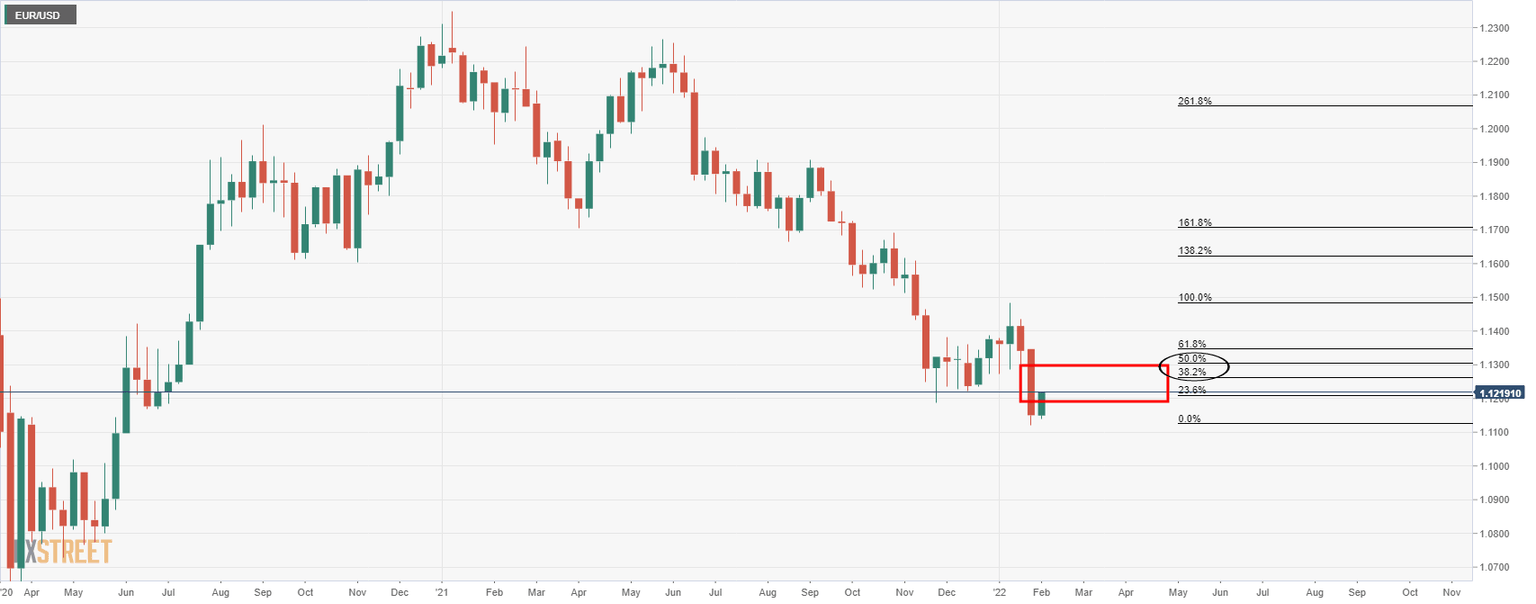

EUR/USD is on the verge of an important upside break on the hourly charts. Bulls have their eyes set on a significant correction of last week's bearish close and eye the 61.8% retracement level of the daily bearish impulse.

EUR/USD weekly chart

The M-formation is compelling. This is a reversion pattern with a high completion rate whereby the price would be expected to head back towards the neckline of the formation, in this case, this is located near 1.1270 and the 38.2% Fibonacci level as additional confluence.

The price, as illustrated has already started to make a move into the prior lows near 1.1220. A bullish weekly close this week will cement the probability of a deeper correction to follow.

EUR/USD daily chart

The daily chart shows that the price has rallied sharply into the prior lows following Friday's doji candle. This is a bullish candlestick scenario and is encouraging for the bulls and countertrend traders. The 61.8% Fibonacci retracement of the prior bearish impulse is located at 1.1270 also, cementing the target down for the week ahead.

EUR/USD H1 chart

From a near term perspective, the bulls continue to press on in the New York trade. However. there are now up against a wall of resistance near 1.1230 that could be expected to reject the price in initial tests. However, the market is bullish while above 1.1210. 1.1240 should give way to 1.1270 targets in coming sessions. On the flip side, a break below 1.1180 would leave the price in consolidation once again.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.